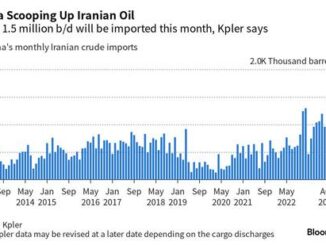

Crude market players are zeroing in on Iran’s ability to increase oil exports, driven by whisperings of progress in talks to revive the 2015 nuclear agreement. Leaders in Tehran and Washington are scrutinizing the text for a deal put on the table by EU mediator Josep Borrell that could allow Iran to return to global oil markets. At a time of tight supplies and high prices, Iranian barrels would be welcomed by most consumers. The outcome remains uncertain as rumors of a rapprochement have ebbed and flowed for months. But, if allowed, Energy Intelligence sees the potential for the country to raise crude production and exports swiftly, as it did in 2016 when it surprised most analysts with its rapid rebound. Under its “Breakthrough” scenario the Energy Intelligence Research & Advisory unit sees Iran’s output rising to 2.95 million barrels per day in December before slowly increasing to 3.7 million b/d by June next year, assuming a deal is struck in August. This scenario would result in exports rising to between 1.25 million b/d and 2 million b/d, respectively, up from an estimate of just below 1 million b/d in August. For this scenario to come to fruition, Iran would have to experience limited technical constraints. The main drag on exports in this case would be the time it takes the US to verify Iran’s nuclear compliance and for Tehran to verify Washington’s promises to let its oil flow freely. That verification process would impact whether buyers still fear risks from US sanctions not related to the so-called Joint Comprehensive Plan of Action (JCPOA) and whether banks are willing to re-establish payment channels.

If US sanctions outside the JCPOA create a messy and uncertain market for Iranian crude, the rise in output may be more modest, Energy Intelligence estimates. Under a “Slow-Going” scenario, Iran’s production rises to 2.74 million b/d and its exports to around 1.04 million b/d by year’s end — from 2.62 million b/d and a lower August export level of 920,000 b/d. Should talks collapse, the “No-Deal” scenario forecasts a decline in exports, assuming a crackdown by the US results in an even more onerous sanctions campaign. Such an outcome would make it harder for the country to sell its crude and choke its oil industry. Even sales to China could decline if buyers become more cautious, robbing Iran of its only real customer. Under such a scenario, Iranian exports may drop as low as 500,000 b/d, — as happened in 2019 after the Trump administration’s withdrawal from the JCPOA in 2018. A no-deal scenario would likely see Iran’s production remain relatively flat, depending on the tenacity of US sanctions enforcement and the country’s domestic demand.

The view of Iran’s industry from inside the country is more optimistic than even the highest Energy Intelligence estimates. Iran presently produces 2.5 million-2.6 million b/d of crude, according to one Iranian oil official, while exports range between 600,000-900,000 b/d. But the export figure is likely to include not only crude but up to 200,000 b/d of condensate, the official told Energy Intelligence. But even Iran’s own technocrats are unsure as crude sales are now handled by the powerful Revolutionary Guard. In case of a return to the nuclear deal, Opec’s former No. 2 producer should be able to boost output to 3.8 million b/d within three months and to 4 million b/d soon after, the official said — similar to Iran’s ramp-up in early 2016 when the nuclear deal came into force. This would add around 1.3 million-1.5 million b/d of crude exports within three months. The figure varies depending on the level of domestic oil consumption, which can run between 1.8 million and 2 million b/d. Iran should then be able to add another 200,000 b/d in crude exports once it hits its maximum production capacity of 4 million b/d, the official estimated. But the greatest challenge for the country won’t be raising oil production or exports — it will be finding countries other than China willing to buy it, the official admitted.

Source: Energyintel.com