Lowers GDP growth projections and PCE inflation projections for 2024.

By Wolf Richter for WOLF STREET.

The FOMC voted unanimously today to keep its five policy rates unchanged, with the top of its policy rates at 5.50%. It was the third meeting in a row when the Fed held its policy rates, after the rate hike at its meeting in July. The decision had been widely telegraphed.

The infamous “dot plot,” where individual members of the FOMC jot down how they see the trajectory of policy rates in the future, indicated three 25-basis-point rate cuts in 2024, ending the year at 4.75% top of range.

Today, the Fed kept its policy rates at:

Federal funds rate target range between 5.25% and 5.5%.

Interest it pays the banks on reserves: 5.4%.

Interest it pays on overnight Reverse Repos (RRPs): 5.3%.

Interest it charges on overnight Repos: 5.5%.

Primary credit rate: 5.5% (what banks pay to borrow at the “Discount Window”).

The statement changed a tad, by adding “any” to the key sentence, thereby toning down the chance of additional rate hikes, but leaving the door cracked open, just in case:

“In determining the extent of any additional policy firming (changed from “extent of additional policy firming”) that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

QT continues, with the Treasury roll-off capped at $60 billion per month, and the MBS roll-off capped at $35 billion a month.

The “dot plot.”

Three rate cuts in 2024. In its updated “Summary of Economic Projections” (SEP) today, which includes the “dot plot,” the median projection for the federal funds rate at the end of 2024 was 4.675%, or 4.75% top of range, so three 25-basis-point cuts by year end.

Of the 19 participants, 2 saw no rate cuts; 17 saw one or more rate cuts; 8 saw two or fewer cuts; 6 saw three cuts; and 5 saw four-plus cuts.

These are the projected mid-points of the target range by the end of 2024, compared to today’s mid-point of 5.375%:

2 expect: 5.375% (no cuts)

1 expects: 5.125% (1 cut)

5 expect: 4.875% (2 cuts)

6 expect: 4.625% (3 cuts) = median

4 expect 4.375% (4 cuts)

1 expects 3.875 (6 cut)

The median projection for GDP growth for 2024 dipped to 1.4%.

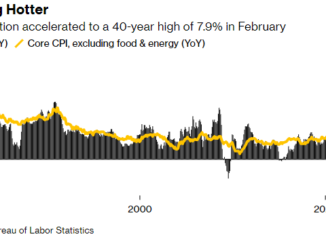

The median projection for “core PCE” inflation dipped to 2.4% by the end of 2024. The projections see core PCE inflation returning to the Fed’s 2% target in 2026.

QT continues, with the Treasury roll-off capped at $60 billion per month, and the MBS roll-off capped at $35 billion a month, as per plan. The Fed has already shed over $1.2 trillion in assets since it started QT in July 2022, and this will continue on autopilot.

I will cover Powell’s preconference in a little while. Stay tuned.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack