What a day on the Energy News Beat News Desk!

In this Energy News Beat Stand-Up, we had a wild day on the News Desk!

We cover some huge stories, and any one of them would be a great single podcast, but we have 8 stories and stocks that Stu reviews on VectorVest software.

The main topics discussed in thispodcast are:

**1. Ukraine War & Russia-U.S. Economic Relations** Stu Turley discusses a Bloomberg report about a Russian memo proposing a return to U.S. dollar-based trade as part of a potential broader economic partnership with the Trump administration. This development could signal a possible end to the Ukraine conflict and have significant implications for global geopolitics and energy markets.

**2. U.S. Energy Engagement with Venezuela**

Secretary of Energy Chris Wright made a high-level visit to Venezuela—the most significant U.S. energy-focused trip to the country in nearly three decades. The goal was to revitalize Venezuela’s struggling oil sector through investments, licensing reforms, and legal changes. Chevron’s return to processing Venezuelan oil in U.S. Gulf Coast refineries signals a thawing of U.S.-Venezuela energy relations.

**3. Tightening Global Oil Markets**

The discussion covers how U.S. sanctions pressure on Russian and Iranian oil flows is creating tighter-than-expected oil markets. Millions of barrels of sanctioned crude are accumulating in floating storage, affecting global supply dynamics. In a memo covered by Bloomberg, President Putin proposes trading the US dollar, signaling a potential end to the war in Ukraine.

**4. Trump Administration’s Coal Industry Support**

President Trump issued an executive order leveraging federal purchasing power to sustain coal operations, framing it as a national security matter. The Tennessee Valley Authority (TVA) also decided to keep two major coal facilities operational beyond their originally scheduled closure dates.

**5. Energy & Financial Markets Analysis**

The podcast includes commentary and demonstrations of the VectorVest software we use to evaluate the performance of various energy-sector companies (oil, gas, and coal), as well as the host’s personal trading strategies and market observations.

Stories Covered on the Podcast Today

In a stunning development that could reshape global energy markets and geopolitics, an internal Russian memo has surfaced proposing a return to the US dollar for settlements as part of a broader economic partnership with the Trump administration.

This move, if realized, might signal the beginning of the end for the ongoing war in Ukraine, as economic pressures from Western sanctions appear to be forcing Russia’s hand. As host of the Energy News Beat Channel, I’ve long argued that President Putin wants to do business with the United States—despite the rhetoric—and this could pave the way for new trade alliances while potentially spelling trouble for the BRICS bloc’s de-dollarization ambitions.

2.What Should Investors Look at After Secretary Chris Wright’s Trip to Venezuela?

In a landmark visit marking the highest-level U.S. energy-focused trip to Venezuela in nearly three decades, U.S. Energy Secretary Chris Wright met with interim President Delcy Rodríguez and oil executives in Caracas. The February 2026 trip comes amid the Trump administration’s efforts to revitalize Venezuela’s beleaguered oil sector following the capture of former President Nicolás Maduro. Wright’s optimistic outlook highlighted potential surges in oil, natural gas, and electricity production as early as this year, positioning Venezuela as a key opportunity for investors amid global energy shifts.

But what exactly should investors monitor in the wake of this development? From production boosts and investment licensing to the role of Chinese firms and cash flow improvements, here’s a breakdown of the critical factors.

Potential Surge in Oil Production and Its Implications

Secretary Wright expressed confidence that Venezuela could experience a “dramatic increase” in oil production, potentially reaching beyond its current output of around 1 million barrels per day (bpd).

Investors should watch for operational metrics from state-owned PDVSA and joint ventures. Recent U.S. actions, including the easing of sanctions, have already enabled sales of 50 million barrels of crude, with proceeds flowing back into Venezuela’s economy.

Key indicators include monthly OPEC reports on Venezuelan output and announcements from companies like Chevron, which has received expanded licenses to resume and scale operations.

A stable political environment will be crucial, as any volatility could deter long-term commitments.

Investments Moving Forward: Licensing and Legal Reforms

Wright praised Venezuela’s recent overhaul of its hydrocarbons law, which grants private companies greater control over production, sales, and pricing, ending PDVSA’s monopoly.

This reform caps royalty rates at 30% and allows firms to manage operations at their own risk after government approval of business plans.

While Wright noted it’s a “meaningful step,” he cautioned it’s not yet sufficient for massive capital inflows, emphasizing the need for debt restructuring to compensate for past expropriations—though this won’t happen “overnight.”

On the U.S. side, the Treasury’s Office of Foreign Assets Control (OFAC) has issued General Licenses 46 and 47, authorizing established U.S. entities to engage in oil trade, export, and diluent supply.

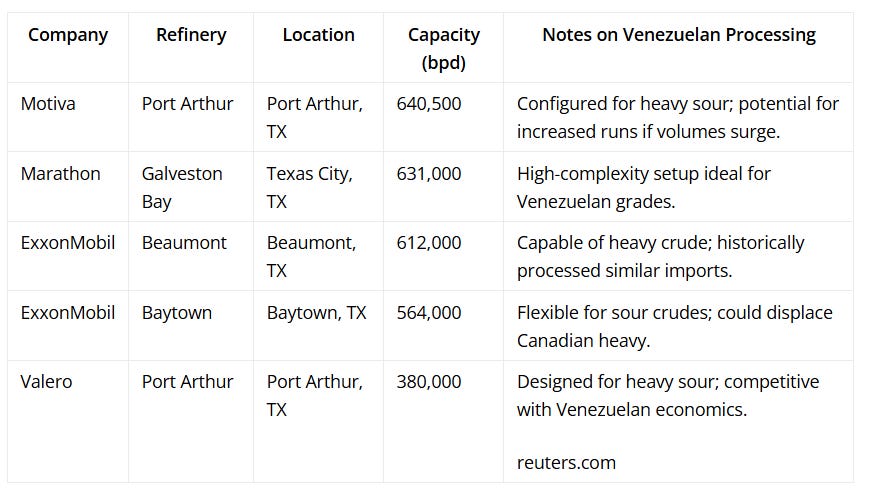

The recent geopolitical shift in Venezuela, following the U.S.-led capture and removal of former President Nicolás Maduro in early 2026, has opened new doors for American energy companies. Chevron, the only U.S. oil major still operating in the country, is ramping up its activities amid eased sanctions and a special Treasury Department license. This development marks a significant step in redirecting Venezuelan heavy crude oil back to U.S. refineries, particularly along the Gulf Coast, where infrastructure is well-suited to process this dense, sour crude. As Chevron CEO Mike Wirth stated during the company’s fourth-quarter earnings call, production in Venezuela currently stands at about 250,000 barrels per day (bpd), with potential for a 50% increase—to around 375,000 bpd—over the next 18 to 24 months, contingent on additional U.S. government authorizations.

This growth trajectory comes as the first major shipments of Venezuelan crude arrive in the U.S. post-Maduro, signaling a revival of a supply chain that once fed over 1.3 million bpd to American refineries in the late 1990s. However, the sudden surge—Chevron alone increased exports to 220,000 bpd in January 2026 from 99,000 bpd in December—has created challenges, including pricing pressures and difficulties in absorption by refiners.

Venezuelan oil, known for its heavy and sour characteristics (API gravity around 16 degrees for benchmark Merey crude, with sulfur content of 1.5-2.7%), is ideally suited for complex Gulf Coast facilities equipped with coking units to convert it into higher-value products like gasoline, diesel, and jet fuel.

4.Vitol CEO Says Oil Market Tightens on Geopolitical Squeeze

In a landscape where energy markets are increasingly shaped by geopolitical maneuvering, Vitol CEO Russell Hardy has sounded a note of caution—and opportunity—for the global oil trade. Speaking at the International Energy Week conference in London, Hardy highlighted how U.S. pressure on sanctioned oil flows from Russia and Iran is constricting supply outlets, leading to a tighter market than previously anticipated. Despite earlier forecasts of an oil glut in 2026, the reality on the ground tells a different story: millions of barrels of sanctioned crude are piling up in floating storage, boosting demand for compliant supplies and potentially driving prices higher.

This shift comes amid intensified U.S. enforcement against the so-called “dark fleet”—a shadowy network of aging tankers evading sanctions to transport Russian, Iranian, and Venezuelan oil. As India bows to pressure from the Trump administration and halts its purchases of Russian crude, China remains the primary lifeline for these sanctioned producers. But with unsold barrels lingering at sea and alternative supplies abundant, the black market for this oil is cracking under the strain. Let’s dive into the details and explore the broader implications for oil prices and OPEC’s influence.

5.Trump to Assign Pentagon to Buy Electricity from Coal to Keep Them Alive

In a bold move to resuscitate the struggling U.S. coal industry, President Donald Trump is set to issue an executive order directing the Pentagon to procure electricity from coal-fired power plants. This initiative aims to leverage federal purchasing power to sustain coal operations, framing it as a matter of national security and energy independence. The plan includes agreements for the military to buy power directly from coal facilities, potentially injecting new life into a sector battered by competition from natural gas and renewables.

And this move comes alongside the repeal of the Obama-era climate rulings that have cost U.S. taxpayers billions. Trump Set to Repeal Landmark Climate Finding in Gigantic Regulatory Rollback

According to recent reporting, the order invokes the Defense Production Act to prioritize coal in military energy needs, with the goal of preventing plant closures and maintaining domestic fuel supplies.

6.TVA Does Not Want to Close Two Coal-Fired Power Plants: A Shift in Energy Strategy Amid Rising Dema

The Tennessee Valley Authority (TVA), the nation’s largest public utility, has made a surprising pivot in its energy plans. Originally set to retire its remaining coal-fired power plants by 2035 as part of efforts to curb greenhouse gas emissions, TVA now prefers to keep two of its largest coal facilities operational beyond their scheduled closure dates.

This decision involves the Kingston Fossil Plant and the Cumberland Fossil Plant in Tennessee, which were slated for shutdown in 2027 and 2028, respectively.

The move comes ahead of a board meeting dominated by members appointed by the coal-friendly Trump administration and reflects broader pressures from surging electricity demand, particularly from data centers and AI operations.

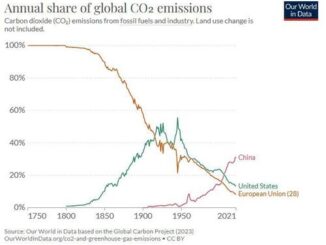

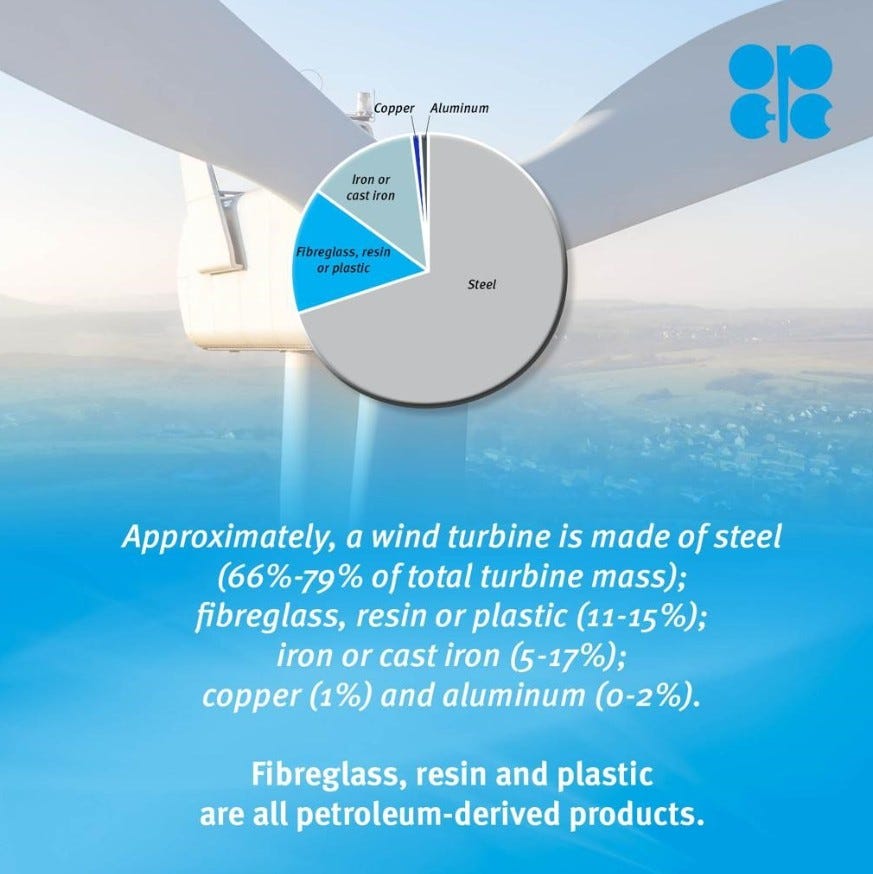

7.China’s Clean Energy Machine is Based on Oil and Coal to Survive

In the global race toward a sustainable future, China stands out as a powerhouse in renewable energy deployment. With record-breaking installations of solar panels and wind turbines, the nation has positioned itself as a leader in the “clean energy” revolution. However, beneath this green facade lies a stark reality: China’s renewable sector is heavily reliant on fossil fuels like oil and coal—not just for energy supply, but for the very manufacturing processes that build these technologies. This dependency raises questions about the true sustainability of the transition, especially as global oil producers like OPEC highlight the intertwined nature of fossils and renewables.

8.Trump Set to Repeal Landmark Climate Finding in Gigantic Regulatory Rollback

Next Wednesday, David Blackmon and Stu Turley will be on a podcast with Dr. Matthew M. Wielicki live on X, YouTube, and LinkedIn to cover the breadth of this ruling.

Alongside President Trump in the White House’s Roosevelt Room, U.S. Environmental Protection Agency (EPA) Administrator Lee Zeldin announced the single largest deregulatory action in U.S. history. In this final rule, EPA is saving American taxpayers over $1.3 trillion, eliminating both the Obama-era 2009 Greenhouse Gas (GHG) Endangerment Finding and all subsequent federal GHG emission standards for all vehicles and engines of model years 2012 to 2027 and beyond. The action also eliminates all off-cycle credits, including for the almost universally hated start-stop feature. EPA’s historic move restores consumer choice, makes more affordable vehicles available for American families, and decreases the cost of living on all products by lowering the cost of trucks. This major deregulatory process included substantial public input and robust analysis of the law following the U.S. Supreme Court decision in Loper Bright Enterprises v. Raimondo and West Virginia v. EPA.

“The Endangerment Finding has been the source of 16 years of consumer choice restrictions and trillions of dollars in hidden costs for Americans,” said Administrator Zeldin. “Referred to by some as the ‘Holy Grail’ of the ‘climate change religion,’ the Endangerment Finding is now eliminated. The Trump EPA is strictly following the letter of the law, returning commonsense to policy, delivering consumer choice to Americans and advancing the American Dream. As EPA Administrator, I am proud to deliver the single largest deregulatory action in U.S. history on behalf of American taxpayers and consumers. As an added bonus, the off-cycle credit for the almost universally despised start-stop feature on vehicles has been removed.”

Monday, we have Doomberg, and we will be covering many of the issues covered today with David Blackmon.

Shout out to Steve Reese and the Reese Energy Consulting team at https://reeseenergyconsulting.com/