The Gulf Cooperation Council’s borrowing requirements could drop to $10 billion over the next three years from about $270 billion, if oil prices continue to stay elevated, according to Goldman Sachs Group Inc.

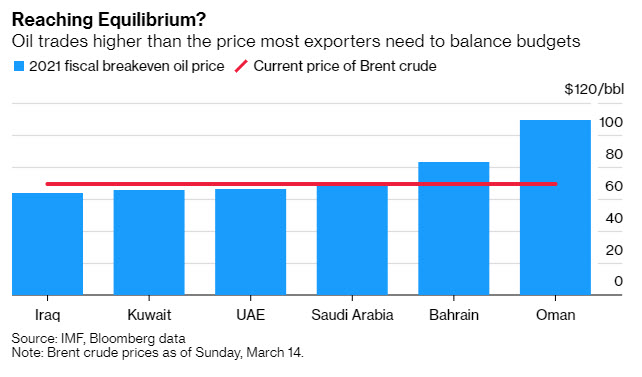

If prices for the commodity average $65 a barrel and all else is equal, borrowing needs for the six countries comprising the council would drop 96% from what they’d be if oil traded at $45, Farouk Soussa, an economist at the bank wrote in a report.

Oil prices have rallied almost 80% since the start of November to about $70 a barrel as major economies roll out coronavirus vaccines and the OPEC cartel — which is dominated by GCC member Saudi Arabia — implements deep production cuts.

Gulf sovereigns raised about $63 billion in bonds and sukuk last year.

More from Goldman:

- Kuwait is likely to have the biggest improvement in its budget balance from high oil levels, with its shortfall narrowing by around 15 percentage points of gross domestic product this year.

- Still, the sovereign is facing a liquidity squeeze that “cannot be remedied by higher oil prices alone.”

- Over the next three years, Saudi Arabia’s net debt is seen rising to a “still manageable” level at 38% of GDP.

- Qatar’s fiscal balance is seen swinging from a 5% deficit to a surplus of 5% of GDP.

- Oman and Bahrain will probably benefit most from higher oil prices, given their weaker external and fiscal positions.

- Other countries in the region are seen having a “more modest improvement” of between 2-4 percentage points of GDP compared with official budgeting.