By John Kemp, senior energy analyst at Reuters

Portfolio investors have amassed one of the largest bullish positions in U.S. gasoline futures and options since before the coronavirus pandemic, anticipating that prices will continue climbing over the next few months.

U.S. gasoline has emerged as the most attractive part of the petroleum complex for investors betting prices will rise further this year in the run up to presidential and congressional elections in November.

Relatively low inventories, employment gains, strong household income growth and the prospect of an active hurricane season are expected to keep gasoline consumption high and inventories under pressure.

Ukraine’s drone attacks on refineries in Russia threaten to tighten the international supply situation even further and have prompted the Biden administration to warn Ukraine’s government to change its targeting.

BUOYANT CONSUMPTION

U.S. gasoline consumption is correlated with employment and household incomes so the current rise in nonfarm jobs and wage rates are likely to underpin strong use in 2024.

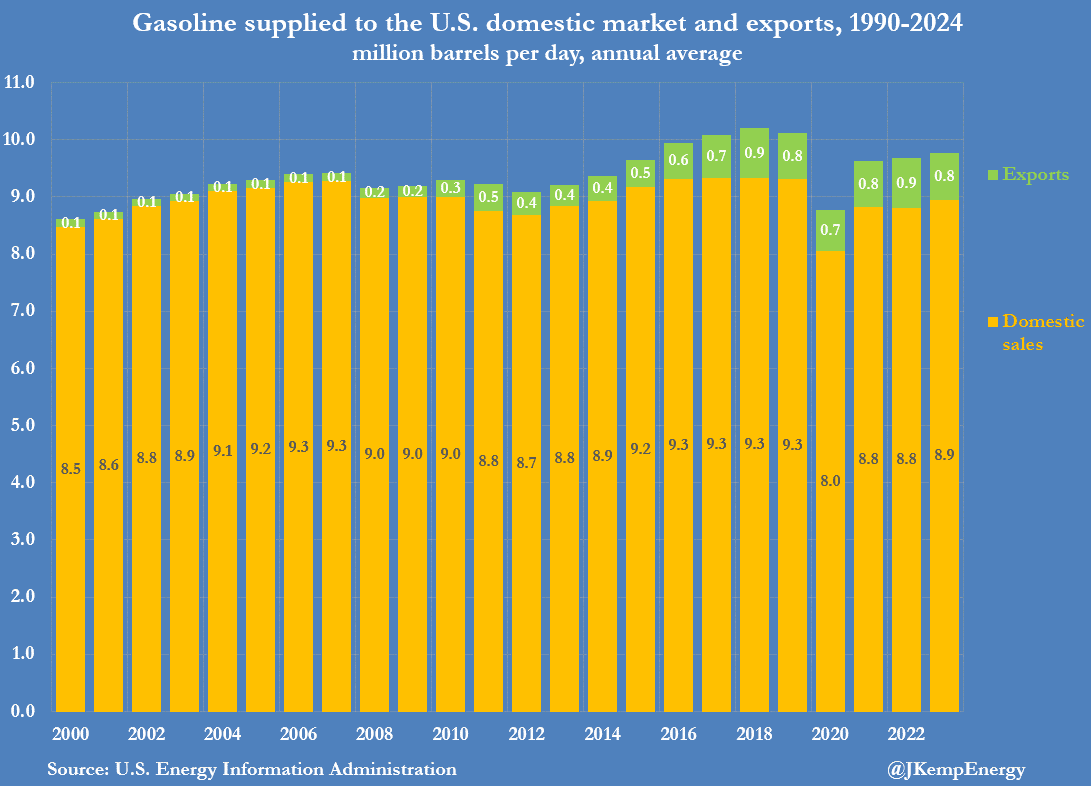

Domestic consumption has been trending structurally lower since 2007 as a result of improvements in fuel economy, ethanol blending and more recently the deployment of electric and hybrid vehicles. But lower domestic use has been more than offset by strong growth in exports, mostly to Mexico and other countries in Latin America, which has kept overall refinery production trending higher.

Strong domestic consumption during the peak summer driving season is likely to cause inventories to tighten cyclically and exert upward pressure on prices in 2024.

ACTIVE HURRICANE SEASON

Nearly half of the total refinery capacity in the U.S. is located along the Gulf of Mexico on the coasts of Texas and Louisiana.

Every year there is a small but non-zero chance refinery processing will be disrupted by a direct hit from a major hurricane.

The North Atlantic hurricane season lasts from June through November with activity peaking in August and September (“Tropical cyclone climatology”, U.S. National Oceanic and Atmospheric Administration, 2024).

The precise number of storms, their intensity and the location of landfalls is highly variable and notoriously difficult to predict months in advance.

But the expected shift from El Nino to La Nina conditions underway in the central and eastern Pacific is often associated with an increased number and intensity of hurricanes in the Atlantic (“Impacts of El Nino and La Nina on the hurricane season,” NOAA, 2014).

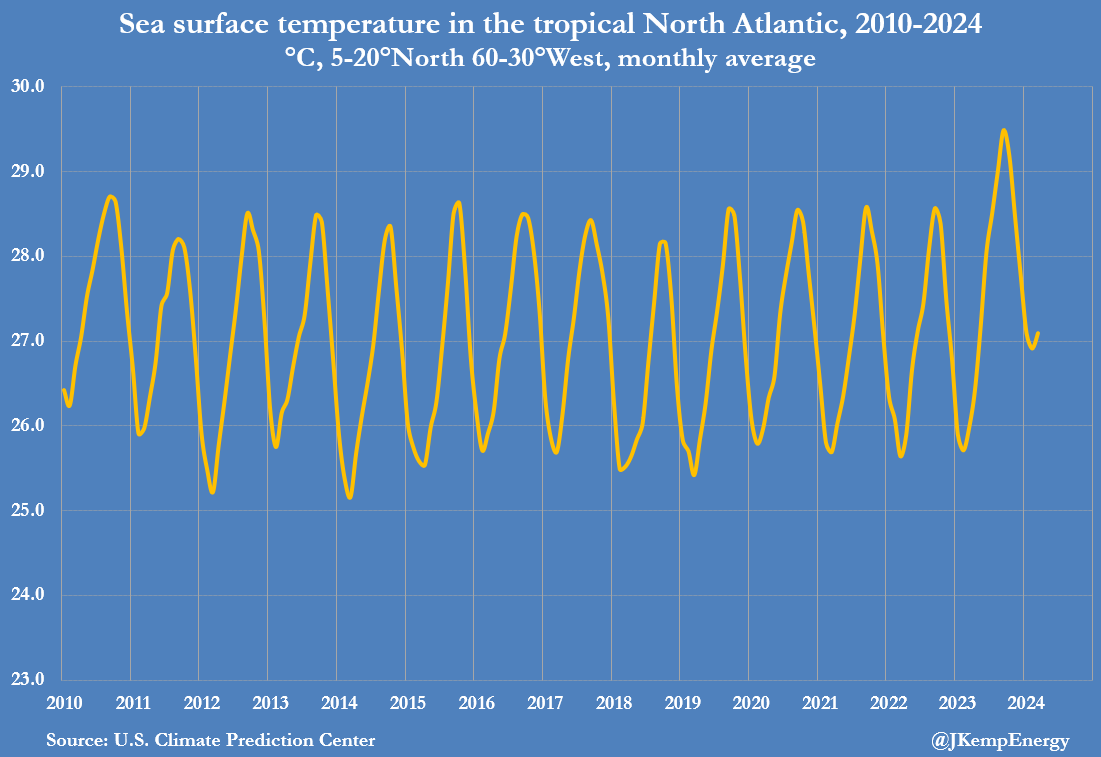

At the same time, Atlantic storm creation and intensity is strongly correlated with sea surface temperatures in the Caribbean and the tropical North Atlantic.

Tropical storm formation requires sea surface temperatures of at least 26°C, among a number of other conditions (“Cyclogenesis”, Australian Bureau of Meteorology, 2017).

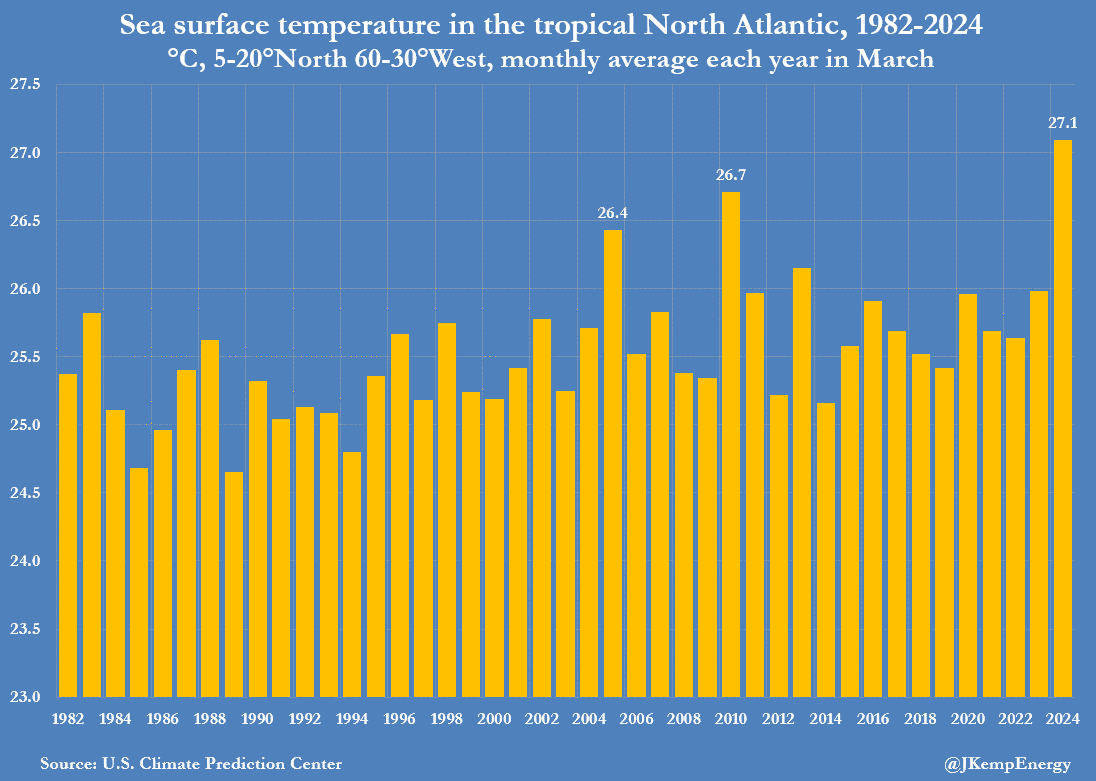

Sea surface temperatures in the tropical North Atlantic were at a record seasonal high in March 2024, according to data from the U.S. Climate Prediction Centre.

Sea surface temperatures surged higher around the world, including a very strong warm El Nino phenomenon in the Pacific, but the exceptional warming was most pronounced in the Atlantic.

Surface temperatures in the Atlantic from 5° to 20° North and from 30° to 60° West averaged almost 27.1°C in March, which was more than 1.5°C above the long-term seasonal average.

If the surface warmth persists into the second and third quarters it is likely to result in an above average number of tropical storms and more major hurricanes in 2024 and an elevated threat to the Gulf Coast refineries.

Colorado State University researchers have predicted an “extremely active” hurricane season in 2024 (“Forecast for 2024 hurricane activity,” CSU, April 4, 2024).

The number of named tropical storms and hurricanes is expected to be more than 50% higher than the long-term average.

BULLISH POSITION

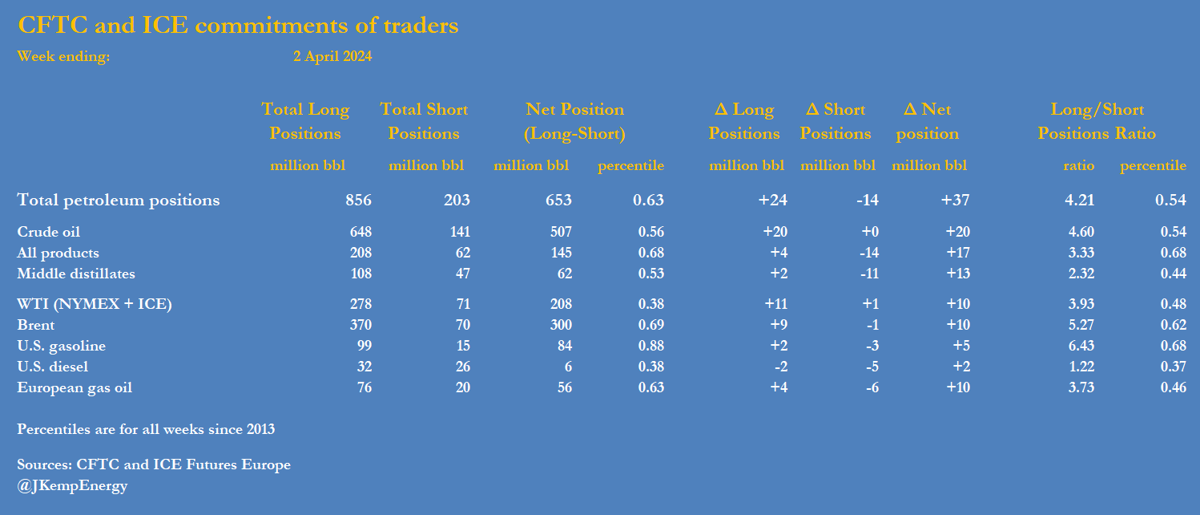

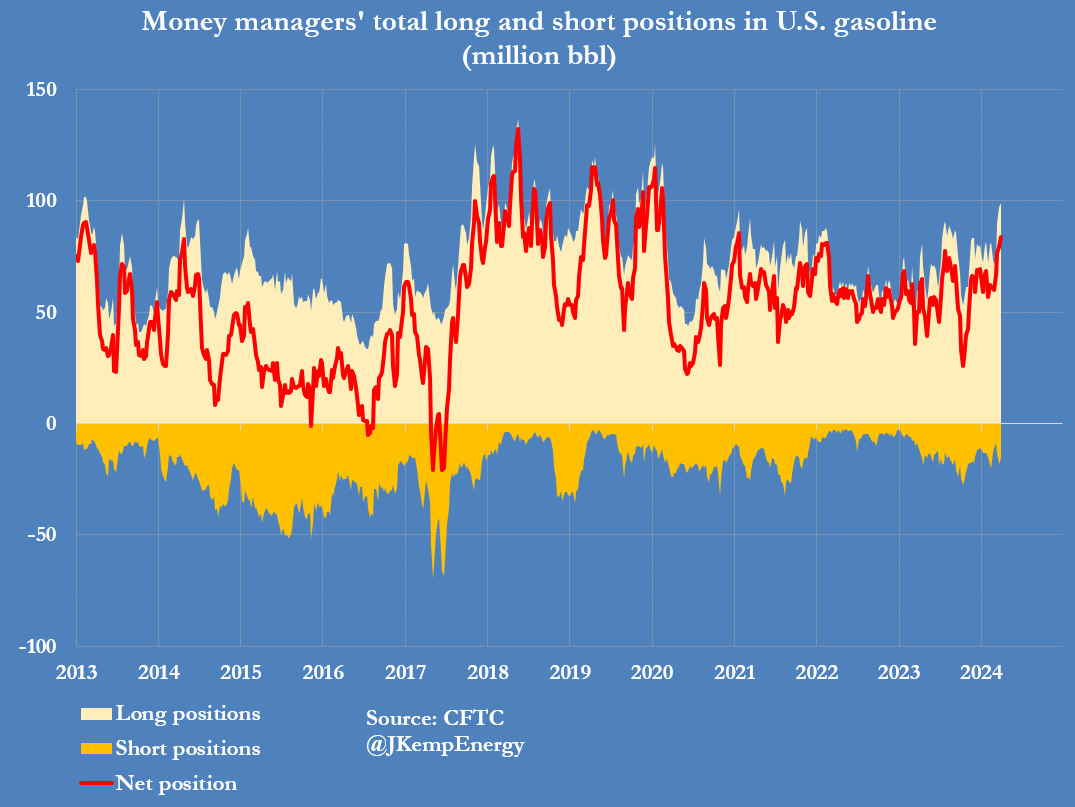

Hedge funds and other money managers owned bullish long positions equivalent to 99 million barrels on April 2, the highest number for more than four years.

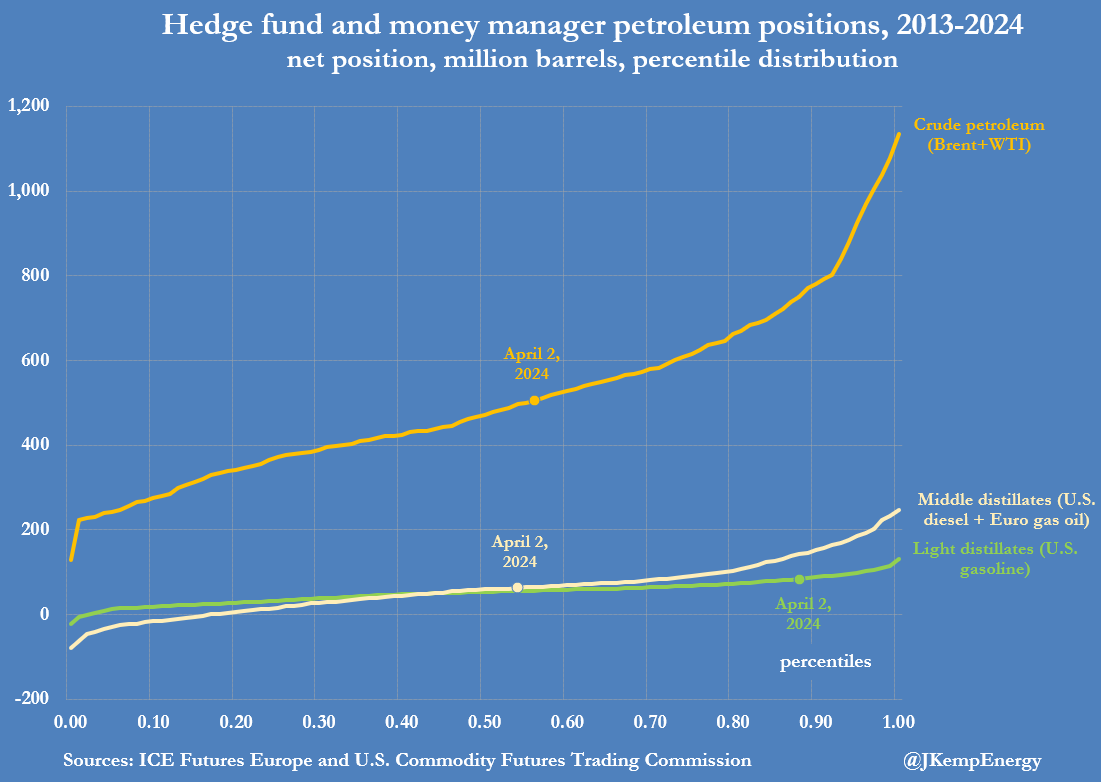

After adjusting for a minority of bearish short positions, the net position was 84 million barrels, which was in the 88th percentile for all weeks since 2013.

Fund managers were more bullish on gasoline than on crude (56th percentile) or middle distillates such as diesel and gas oil (53rd percentile).

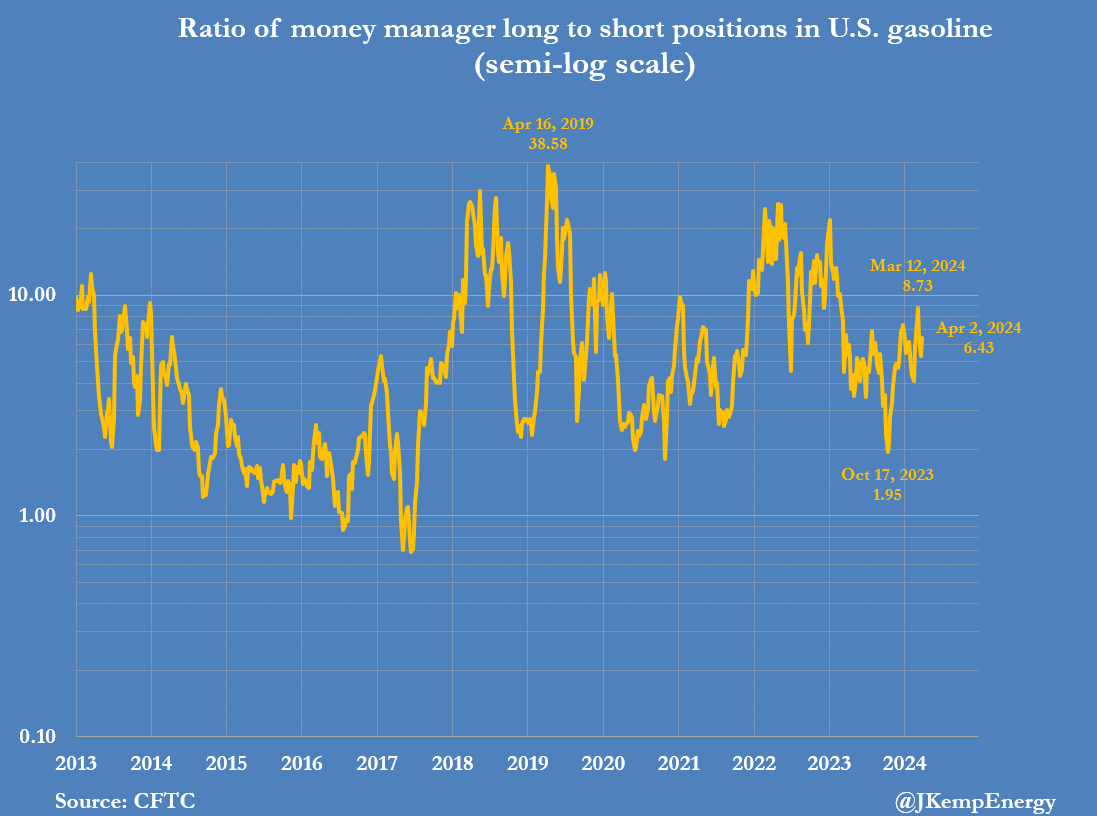

Bullish long positions in gasoline outnumbered bearish short ones by a ratio of more than 6.4:1 (68th percentile) on April 2.

The long-short ratio suggests positioning is less stretched than the absolute number of long positions, but there is still downside risk to prices when long positions are unwound.

LOW INVENTORIES

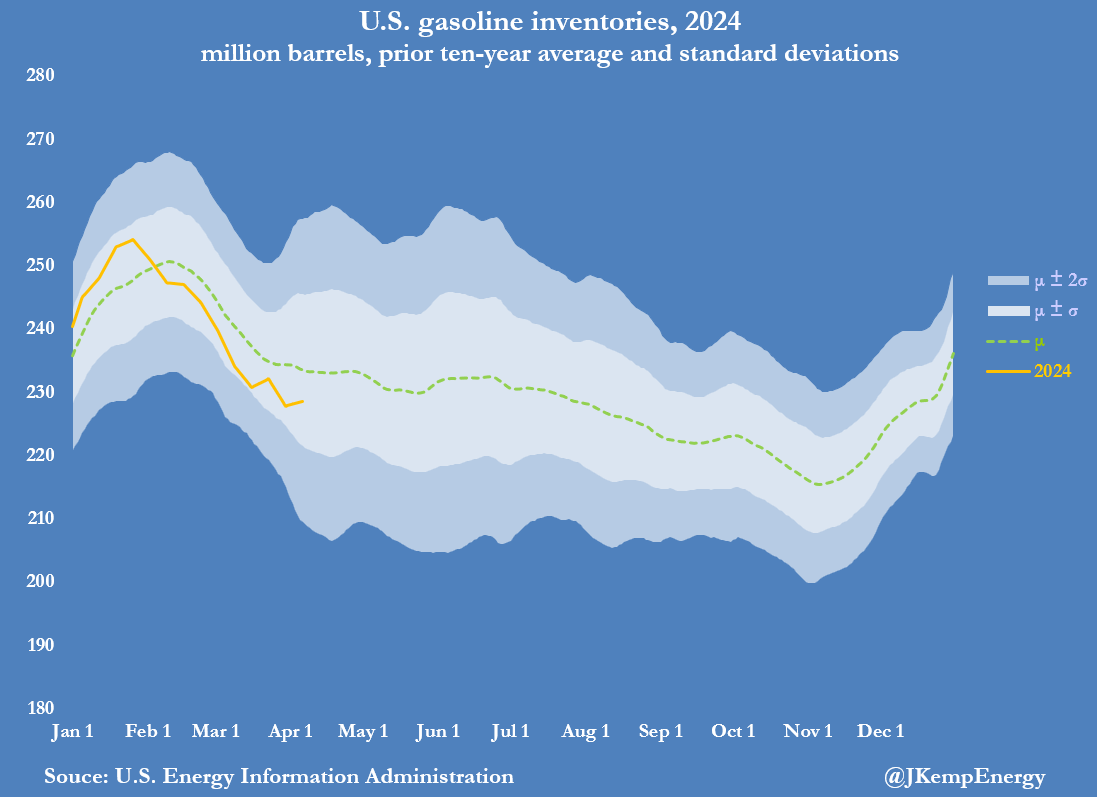

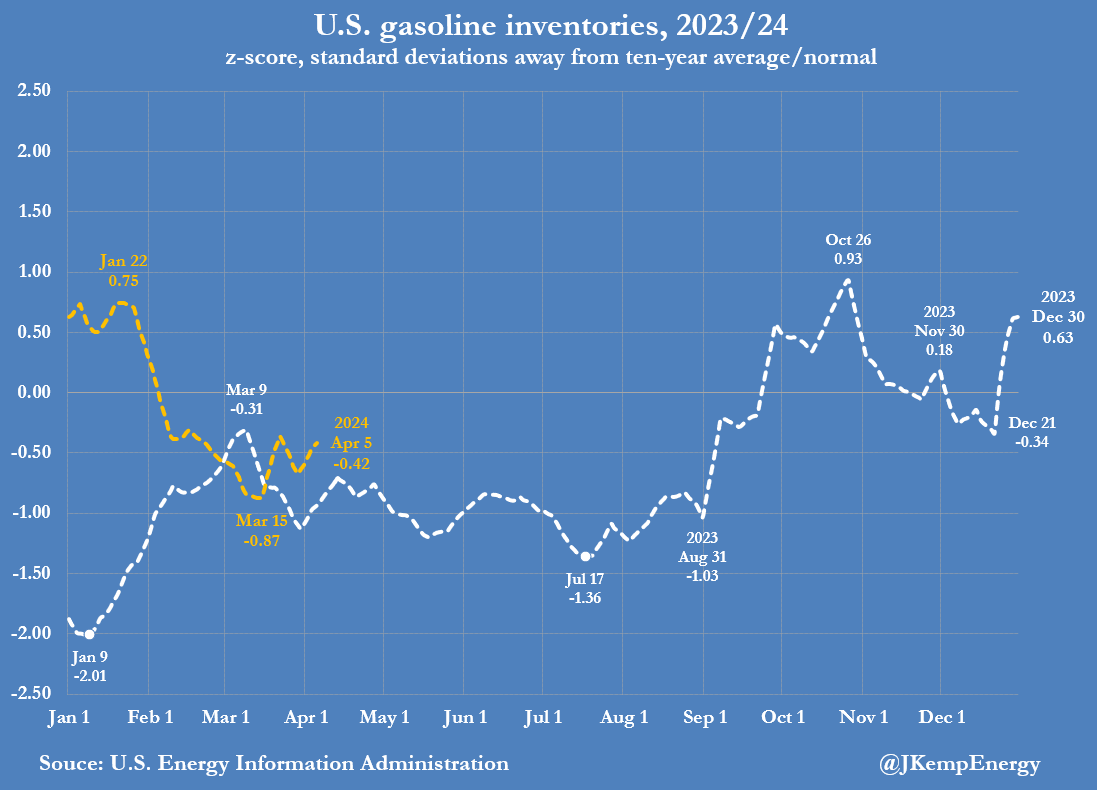

On April 5, U.S. gasoline inventories were 5 million barrels (-2% or -0.42 standard deviations) below the prior ten-year seasonal average.

Stocks had been as much as 7 million barrels (+3% or +0.75 standard deviations) above seasonal average in late January.

But a site-wide power failure stopped BP’s massive refinery at Whiting, Indiana, lasting for more than a month from the start of February and resulted in a sharp depletion of stocks.

Since the refinery restarted in March, the deficit has narrowed slightly, but inventories remain below normal for the time of year, putting upward pressure on prices.

EVEN HIGHER PRICES?

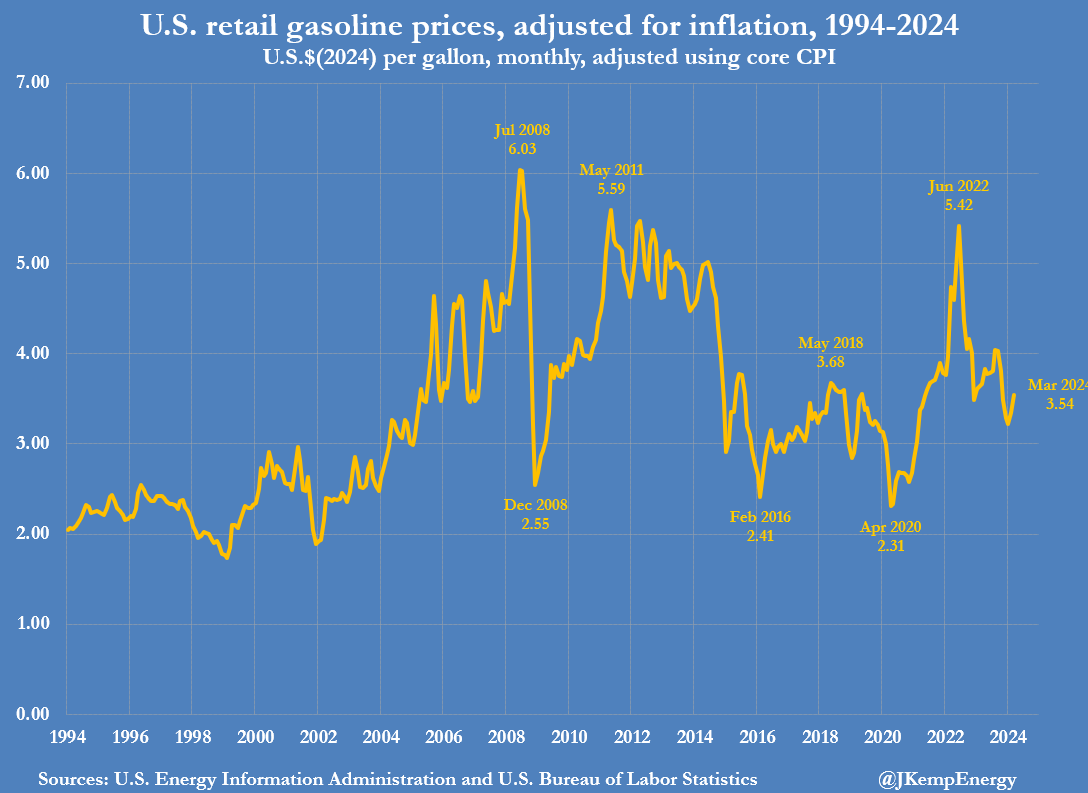

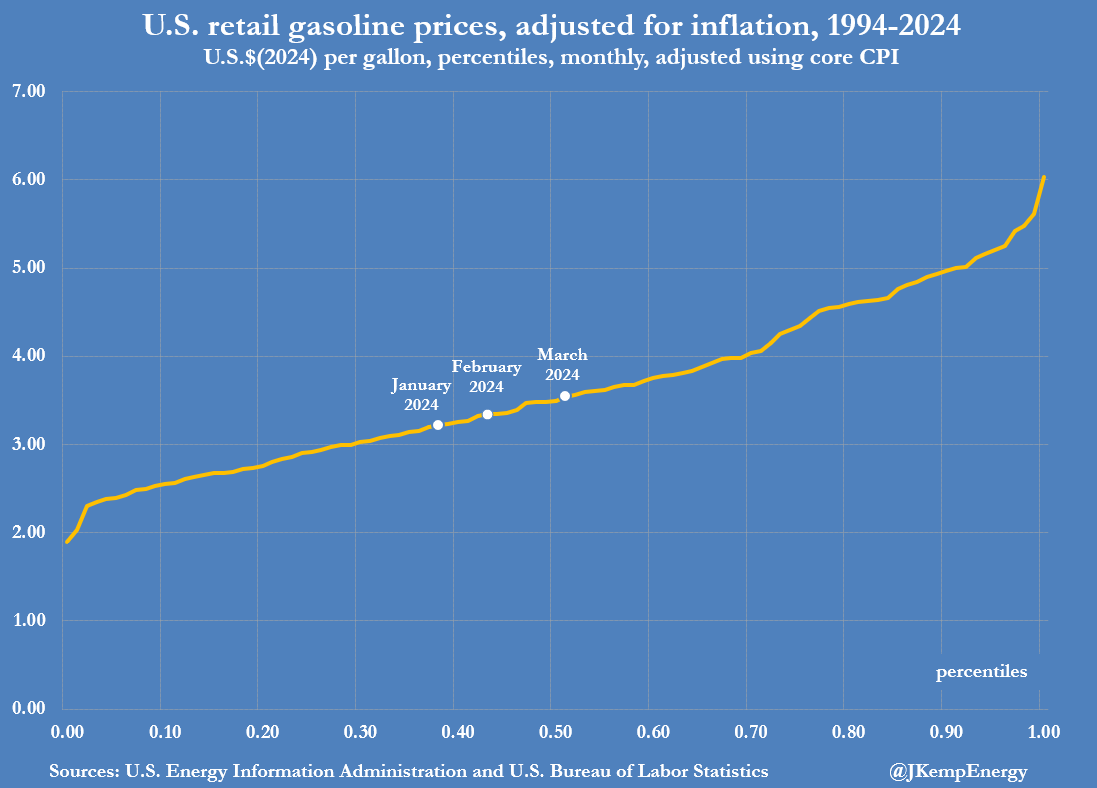

U.S. retail gasoline prices (including taxes) averaged $3.54 per gallon in March 2024, almost exactly in line with the average since the start of the century once inflation is taken into account.

Inflation-adjusted prices have risen from a recent low of $3.22 in January 2024 but are still well below the recent high of $5.42 in June 2022 after Russia’s invasion of Ukraine.

Fund managers are betting heavily that gasoline prices will rise further over the remainder of the year.

From a purely positioning perspective, the large number of bullish long positions that must eventually be liquidated has itself created downside risk to prices.

From a fundamental perspective, however, low inventories, strong consumption, threat to Russia’s refineries, and elevated hurricane risk to U.S. refineries are all sources of upside potential.