This has been an awful year for stocks and bonds as the Federal Reserve wreaks havoc on financial markets to tame the highest inflation in decades. Risks are now increasing that overtightening by the Fed could spark a hard landing in 2023. Most asset classes have been clubbed like a baby seal, while one has escaped the beatdown: investment-grade wine.

Investable wine is considered an ‘alternative asset’ by wealthy investors. Fine wine, with age, improves over time because there is only a limited supply of investment wines produced each year, or vintage, which must satisfy a growing global demand.

Despite risk parity investors deeply in the red, meme stock traders on Reddit wiped out, and crypto kids decimated, wealthy folks holding fine wine investments are sitting back without stress as they are set to lock in positive returns for the year.

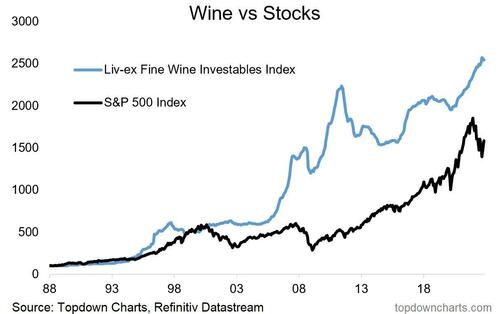

The Liv-ex 1000 benchmark recorded a 13.6% increase year-to-date and a 44.6% rise over five years. What is most intriguing about investable wine is how it “acted like a defensive asset this year,” explained Topdown Charts founder Callum Thomas.

Thomas continued: “We also saw a similar thing during the dot-com burst bear market, and during the 2008 financial crisis. It goes to show that sometimes you have to be a little bit more creative to find defensive assets (in a year where traditional safe haven assets have disappointed e.g. gold basically flat for the year, and bonds down double-digits).”

And many people might not be aware, but in economic downturns when lending standards are tightening, wealthy folks use wine collections, expensive artwork, and classic cars as collateral for loans while banks refuse to lend money to everyday folks.

Loading…