It’s 13F season and while we will have a comprehensive summary of what hedge funds did in Q3 (which ended 45 days ago) – though we have already discussed on several occasions that using real-time data, hedge funds massively derisked after suffering staggering losses in Q2 and Q3 – we start our reporting with what Warren Buffett’s Berkshire Hathaway did.

Which actually wasn’t all that much: the reported value of Berkshire’s long-only equity portfolio declined modestly from $300BN to $296BN, with only modest underlying changes. Here are the most notable ones:

Added a new position in Taiwan Semiconductor (it just made the top 10 with at $4.1 billion as of Sept 30); and much smaller positions in Louisiana Pacific ($297 million) and Jefferies ($12.8 million).Exited one position: what was formerly a $180 million stake in STORE CapitalAdded to holdings in Chevron, Occidental, Paramount, Calenese, and RH:

Occidental: 35.8 million shares, up 23% to 194.4 million valued at $11.9 billion, representing 21% of shares outstandingChevron Corp.: 3.92 million, up 2.4% to 165.4 million valued at $23.8 billion, representing 8.4% of shares outstandingRH: 190,000, up 8.8% to 2.36 million valued at $580.7 million, representing 9.9% of shares outstandingParamount Global Class B: 12.8 million, up 16% to 91.2 million valued at $1.74 billion, representing 15% of shares outstandingCelanese Corp.: 553,469, up 6% to 9.71 million valued at $877.2 million, representing 9% of shares outstandingTrimmed holdings in Activision, US Bancorp, BofNY Mellon, Kroger, and General Motors:

U.S. Bancorp: 42 million shares, down 35% to 77.8 million valued at $3.14 billion, representing 5.2% of shares outstandingActivision Blizzard Inc.: 8.26 million, down 12% to 60.1 million valued at $4.47 billion, representing 7.7% of shares outstandingBank of New York Mellon Corp.: 10.1 million, down 14% to 62.2 million valued at $2.4 billion, representing 7.7% of shares outstandingKroger Co.: 2.17 million, down 4.1% to 50.3 million valued at $2.2 billion, representing 7% of shares outstandingGeneral Motors Co.: 2.88 million, down 5.4% to 50 million valued at $1.6 billion, representing 3.4% of shares outstanding

Berkshire’s largest position remains Apple at 894.8 million shares of $123.7 billion as of Sept 30. Other top 5 holdings are:

Bank of America Corp.: unchanged at 1.01 billion valued at $30.5 billionChevron Corp.: up 3.92 million, to 165.4 million valued at $23.8 billion, representing 8.4% of shares outstandingCoca-Cola Co.: unchanged at 400 million valued at $22.4 billionAmerican Express Co.: unchanged at 151.6 million valued at $20.5 billion

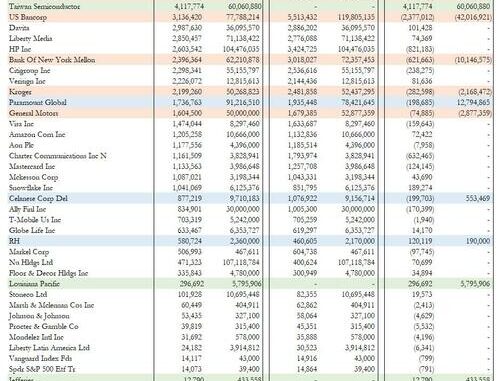

Full details of all Berkshire Q3 moves can be found in the table below.