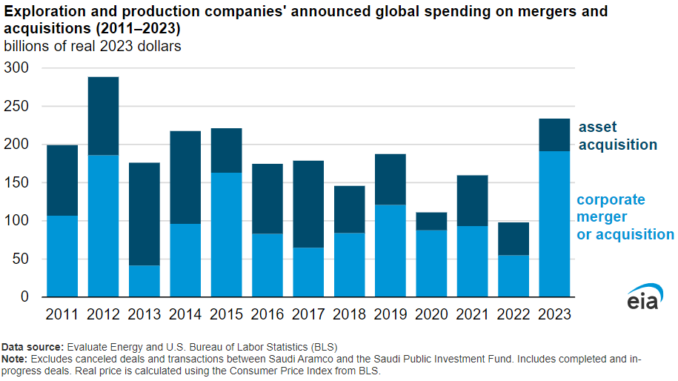

In 2023, crude oil and natural gas exploration and production (E&P) companies increased spending on mergers and acquisitions (M&A) to $234 billion, the most in real 2023 dollars since 2012. Recent dealmaking marks a return to the previous trend of consolidation among oil companies in the United States after transactions declined amid significant oil market volatility in 2020 and 2022.

Spending on M&A includes both corporate M&A and asset acquisitions. Corporate M&A involves one company merging or acquiring another company. Asset acquisition is when one owner purchases an asset from another owner. Corporate M&A was 82% of total announced spending, due in large part to two in-progress deals: ExxonMobil’s announced acquisition of Pioneer Natural Resources for $64.5 billion and Chevron’s announced acquisition of Hess Corporation for $60 billion. These deals are the largest by value in real terms since Occidental Petroleum Corporation acquired Anadarko Petroleum Corporation for a total acquisition cost of $55 billion in 2019.

Corporate M&A and asset acquisitions, such as acreage sales, can be attractive for both buyers and sellers. Buyers can purchase proved reserves instead of using capital expenditures on exploration and development that might not generate profitable assets. Some companies may also want to diversify their portfolios or purchase acreage that geographically complements their existing portfolios, which can lead to lower costs and greater production efficiency. Sellers may see selling property or merging with companies as beneficial for shareholders or, in some cases, may seek out buyers as a way to emerge from bankruptcy proceedings and improve balance sheets.

One result of recent consolidation activity is larger companies that own more producing assets. Chevron is currently the largest crude oil and natural gas liquids (NGL) producer in the United States, accounting for 5% of the U.S. total with average production of just over 1.0 million barrels per day (b/d) in the third quarter of 2023 (3Q23). If Chevron successfully acquires Hess Corporation, it could increase Chevron’s share of U.S production to 6% (just over 1.2 million b/d), based on 3Q23 data.

Similarly, ExxonMobil, the fourth-largest crude oil and NGL producer in the United States, has the potential to increase its production to nearly 7% of total U.S. production (from about 750,000 b/d to 1.3 million b/d) if it successfully acquires Pioneer Natural Resources. Barring any other large production or asset ownership changes, recent M&A could make ExxonMobil the largest crude oil and NGL producer in the United States.

ExxonMobil’s goals for the acquisition of Pioneer Natural Resources include increasing the company’s footprint in the Permian Basin in West Texas, realizing advantages from combining ExxonMobil’s and Pioneer’s adjoining acreage, and reducing overall risk in its production portfolio by increasing its domestic crude oil production, based on public statements. ExxonMobil expects that combining its 570,000 net acres in the Delaware and Midland Basins—both sub-basins of the Permian Basin—with Pioneer’s more than 850,000 net acres in the Midland Basin will result in an estimated 16 billion barrels of oil equivalent (BOE) worth of reserves in the Permian Basin. The Permian has been the main source of increasing crude oil production in the United States in recent years, and we expect it to continue to be a major source for production growth in the United States going forward.

Public statements suggest Chevron’s primary goal for acquiring Hess Corporation is to gain access to the Stabroek Block off the coast of Guyana. The Stabroek Block is the world’s largest oil discovery in the last 10 years; Chevron estimates the block has more than 11 billion BOE of recoverable resources. Hess owns a 30% stake in the Stabroek Block, ExxonMobil owns 45%, and China National Offshore Oil Corporation owns 25%. ExxonMobil filed an arbitration claim to block Chevron’s acquisition of Hess’s Stabroek Block stake, claiming a right to first refusal of a sale. The outcome of the claim could affect whether the acquisition is completed or not.

Other recent notable deals include:

- Diamondback Energy announced it will merge with Endeavor Energy for a total transaction cost of $26 billion, which is the total cost for Diamondback Energy to acquire all Endeavor Energy shares, its net debt, and transaction costs from the merger. The combined company has the potential to be the third-largest oil and natural gas producer in the Permian Basin, behind ExxonMobil and Chevron.

- Occidental Petroleum Corporation announced it will acquire CrownRock L.P. for a total acquisition cost of $12 billion. Occidental, which produced about 1.2 million BOE per day (BOE/d) of crude oil, NGL, and natural gas in 3Q23, expects to add 170,000 BOE/d of production in 2024 from CrownRock’s assets in the Midland Basin.

- Chesapeake Energy announced it will merge with Southwestern Energy for a total transaction cost of $11.5 billion, which is the total cost for Chesapeake Energy to acquire all Southwestern Energy shares, its net debt, and transaction costs from the merger. The combined company, which will assume a new name at closing, could become the largest natural gas producer in the United States.

- Chevron acquired PDC Energy, Inc., for a total acquisition cost of $7.6 billion in August 2023. Prior to acquisition, PDC Energy produced 178,000 b/d of crude oil and NGL in 2Q23, mainly from assets in the Denver-Julesburg Basin in Colorado.

- ExxonMobil acquired Denbury, Inc., for a total acquisition cost of $4.9 billion in November 2023. The deal provides ExxonMobil with the largest CO2 pipeline network in the United States and 10 onshore sequestration sites used for carbon capture and storage.

- APA Corporation announced it will acquire Callon Petroleum Company for a total acquisition cost of $4.5 billion. In 3Q23, APA Corporation produced 150,000 b/d of crude oil and NGL in the United States, and Callon Petroleum Company produced 81,000 b/d. Both companies operate primarily in the Permian Basin in West Texas and New Mexico.