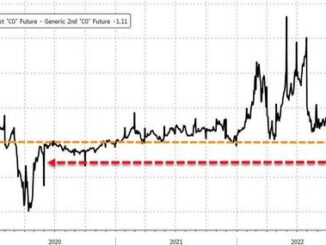

For the last two years oil prices have really been in a very narrow range from $70/bbl. to $85/bbl. Brent crude so to speak. At the start of this year Brent was trading close to $75/bbl. and it is now up 10% for the year as we end the first-quarter winter demand period.

OPEC+ is still committed to keeping their production cuts through the end of June, with Saudi Arabia also agreeing to keep its additional 1 mbpd voluntary cut as well. These supposed cuts, which were meant to be in place for only a few months to a quarter, have now been in place for the better part of a year or more! One wonders if the cuts were not in place at all, where would the fair value of Brent crude oil be?

Given the demand supply and inventory balances, there has never been any shortage of oil, nor is there one today. It is deliberately being held back so as to keep the prices higher for longer, something the Fed is well acquainted with, despite OPEC’s constant affirmation that it is to provide stability.

Middle Eastern countries have spent vast amounts investing in all industries outside of oil and gas to diversify their revenue and income streams away from traditional fossil fuels as oil revenues will not be here to stay forever. Saudi Arabia’s own budget deficit needs about $95/bbl. Brent. This is not the official number but more like the number they need to break even given how much and how fast they have spent on tons of unique and aggressive campaigns.

If it were not for this OPEC+ cut, oil prices could very well be in the high $40s to $50s given the demand outlook in the global economy. The OPEC+ view is to keep the market balanced till demand eventually picks up which would naturally take prices higher and allow them to release their production as and when. But we know historically speaking, they are much quicker to cut than to release it back.

Brent oil prices have been falling since the highs reached during the Russia-Ukraine war when the market thought about 10 mbpd of oil would be out. Despite sanctions, Russian oil made it to the ports of China and India, which did not care to take a political view as their consumer and economic view was far more important to them. All these sanctions have done is reroute the oil to different partners, but it is still flowing and Russia is still making money.

The real tightness if at all is in refining. Whenever there is a shortage on the product side, be it due to refinery maintenance or drone attacks on Russian refineries, that is where the true “tightness” in oil comes into play. Recently, Ukraine has decided to target Russian product refineries, which caused a surge in heating oil and product prices. Ukraine has now figured out how to curb Russian enthusiasm, but this also hurts America, their biggest donor, as the U.S. consumer faces higher prices of gasoline at the pump; not a wise move into an election year.

The U.S. is the only economy showing signs of robust growth, although even that is now slowing down. The European Union, U.K., and Chinese demand has been slower than last year. Winter has been warmer than normal on average, and U.S. gas is still trading below $2/mmbtu given the temperatures, higher wind generation and ample inventory. Prices never spiked.

Everyone seems to be waiting for the demand rebound globally, which is being delayed by China’s property weakness and domestic consumer uncertainty. OPEC+ may be cheering now, but if the U.S. does enter a recession, prices may not be able to hold up and the cartel will not be able to cut any more. It has made a huge bet in losing market share as it hopes to take advantage of higher prices later, but the longer the price takes to recover, the more impatient they will become. After all, years of investment have gone into increasing capacity.

No one talks about a recession anymore and we have gone from talk of a hard landing to a soft landing to “is there even a landing?” What a change in a year. All eyes are on the Fed and if, and when, they do decide to cut rates. With talks of 2.5% GDP, inflation below 3% and unemployment at 4%, one wonders why there is a need to cut at all, if the economy is so robust!

Take the Survey at https://survey.energynewsbeat.com/

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack