In the evolving landscape of the U.S. energy grid, natural gas turbines have long served as a reliable backbone for electricity generation. However, the rapid integration of intermittent renewable sources like wind and solar has introduced new challenges. These renewables, while questionably contributing to decarbonization goals, fluctuate based on weather conditions, forcing gas turbines to cycle more frequently—ramping up and down or idling—to maintain grid stability. This operational stress not only accelerates wear and tear on turbines but also drives up maintenance costs, increases downtime, and ultimately raises expenses for consumers. Drawing on data from the U.S. Energy Information Administration (EIA) and other sources, this article explores the scale of gas turbines on the grid, the impacts of intermittency, and the hidden economic burdens.

We have also listed the three main sources for natural gas turbines, and we will cover their stock performance on the next Energy News Beat Stand Up.

The Scale of Gas Turbines on the U.S. Grid

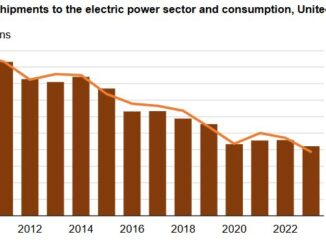

Natural gas-fired power plants are the dominant force in U.S. electricity generation, accounting for about 43% of utility-scale production in recent years.

As of 2022, there were approximately 2,000 gas power plants operating across the country, with a combined capacity of around 500 gigawatts (GW).

This includes a mix of combined-cycle gas turbines (CCGTs), simple-cycle gas turbines (SCGTs), steam turbines, and internal combustion engines. CCGTs, which make up the largest share at about 58% of the fleet, are designed for efficient, steady operation but are increasingly called upon for flexible duties.

By 2025, developers planned to add another 18.7 GW of CCGT capacity, with further expansions anticipated through 2028.

However, the total number of plants has hovered around 1,900 to 2,000 since 2019, reflecting a mature but aging infrastructure.

These turbines generated a record 7.1 million megawatt-hours (MWh) on a single day in August 2024, underscoring their critical role in meeting peak demand, especially during heatwaves when renewables may underperform.

The Operational Strain from Intermittent Renewables

Wind and solar power are inherently variable, producing energy only when conditions allow. This intermittency requires gas turbines to act as a balancing mechanism, spinning up quickly to fill gaps or idling when renewables surge. In 2023, natural gas accounted for 43% of generation, but its plants are now operating at lower capacity factors—around 56% for CCGTs—due to preferential dispatch of renewables.

The EIA notes that as renewables grow, gas turbines are increasingly used to counter their intermittency, leading to more frequent cycling and ramping.

Cycling involves starting, stopping, and adjusting output, which deviates from the steady-state operation gas turbines were designed for. For instance, in regions with high renewable penetration like the Western Interconnection, wind and solar can require fossil generators to ramp up and down rapidly, leading to deeper load following and potential wear on components.

Aging infrastructure exacerbates this: turbines over 25 years old see failure rates double, with thermal stress and corrosion accelerating degradation.

In flexible operations, turbines may experience up to hundreds of starts per year, far beyond traditional baseload designs.

Escalating Maintenance, Downtime, and Economic Hardships

The shift to intermittent support imposes significant economic penalties on gas turbines. Cycling causes thermal mechanical fatigue (TMF) cracking and other degradation, shortening component life and increasing maintenance intervals.

Studies estimate that wear and tear from renewables integration could add $35 million to $157 million annually in operations and maintenance (O&M) costs across the Western Interconnection for fossil generation.

Unplanned downtime from failures is particularly costly: repair expenses for unexpected issues are 30-50% higher than proactive maintenance.

Downtime is another major issue. Major overhauls for large turbines can take two to three weeks, during which plants are offline.

With more cycling, equivalent forced outage rates (EFOR) rise, and component replacements become more frequent. For example, cracking in expander nozzles can double with increased starts, leading to shorter equipment life and higher capital spending.

Globally, unplanned downtime in the oil and gas sector (including turbines) has surged to $149 million per facility annually, a 76% increase in two years.

These hardships translate to reduced efficiency: cycling lowers overall plant efficiency by 20-30% compared to steady operation, increasing fuel use and emissions per MWh.

In high-variability scenarios, variability costs for wind alone range from $3.90 to $8.73 per MWh.

The Ripple Effect: Higher Costs for Consumers

Consumers bear the brunt of these stresses through elevated electricity prices. Integration costs for intermittents—covering backup, grid upgrades, and balancing—range from $8 to $50 per MWh, far exceeding the $1-3 per MWh for steady sources like nuclear.

In Texas’ ERCOT grid, wind and solar variability added an estimated $2.3 billion in 2023 via higher energy and ancillary service prices.

When accounting for reliability needs, wind and solar in New England can cost 6-12 times more than natural gas.

Nationwide, reliance on gas for backup amid renewables growth has pushed system costs higher, even as natural gas prices remain low. The EIA forecasts a 3% drop in gas-fired generation in 2025 due to renewables, but the cycling burden persists, potentially leading to affordability crises.

Without policy adjustments, these hidden costs could escalate, straining household budgets and grid reliability.

Leading Gas Turbines In the United States

Stuart Turley, Energy News Beat podcast host, will be covering these companies on the next Energy News Beat Stand Up this week. We will go through their earnings and stock performance using VectorVest.

GE Vernova

GE Vernova, spun off from General Electric in 2024, is the U.S. market leader in gas turbine orders by megawatt capacity, with a backlog exceeding 60 GW. Its Power segment, which includes gas turbines, drove significant growth in Q3 2025 (ended September 30, 2025), reported on October 22, 2025.

Revenue: $10.0 billion, up 12% year-over-year (10% organic growth), with equipment and services both contributing.

Net Income: $0.5 billion (margin: 4.5%).

Adjusted EBITDA: $811 million, more than tripled from the prior year, reflecting margin expansion.

EPS: Not explicitly broken out in summaries, but overall profitability improved.

Free Cash Flow: Positive (specific figure not detailed in summaries).

Orders: $14.6 billion, up 55% organically, fueled by Power (gas turbines) and Electrification segments.

Gas Turbine Highlights: Strong demand for heavy-duty turbines, with production ramping to 70-80 units annually by 2026. The company reaffirmed full-year 2025 guidance: revenue toward the higher end of $36-37 billion, adjusted EBITDA margin of 8-9%, and free cash flow of $3.0-3.5 billion.

Investment Analysis: Shares have performed well amid AI-driven energy demand, but Q4 2025 results (due January 28, 2026) may show slight revenue dips due to turbine delivery timing. Analysts expect continued backlog growth, making GEV a buy for long-term energy transition exposure.

Siemens Energy

Siemens Energy holds a significant share of the U.S. gas turbine market, with expansions in manufacturing to meet demand. Its fiscal year ends September 30, so the latest is Q4 FY2025 (July-September 2025), reported in November 2025.

Revenue: €10.4 billion (about $11.3 billion USD), up 9.7% on a comparable basis, led by Grid Technologies.

Profit Before Special Items: €471 million (vs. -€83 million in Q4 FY2024).

Net Income: €236 million (vs. -€254 million loss in Q4 FY2024).

EPS: €0.19 basic (vs. -€0.34 in Q4 FY2024).

Free Cash Flow Pre-Tax: €1,327 million (up from €932 million).

Orders: €14.2 billion, down 2.5% comparable, but backlog hit €138 billion with a 1.36 book-to-bill ratio.

Gas Turbine Highlights: Gas Services segment delivered double-digit revenue growth and profitability gains. Year-to-date gas turbine orders totaled 14 GW, with 65% for data centers; U.S. orders made up half of Gas Services’ Q3 FY2025 total.

Investment Analysis: The turnaround from prior losses highlights operational strength in turbines. Shares could benefit from backlog execution, though supply chain pressures persist. Analysts view it as undervalued relative to peers, with potential for dividend resumption.

Mitsubishi Heavy Industries (Parent of Mitsubishi Power)

Mitsubishi Power is expanding U.S. production, planning to double global turbine capacity. The parent’s fiscal year ends March 31, so the latest is 1H FY2025 (April-September 2025), reported November 7, 2025 (equivalent to Q1+Q2).

Revenue: 2,113.7 billion yen (about $14.1 billion USD at 150 yen/USD), up 144.4 billion yen year-over-year.

Profit from Business Activities: 171.5 billion yen (about $1.14 billion USD), up 3.4 billion yen.

Net Income: Not detailed in summaries, but overall positive.

EPS: $0.09 for the period (missed estimates of $0.14 by $0.05).

Orders: 3,314.7 billion yen (about $22.1 billion USD), up 260.0 billion yen.

Gas Turbine Highlights: Power Systems segment (including turbines) contributed to growth, with backlogs through 2028-2030. The company is investing hundreds of millions in U.S. turbine production amid strong demand.

Investment Analysis: The EPS miss led to some share pressure, but order intake signals robust pipeline. Q3 FY2025 (October-December 2025) results are due around February 2026. Analysts see upside from energy demand, though currency fluctuations (yen weakness) could boost exports.

These companies are well-positioned for growth as U.S. gas turbine demand surges, projected at 194 units globally in 2025 (nearly double 2024).

Looking Ahead: Balancing Reliability and Renewables

Gas turbines remain essential for a stable grid, but the economic hardships from renewable intermittency highlight the need for better integration strategies. Advances in turbine flexibility, energy storage, and hybrid systems could mitigate stresses, but until then, the costs of variability will continue to mount. Policymakers and utilities must weigh these realities to ensure affordable, reliable energy for all. As the energy transition accelerates, addressing these challenges will be key to avoiding unnecessary burdens on consumers and the grid.

Sources: theenergynewsbeat.substack.com,

Get your CEO on the podcast: https://sandstoneassetmgmt.com/media/

Is oil and gas right for your portfolio? https://sandstoneassetmgmt.com/invest-in-oil-and-gas/