Authored by Alasdair Macleod via GoldMoney.com,

Last week in my Goldmoney Insight, I analysed the rationale for a new gold backed trade settlement currency on the agenda of the BRICS summit in Johannesburg on 22–24 August. This article is about the consequences for the dollar-based fiat currency regime.

There is strong evidence that planning for this new trade settlement currency has been in the works for some time and has been properly considered. That being so, we are witnessing the initial step away from fiat to gold backed currencies. Without the burden of expensive welfare commitments, all the attendees in Johannesburg can back or tie their currency values to gold with less difficulty than our welfare-dependent nations. And it is now in their commercial interests to do so.

We have been brainwashed with Keynesian misconceptions and the state theory of money for so long that our statist establishments and market participants fail to see the logic of sound money, and the threat it presents to our own currencies and economies. But there is a precedent for this foolishness from John Law, the proto-Keynesian who bankrupted France in 1720. I explain the similarities. That experience, and why it led to the destruction of Law’s livre currency illustrates our own dilemma and its likely outcome.

It’s not just a comparison between fiat currency and gold. America’s financial position is dire, more so than is generally realised. The euro is additionally threatened with extinction because of flaws in the euro system, and the UK is already in a deeper credit crisis than most commentators understand.

Introduction

On 7 July, news leaked out and was then confirmed by Russian state media that the BRICS meeting in Johannesburg would have a proposal on the agenda for a new gold-backed currency to be used exclusively for trade settlement and commodity pricing. It appears that this is still beyond the comprehension of the mainstream media who have failed to even report on it. But like the fall of the Berlin Wall in the twentieth, it will probably turn out to be the most important monetary and geopolitical development this century.

The very few of us who have followed this story from the outset know that the Russian confirmation is the culmination of a trail of clues dating back to the time of the western alliance’s sanctions on Russian trade. With very few exceptions, among those who don’t understand the whys and wherefores that lead us to this event are the press, economists of all schools, and the western financial community.

Driving this is a war between the hegemons, with America on one side and Russia in partnership with China on the other. Until Russia was sanctioned, the Asian hegemons appeared to have a policy of sitting on their hands and letting the Americans tie themselves in knots. This has been evident in military strategy — Syria, Afghanistan, and other pyrrhic victories or failures. But it has also been true in the hidden financial war. And it is the financial war which could determine the military outcome, because if the dollar is destroyed, so will be America’s military capability and NATO will fall apart.

That much should be obvious to independent observers. Therefore, an important question to be answered is under what circumstances would the Asian hegemons drop their generally passive strategy and take the initiative? As well as Russia’s Special Military Operation last year, there is evidence that the time has now arrived. Russia’s trade surplus has now fallen sharply, and the SMO in Ukraine is a drain on otherwise healthy government finances. Because of these factors, President Putin needs to act soon to bring his SMO to a conclusion, or alternatively act to drive global commodity prices higher, which is the same thing as undermining the purchasing power of the dollar.

China sees this and faces an additional problem from the escalation of US hostilities over Taiwan. If Ukraine continues to worsen with neither party being able to backdown, China could be dragged into the conflict, given the common enemy. Furthermore, with much of Africa and Latin America migrating away from America’s sphere of influence and towards Asia, rising dollar interest rates are creating a crisis for those of them owing dollars. China almost certainly believes that in bankrupting these emerging economies by raising interest rates, America is attempting to stop them from joining BRICS, and seeks to take over many of their assets and infrastructure which China has helped create.

This threat is now greater to China’s long-term economic strategy than threats to her export trade with America and Europe. This is why China is now prepared to back the Russian plan for a new gold-backed trade currency, which is bound to rapidly undermine the fiat dollar, as all central banks in the Asian hegemons’ sphere of influence sell off their dollar reserves to acquire physical gold. For a long time, I have described activating gold as being the financial equivalent of a nuclear war — this is about to be tested.

A lesson for us from Cantillon

One of the earliest writers on economics was an Irishman, Richard Cantillon, who went into partnership with his cousin, also named Richard in Paris in 1714, finally assuming control of the bank. It was during this period that John Law befriended the Duc d’Orl?ans, the Prince Regent for the infant King Louis XV who succeeded Louis XIV in 1715. John Law was a proto-Keynesian, with similar policies for the state expansion of credit as the means by which a government could stimulate an economy, thereby increasing tax revenue. With the royal finances facing bankruptcy due to Louis XIV’s profligacy, the Regent grasped at Law’s scheme like a drowning man thrown a lifebelt.

There were four essential elements to Law’s scheme, which resonate with the monetary regime today:

The establishment of a bank with the principal function of issuing banknotes to replace gold and silver coins as the medium of exchange. This would evolve his commercial bank into a prototype central bank, appointed by the government to have a monopoly on the note issue. Gold and silver coins were to be driven out of circulation entirely.

The establishment of a trading entity (later known as the Mississippi venture) as part of a debt management scheme for the benefit of royal finances. The bank and the venture were to be the only tradable financial assets. This equates with all bond and stock market asset values being inflated currently, for the general enhancement and perpetuity of tax revenues.

To use his position as controller general of finances to boost the values of both his Royal Bank and the Mississippi venture by expanding the quantity of banknotes and bank credit.

To merge the new central bank with France’s import and export monopoly embodied in the Mississippi venture to secure income from trade tariffs and duties, significantly enhanced by the wealth created through the expansion of credit.

The similarity of Law’s financial policies with those of today are remarkable. The state’s monetary monopoly over its economy managed by a central bank replicates Law’s design for his fiat currency. The manipulation of today’s fiat currencies has ensured a wealth transfer from savers to the state for the benefit of government finances. The Fed and other central banks believe that a heathy stock market (a bubble?) is essential to maintaining consumer confidence in spending, and therefore sustaining tax revenues. The expansion of central bank balance sheets creates a wealth illusion in bond and stock markets, leading to irrational valuations.

While profiting hugely as a banker by lending credit to wealthy speculators, Cantillon was sceptical of Law’s scheme from the outset. And he was not above the sharp practice of taking in stock as collateral against loans and immediately selling it without informing the borrower. This was to result in legal actions in London’s Court of Chancellery after the bubble burst, all of which found in his favour on technicalities.

In 1720, Cantillon decided the collapse of Law’s scheme was coming. He sold all the remaining shares under his control amounting to 1,742 shares, 573 of which were collateral taken in that year at prices between 8,200 livres prior to 12 March to as low as 4,550 livres in September for a total value of 8,229,786 livres.

Besides clearing out all remaining shares under his control, his choice of action was to short Law’s livres on the foreign exchanges in London and Amsterdam in preference to Mississippi stock in the market. As events proved, Cantillion was right, because between the peak of the bubble in February 1720 and the final quarter of that year, Law’s merged Mississippi venture lost two-thirds of its value, while the livres became worthless in London and Amsterdam.

From his Essai sur la Nature du Commerce en General published posthumously in 1755, it was clear that Cantillion understood the inconsistencies in Law’s actions. In late-February 1720, Law promised to not expand the money supply, but from early March he was forced to do so to support share prices by buying them in the market. In May over the Whitsuntide holiday, with the agreement of the Prince Regent it was decreed that there would be a phased reduction in shares and banknotes to stabilise the shares and the currency, but that failed in both respects. These actions rhyme strongly with the inconsistency of central bank policies today — fighting inflation while still relying on currency debasement to fund fiscal deficits. Furthermore, central banks are raising interest rates in an attempt to control price inflation, without realising that it is the valuation users place on a fiat currency which ultimately sets its value, not monetary policy.

Today, bank credit has stopped growing and is already contracting in a number of major currencies, being driven by a combination of high commercial bank balance sheet leverage and growing concerns over bad and doubtful debts which taken together threaten to bankrupt entire banking systems. Furthermore, like Law’s Banque Royale which did not survive the 1720 crisis, today’s central banks are already technically bankrupt on a mark-to-market valuation basis due to their acquisition of government bonds at inflated prices through quantitative easing.

The one shoe to drop is the switch from raising interest rates intended to stop the general level of consumer prices rising above official 2% targets, to rescuing the entire system through a renewed credit expansion. But as the John Law experience in February 1720 showed, while a switch from supporting currency values to credit expansion to rescue a failing system is inevitable, equally it does not succeed.

The dollar and related currencies are being challenged

So far, few have minded that the dollar is a naked fiat currency. But the proposed BRICS trade settlement currency clothed in gold is bound to expose that nakedness for all markets to see. Not only will we then witness the ending of the fiat dollar regime, but we will see a forerunner of its replacement. In common with the punters at the top of the Mississippi bubble in February 1720, today there are very few commentators who, like Cantillon, detect these dangers ahead.

For fiat currencies it is a problem with two aspects. A properly designed new BRICS trade settlement currency will lead to problems for fiat currencies on a comparative basis. And led by the dollar, the fiat currencies’ credibility is being undermined from within as well. As this becomes increasingly apparent, like John Law’s livre the dollar can be expected to sink towards oblivion valued in real money, which is the gold being adopted as an anchor for the new BRICS currency.

The first problem the US authorities will face is the falling off of foreign demand for dollars and dollar debt, likely to be followed by outright sales. Of the major foreign holders of US Treasury debt amounting to $7,581bn in April, the largest liquidation in recent years was by China, as the chart below shows.

But at a pinch, by recycling dollars through financial centres to compensate, such as Cayman Islands, Luxembourg, London and Dublin, non-buying from China and the BRICS tribe can probably be offset. China and others could even be dealt with by the US Treasury refusing to accept transfers of bond ownership, but at a risk that it would seriously backfire.

The wider problem is liquidation of the dollar itself. In April, foreigners owned short-term securities, including bank deposits, CDs, and T-bills totalling $7,198bn, and long-term securities totalling $24,865bn for a combined total of $32,063bn. This is considerably more than the US’s entire GDP and does not include Eurodollars, which is dollar denominated credit created between foreign banks abroad not reflected in correspondent banking balances. Worse still, US resident citizens, businesses, and investors hold short-term assets and deposits in foreign currencies to the equivalent of $689bn (US Treasury TIC figures for March), being the only foreign currency available to absorb net dollar liquidation by foreign holders of dollars. And virtually all long-term investments are in ADR form, which means that liquidating these investments does not raise foreign exchange transactions (and therefore demand for dollars) unless they are bought by foreigners.

The crisis phase of Triffin’s dilemma is rapidly approaching, and there is very limited non-dollar liquidity on the foreign exchanges to avert it. Already, the dollar has breached an important chart support line on its trade-weighted index, as the next chart shows.

As a measure of foreign confidence in the dollar, the TWI has suddenly deteriorated in the wake of the Russian confirmation that a new gold-backed trade currency is on the BRICS summit agenda. And if it is not just deteriorating dollar sentiment, it will be rising interest rates and a securities bear market which will accelerate a dollar liquidation.

It is universally assumed in global financial markets that consumer price inflation will subside and that central banks will be able to reduce interest rates. But only this week, Russia refused to renew permission for grain shipments from Odessa, giving further impetus to global food price inflation. Falling inflation is the condition for the maintenance of financial asset values, and therefore for foreigners to retain dollar portfolio assets: but rising grain prices and the current renewed strength in oil prices indicate that the inflation dragon is still breathing its fire.

A further error in the hope that interest rates will soon decline is to not realise the consequences of commercial banks restricting credit expansion. In doing so they are sure to drive up the interest cost of credit — it used to be called a credit crunch. This contraction of bank credit, which is only just beginning to be apparent in US banking statistics, will not only threaten bankruptcy for many businesses thereby driving the economy into a slump, but it will increase the government’s funding requirements due to tax shortfalls and increasing welfare liabilities.

Meanwhile, to the confusion of neo-Keynesian expectations consumer price inflation will continue to be a problem, even accelerating again after the current pause. The error here stems partly from discarding Say’s law, and not realising that a general glut of products arising from falling consumption cannot happen. A further error is to not understand that the fiat dollar will continue to lose value measured in goods, just as John Law’s livre did after May 1720 despite belated attempts to contract the bank note issue. Like spots are to measles, inflation of prices is the visible symptom of all dying fiat currencies.

The essential point is that markets are taking over control of interest rates from the central banks. This is an additional problem for the US authorities. Along with other group-thinking central bankers in the Bank for International Settlements network, they will learn the hard way that interest rates are not the price of money, but the compensation foreigners require to maintain their holdings. And even that assumes that with the correct interest compensation foreigners will continue to be passive holders, rather than deploying credit for better purposes as they seem bound to do.

Now that a sound money alternative to maintaining reserve balances in dollars is emerging, if the dollar is not to suffer a major crisis at the minimum the Fed will have to go along with the markets and raise rates. Another way of looking at this dilemma is that if the authorities attempt to support the dollar by activating swap lines, it will contract the quantity of dollar credit in circulation, worsening the credit crunch. But as John Law discovered in the months following May 1720, contracting credit in a fiat currency does not necessarily save it. The implications for the US Government’s deficit and its funding costs are also dire.

US budget deficits and inflation

The chart above is of US Government debt outstanding daily for the last year, according to the US Treasury. Besides the period when negotiations to raise the debt ceiling put the outstanding debt level on hold, there are two notable features. The first is that in only a year, government debt has increased by $2,027bn (6.6%), and secondly the rate of increase is accelerating alarmingly. A large part of the problem is that the cost of funding US Government debt is soaring, as the next chart shows.

Congressional Budget Office forecasts are for budget deficits exceeding $1.5 trillion this and next fiscal year. But the interest rate assumption is an average of 2.7% for both years and beyond, which is clearly behind events and overly optimistic.

Put together the two charts above and you have the classic debt trap, whereby US finances are deteriorating beyond control. Furthermore, the US faces the prospect of a severe contraction of business activity due to the slowdown in bank lending and its effects on interest rates. Tax revenues will undershoot current Congressional Budget Office estimates and mandated welfare commitments will increase on the expenditure side. Consequently, government borrowing will accelerate even further and interest payments on it will as well.

Funding this accelerating deficit must be causing the US Treasury an enormous headache. Just as President Biden went to Saudi Arabia to persuade MBS to accelerate oil output unsuccessfully, Janet Yellen visited China’s Vice Premier He Lifeng as this financial crisis is developing. Of course, none of this was mentioned in the press communiqu?s, but you can bet your bottom dollar that Yellen wanted China to start buying Treasuries again, or at the very least to stop selling them. But the implications for the dollar are still dire, and it becomes something of an open question as to when foreign holders of the dollar will realise how serious America’s finances have become.

Even without a banking crisis, the Fed will be faced with a stark choice: does it try to save the dollar, or does it try to salvage government finances. Welcome to the John Law dilemma.

All fiat currencies are threatened

Gold backing for the new trade currency is bound to create problems for BRICS national currencies, which may or may not be fully appreciated by individual BRICS nations. The solution for them is to secure their own currency values, either by setting their own gold standards or linking them to the new trade currency in some sort of currency board arrangement. While many of these nations have a history of currency mismanagement, theirs is essentially a confidence problem which can be resolved by turning their backs on the dollar-based fiat currency system.

All these governments have finances that can be balanced with a little fiscal discipline, because they don’t have the welfare burdens that the advanced economies have to contend with. The benefits to their economies of sound money and the low level of interest rates that comes with it are obvious, and social and economic progress can be expected to be as miraculous as those enjoyed in Britain under her nineteenth century gold standard.

But the introduction of a new trade currency backed by gold will undermine the major fiat currencies which have survived on Keynesian myths, which like those of the proto-Keynesian John Law are about to be terminally challenged. And the euro will have an additional problem arising from the ECB’s committee-designed structure.

Like other central banks the ECB not only reduced interest rates, in its case to unnaturally negative levels, but it paid top euro for government bonds as part of its “asset purchase programmes” — currency-debasing QE to the rest of us. Consequently, since the mark-to-market losses have wiped out its equity many times over, and also the equity of nearly all the national central banks which are the ECB’s shareholders, the whole euro system is technically bust — a situation which will worsen if Eurozone bond yields continue to rise. Furthermore, there are substantial imbalances in the TARGET2 settlement system between the euro system’s members which remain unresolved.

When a central bank has one shareholder such as its government, recapitalising it is relatively simple and can be done in a heartbeat. On its balance sheet the central bank creates a loan in favour of the shareholder, and instead of balancing the asset represented by the loan with a deposit liability, it enters the balancing item as equity. In many jurisdictions, this can be done and subsequently confirmed by the legislature. But the structure of the euro system requires multiple governments to agree to recapitalise their own central banks as well as the ECB. The recapitalisation of the entire system will be far from a fait accompli and almost certainly will become an embarrassingly public issue.

The ECB takes the view that it will hold the bonds on its balance sheet to maturity, so there is no need to mark to market and recapitalise the system. But that assumes monetary plain sailing for a considerable time and that interest rates will decline from current levels and stay down. Otherwise, the euro system will be called upon to rescue overleveraged commercial banks with mounting portfolio losses and bad debts.

But we can now see that if the new BRICS gold backed trade currency replaces the dollar and euro for potentially more than half the world’s trade measured by GDP on a PPP basis, it will lead to catastrophic falls in exchange rates for both the dollar and the euro valued in gold. Assuming that priced in gold commodities continue to be stable (which over time tends to be the case), then the implications for Eurozone states are that after the current dip inflation of prices will remain high and potentially rise even further due to the euro’s loss of purchasing power. Similarly, bond yields will rise above current levels, commercial banks will be destabilised, and the euro system’s hidden losses multiply.

This is why the future of the euro system and the fiat euro itself is at stake. Not only will the euro be on the wrong side of the return-to-gold-backing story, but its structure is an additional, fatal weakness.

Sterling has similar problems to the dollar. London being the centre of financial activities outside the US has led to substantial quantities of sterling accumulating in foreign hands. For now, the increase in interest rates and bond yields has led to the currency recovering against a weakening dollar by 24% since last September. But the increase in rates is causing serious difficulties for residential property, which combined with price inflation is squeezing consumers badly. The UK economy faces the early stages of a nasty credit squeeze, which is clearly evident in the chart below from the Bank of England’s website — the last data point being April.

Interest rates cannot fall while lending is contracting because bank credit becomes increasingly scarce at a time of rising demand for liquidity. This is the consequence of rising input prices and slowing sales volumes. So far, consumers have absorbed much of the increase in prices by extending credit card debt, which increased by 9.5% in the year to April. But with mortgage and other costs now hitting consumers hard, sales volumes of goods and services are set to contract even further, in turn accelerating the reduction in business lending as banks turn increasingly cautious. For nearly all businesses, cash flow is slowing to a halt. And my company doctor friends and insolvency practitioners have never been so busy reconstructing companies with a view to avoiding bank debt write-offs.

Just as banks fuelled the boom, they are now fuelling the bust. This is a point which is poorly understood by market participants, who have come to believe that it is the Bank of England which sets interest rates. It is a common error behind the state theory of money, which is now being challenged by events in Asia and much of the developing world.

The consequences for gold

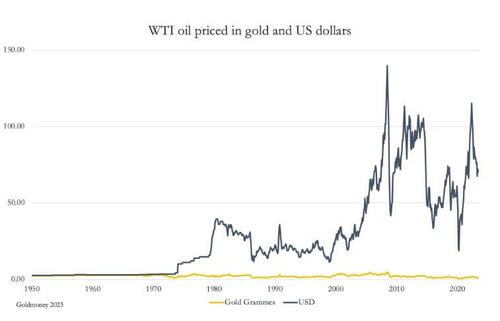

Apart from monetary stability, the raison d’?tre for BRICS adopting a gold-backed trade currency lies in its relationship with commodities. This is illustrated in the chart below, which is of oil priced in dollars and gold.

Oil priced in gold has been considerably more stable than priced in dollars, a fact also reflected in any non-seasonal commodity you care to name. For energy and commodity producers, the volatility of the dollar as a pricing medium plays havoc with the values upon which extraction costs are predicated. Additionally, pricing in dollars has depressed the pricing of oil in gold, which is currently half what it was in 1950. This will have been noticed by Russia, Iran, and Saudi Arabia.

Price stability also benefits manufacturers, who in their business calculations can be more certain over long-term cost assumptions. They also benefit from low level interest rate stability that comes with a gold standard, particularly when compared with the current increasing interest rate volatility under the fiat currency regime. Russia is a case in point: the central bank’s interest rate is 7.5%, and the 10-year government bond yields 11.5%, despite June’s consumer price inflation at 2.76%. If the rouble went on a gold standard, and as confidence in the arrangement becomes established the overnight rate is likely over time to drop below 3% and bond yields should decline to not much more.

This argument is sure to have also persuaded the Chinese and other manufacturing nations in the BRICS community that tying production costs to gold is beneficial, exploding the myths about fiat currency flexibility, which have only led to the weaponization of the fiat dollar by the US government.

The benefits of gold-backed currencies are clear. The problems arising from adopting gold standards principally affect the standing of fiat currencies reluctant to embrace gold. China’s exporters are bound to experience the purchasing power of dollars and euros declining, perhaps collapsing completely. This leads to higher prices for Chinese goods in all major fiat currencies. But by sanctioning a new BRICS gold backed currency, the Chinese are now going along with the less visible benefits of valuing export goods in gold, and along with Russia she now has good reasons to put the renminbi onto a gold standard as well.

In short, we are witnessing the end of the fiat currency era, which in pure form has existed since Bretton Woods was abandoned 52 years ago. Americans, Europeans, and the British will experience gold prices rising against their fiat currencies, possibly at an accelerating rate when foreigners start dumping their currencies in favour of gold. But it won’t be gold rising so much, as their fiat currencies failing, just like John Law’s livre.

Loading…