European gas futures predictably relinquished recent gains as fears of Australian LNG strikes receded after Woodside Energy struck a tentative deal with union bosses (more on this below). But the most interesting EU gas story last week was BASF’s deal to import US LNG from Cheniere Energy, which could save the German chemicals giant as much as $4.8 billion compared to buying gas at European wholesale prices, according to calculations by Energy Flux.*

BASF signed a sales and purchase agreement (SPA) to buy 0.8 million tonnes per annum (mtpa) over 15 years from Cheniere’s proposed expansion of its Sabine Pass LNG plant in Louisiana from mid-2026. The price will be indexed to Henry Hub with an undisclosed mark-up. Typically, such deals are struck at 115% Henry Hub.

BASF said the deal “will ensure reliable supply of natural gas at competitive terms”. Pre-2021, such a statement would have raised eyebrows. When Germany was amply supplied with Russian gas, the country did not even have a functioning LNG import terminal. Committing to import American LNG via the Netherlands or France would have made little sense other than as a strategic hedge against gas supply disruption which, pre-Ukraine, was not perceived as a material risk.

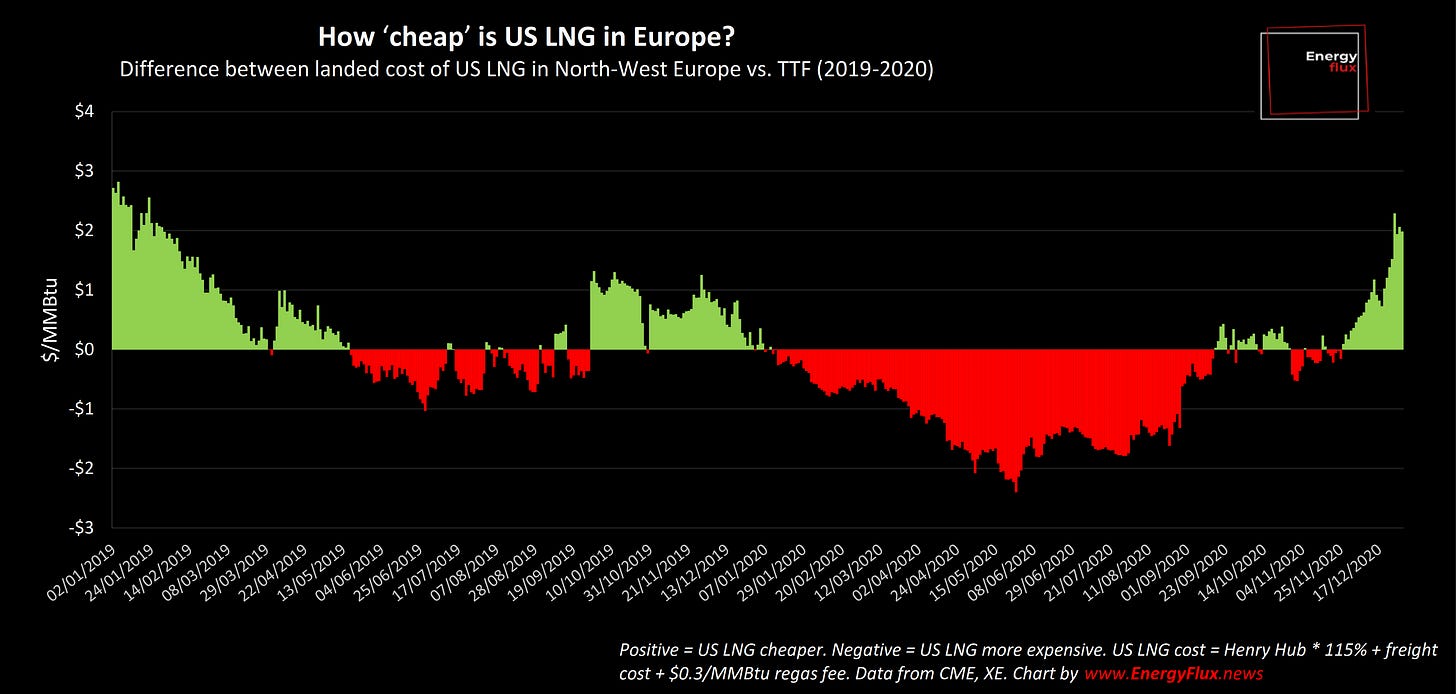

US LNG was uncompetitive in Europe in summer 2019, when the world was awash with gas. The cost of liquefying and transporting the fuel across the Atlantic became prohibitive when TTF, the European gas benchmark, fell as low as $3.21 per MMBtu. That situation was compounded when the Covid-19 pandemic struck in 2020 and lockdown-induced demand destruction forced Cheniere’s long-term customers to cancel a slew of US LNG cargoes.

Cheniere’s customers paid at least $708 million to cancel an estimated 67 cargoes over April-June 2020. With EU storage levels brimming and floating storage maxed out, paying the penalty was a better option than lifting cargoes that had literally nowhere to go. Those memories prevented European companies such as BASF from jumping into long-term SPAs, even in the wake of Russia’s war of aggression in Ukraine.

Faltering gas flows on Nord Stream changed all that, triggering a giddying spike in TTF that put US LNG firmly back in the money in Europe. Margins went stratospheric when the subsea pipeline was destroyed in an audacious act of sabotage in September 2022. In hindsight, the 2020 price crash was a mere blip before EU gas markets went through the looking-glass.

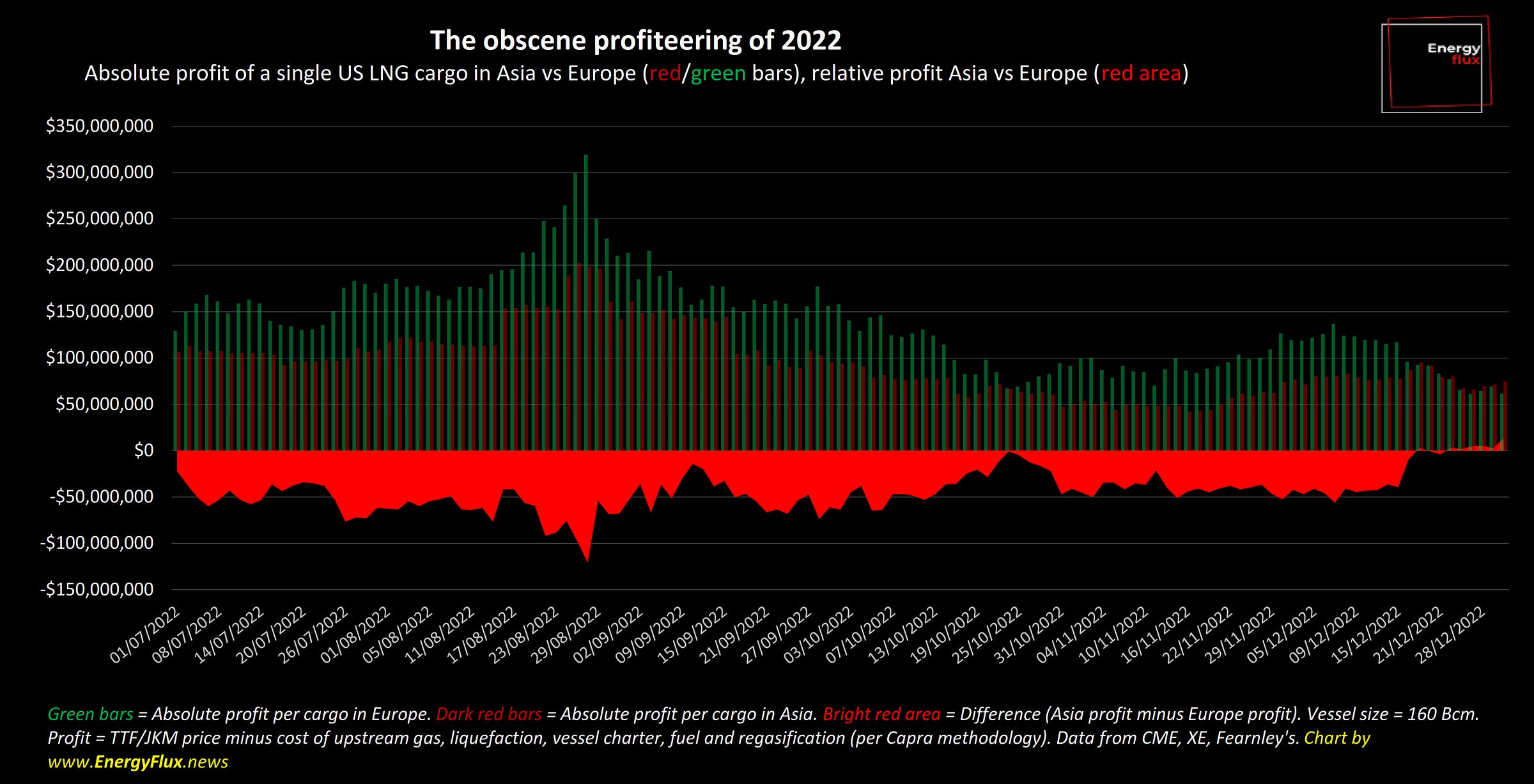

This created a once-in-a-generation profit-making opportunity for anyone buying gas at prices indexed to non-European benchmarks such as Brent or Henry Hub. Industrial consumers were strongly incentivised to curb output or shut down and resell spare gas into red-hot spot markets. At the height of the 2022 madness, companies lifting liquefied American gas from the Gulf of Mexico were making as much as $300 million from each cargo shipped to Europe.

Not many European industrial companies were buying US LNG at that time, but several utilities were — and this spectacular windfall went a long way to patching up LNG losses incurred in the pandemic year. BASF might have missed out on the bonanza, but it sees a strong ongoing case for rebasing its petrochemicals business around regasified US LNG indexed to Henry Hub.

LNG is rarely used as feedstock for petrochemical plants because it is inherently more expensive than pipeline flows due to the cost of liquefaction, shipping and regas. Energy-intensive petchems operations are usually located close to a source of cheap molecules, and abundant Siberian gas flows created the perfect conditions to grow Germany’s industrial economy.

With reliable pipeline flows now in short supply and benchmark TTF prone to irrational price swings (such as those of recent weeks — more on this below), the calculus has shifted. Forward markets anticipate a tapering in the spread between TTF and Henry Hub in 2026 when the Cheniere SPA is due to kick in, but the savings to be had are still considerable.

* Assuming a natural gas heating value of 1,100 Btu per cubic foot of gas, one tonne of LNG equals 53.57 MMBtu. Therefore, 0.8 million tonnes of US LNG — the amount that BASF will buy from Cheniere every year — contains 42,856,000 MMBtu. The average saving of US LNG landed in Europe versus TTF in the second half of 2026 is $7.39 per MMBtu. If this differential is sustained throughout the 15-year PPA, BASF could save approximately $317 million every year or $4.75 billion over the full term.

That’s a big ‘if’ and gas markets are notoriously fickle, but the idea of US LNG shut-ins is today a very distant prospect. BASF is buying LNG on a free on-board (FOB) basis, so could opt to ship cargoes to higher-paying markets in Asia or Latin America if (somehow) European netbacks were to fall to uneconomic levels. This would require the company to implement new procurement risk management and trading capabilities, but the cost of doing so would be offset by the savings on offer.

Strike fears dissipate

As expected, TTF retreated last week when one of the three Australian LNG exporters reached an agreement in principle with the unions. There is still a chance of industrial action, but supply disruption should be minimal or non-existent depending on the type of any walkout that union members might still agree to.

TTF has exhibited an exaggerated response throughout this period. It rose much more quickly than JKM, the Asian LNG benchmark, when strike news first broke, and last week fell 18% compared to 6% on JKM. If markets were acting rationally then the roles would be reversed, as Australia does not ship any LNG to Europe and Asia has only a fraction of Europe’s gas storage capacity.

The TTF correction cemented the ‘Asian premium’ for LNG, albeit only for October, the front-month. Looking further out, there is still an economic incentive to ship US LNG to Europe as in the autumn months — and the spread flips strongly in favour of doing so from March 2024, when EU gas restocking begins.

Curiously, the TTF correction was not mirrored in the spot price of LNG in North-West Europe. CME’s NWE LNG futures fell only marginally on the week…

… exacerbating the perverse situation of LNG on the water being more valuable than gas held in European storage. In fact, NWE LNG futures are now trading at a premium to TTF all along the strip.

The driver for this, as detailed in last week’s Energy Flux, is the paradox of Europe being simultaneously awash with gas and facing a likely need to import more LNG soon. With Asian buying demand showing no real signs of life, this pricing dynamic is encouraging traders to hold LNG in European waters and wait for the heating season to kick in as temperatures drop.

That’s a tough bet because, even though TTF is still strongly in contango, long-range weather forecasts do not anticipate a particularly cold winter and Europe is in any case well prepared. In power generation, gas is the marginal price-setter and faces a more challenging winter compared to last year. Renewables generation is higher than ever, French nuclear maintenance has made better-than-expected progress and hydro levels are in much better shape.

That said, the TTF correction improved the margins on gas-fired power versus coal, with calendar future clean spark spreads well in the money throughout winter and next spring and summer. Of course, whether must-run zero marginal cost sources will create much space for CCGTs is another matter entirely. With cheap coal also buoyed by a softening EU carbon price, gas power is set to play a more marginal role in the European mix than last winter.