Supply-chain chaos, edgy US-China relations, and scary dependence on China triggered a rethink, now showing up as investments in manufacturing plants.

By Wolf Richter for WOLF STREET.

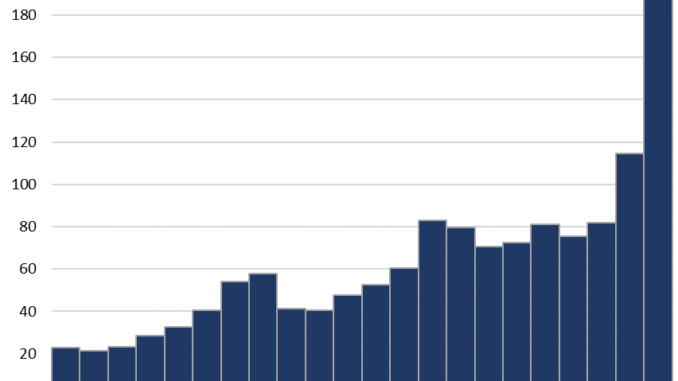

In December, companies plowed $18.4 billion into the construction of manufacturing plants in the US ($220 billion annualized), up by 64% from a year ago, up by 131% from two years ago, and up by 170% from December 2019, according to data from the Commerce Department. The boom in investment in manufacturing plants started in mid-2021.

For the whole year 2023, spending on factory construction spiked by 71% from 2022, and by 138% from 2021, to $196 billion. This is an eyepopping boom. It’s the result of the supply-chain and transportation chaos that companies ran into during the pandemic, the fragile and edgy relationship between the US and China, the scary dependence of US companies on production in China, and in terms of semiconductors, the dependence on production in Taiwan. It all triggered a corporate and government rethink.

And yet, the government subsidies for the semiconductor industry haven’t even made it out the door yet and haven’t shown up in this data here yet, as we’ll see in a moment. That will come later. And the boom wasn’t construction-cost inflation either in 2023 because that has largely settled down:

The US is the second largest manufacturing country by output, behind China and has a greater share of global production than the next three countries combined, Germany, Japan, and India. But it has fallen far behind China in manufacturing. And many US companies and entire sectors are brutally dependent on China, and they got a wake-up call during the shortages and supply-chain chaos of 2020-2021.

The $53 billion CHIPS Act: funds have not yet been disbursed – that’s still coming.

The CHIPS Act, passed in 2022, is a package of grants, loans, loan guarantees, and tax credits for semiconductor makers to entice them to onshore semiconductor production. Of the $53 billion, $39 billion are manufacturing grants that cover up to 15% of the total cost of the fab, up to $3 billion per fab.

About 80% of the cost of a fab is the equipment; construction costs are only a small part of the total. In terms of the data here, we’re just looking at spending on factory construction, not equipment.

But the process of approving the projects and disbursing the cash has been slow. Over 170 companies have applied, including giants such as Intel, Taiwan Semiconductor Manufacturing Co. (TSMC), Samsung, and Texas Instruments. But other than two small grants, no money has been disbursed yet, according to the WSJ.

“This is a merit-based process with tough commercial negotiations – CHIPS awards will be entirely dependent upon which projects will advance U.S. economic and national security,” a Commerce Department spokeswoman told the WSJ.

Industry executives familiar with the negotiations told the WSJ that announcements of large grants will be forthcoming over the next couple of months. The announcements would be preliminary, to be followed by due diligence and then final agreements. Funds will be disbursed in phases as the projects progress. But because of permitting issues and other delays, it could still be years before the plants will be completed.

Among the complications and delays are the CHIPS Act’s requirements on national security, potential shortages of skilled workers – given this sudden boom in activity – and the National Environmental Policy Act, which requires large federally funded projects to pass environmental review before grants are released, which can take years, according to the WSJ.

So these government funds are in the future, and haven’t yet seeped into this data here of factory construction spending.

But there has been a flood of corporate investment: Semiconductor makers already have large projects underway. Intel is building fabs in several states for a total investment of over $43 billion. TSMC has two fabs under construction near Phoenix, for a total investment of $40 billion. Samsung Electronics is investing $17 billion in a fab near Austin. Texas Instruments is investing $30 billion in a massive project near Sherman, TX. Etc.

These are total project costs, including equipment. Construction costs alone are only a small portion of it. But it does add up.

All this activity is happening before the government funds have been disbursed, and before those government funds have made it into the data here on factory construction.

Construction cost inflation was not behind the 2023 spike.

The Producer Price Index for construction of nonresidential buildings hit a peak in January 2023 and has since then declined by 1.4%, and is roughly flat year-over-year. So construction cost inflation was not a major factor in the 2023 spike of construction spending, though it was a factor in 2022.

Investing in manufacturing plants has a large-scale long-term impact on the economy.

Construction spending is the one-time activity to get the building and infrastructure in place. Then there’s the purchase and installation of the equipment. Modern plants are highly automated. And the equipment is more expensive than the building. And then there’s the actual production for many years, with its secondary and tertiary effects on the local and national economy.

Automation equipment and industrial robots cost roughly the same in the US as in China. US labor costs are far higher, but other costs are reduced by bringing manufacturing onshore: Transportation costs are lower, lead times are shorter, there is less geopolitical uncertainty, less risk of losing or having to surrender the IP via technology transfer, etc. So somewhere along the line during the pandemic, something seems to have clicked in the corporate mindset.

We also note: employment in manufacturing rose to a 15-year high:

In January, jobs in manufacturing rose to 13.0 million, the highest in 15 years, according to the jobs report on Friday:

And employment in construction rose to an all-time high:

In January, jobs in manufacturing rose to 8.1 million, the highest ever, according to the jobs report on Friday:

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack