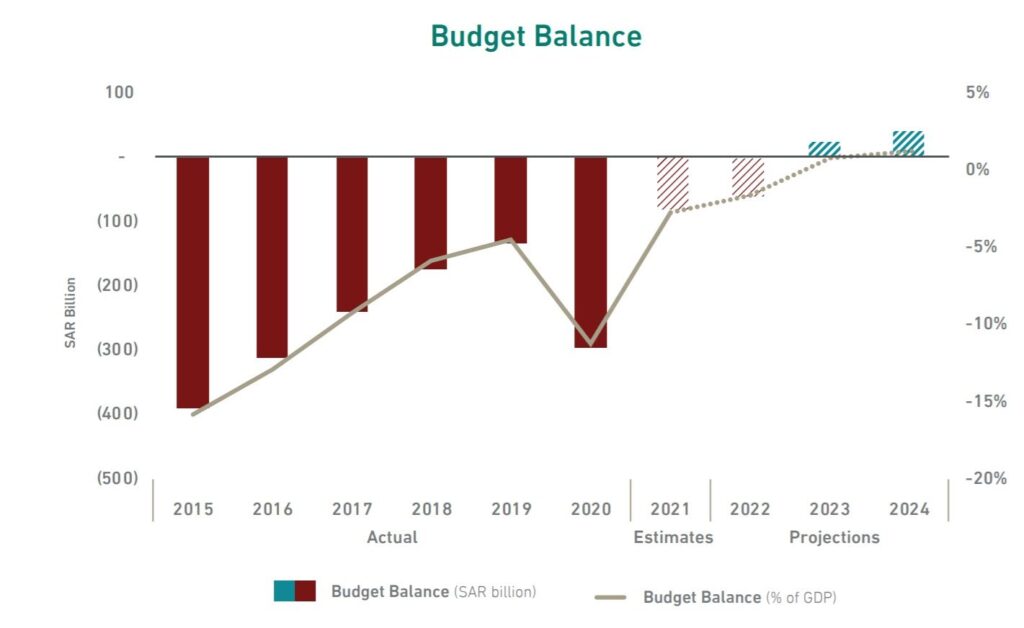

ENB Publishers Note: We covered this story last year when Saudi Arabia produced their budgets for the next several years. It is clear they are not wanting to lower prices. In fact, if you look at their budgets, you can see they need the oil price consistently over $120 next year. See Chart below.

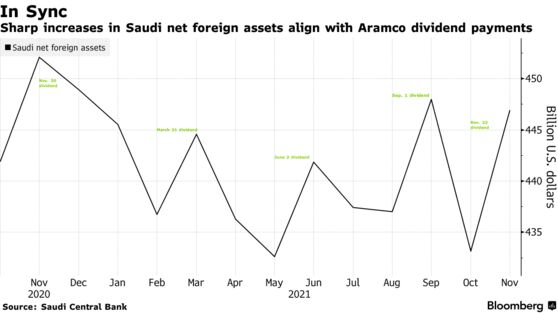

Source Bloomberg: For investors closely watching a key indicator of Saudi Arabia’s financial health, deciphering the ups and downs of its $447 billion foreign-currency reserves has become more about dividends than crude prices.

Sharp increases in the central bank’s net foreign assets now coincide with payouts from state-controlled oil producer Saudi Aramco. Disbursements of the company’s $18.75 billion quarterly dividend, almost all of which goes to the Saudi government, mean the reserves reflect less frequent but larger transfers of cash from the Dhahran-based firm.

Most recently, the correlation became apparent when reserves jumped the most in a decade in November — Aramco paid its last dividend late that month. Similar spikes in other months last year also mirrored the timing of Aramco’s distributions to shareholders.

The closer alignment makes the kingdom’s reserve holdings more predictable. Long watched by investors, economists and currency speculators, the stockpile can now be expected to increase sharply around the dividend schedule — and fall over the months after it in a reflection of cash flow constraints.

Saudi Arabia tethers its currency to the dollar and tends to adjust monetary policy in lockstep with the U.S. Federal Reserve. To maintain confidence in the riyal’s peg, authorities need to have enough reserves to cover every local currency in circulation and demand deposits, according to Bloomberg Economics.

The central bank’s net foreign assets have always been strongly tied to crude income. Before the initial public offering of Aramco in December 2019, transfers to the government came through tax and royalty payments, with additional cash distributions when oil prices were high.

But to make the company more attractive to investors, the tax and royalty rates were tweaked and a large quarterly dividend was introduced.

Since then, central bank data reflect the chunky quarterly transfers — a trend that was partly obscured in 2020 because of the pandemic, when oil revenue plunged and the Saudi sovereign wealth fund took large infusions from the central bank to place bets in the global markets.

Even when Aramco wasn’t earning enough to fund the dividend payments, however, the company cut spending and borrowed to maintain it.

Over the course of 2022, the reserves may get a further boost as the government — which is forecasting the first budget surplus is nearly a decade –looks to rebuild the stockpile.

— With assistance by Abeer Abu Omar