The lengthy decision-making that determines which asset classes Norway’s investing behemoth can buy puts it at a disadvantage compared with smaller money managers, “in particular” regarding ESG, according to Diego Lopez, a managing director at the independent group. Global SWF provides data and analysis on more than 400 sovereign investors and public pension funds.

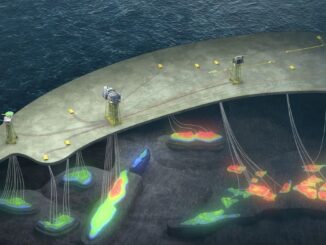

The Norwegian fund, which was built from the country’s North Sea oil and gas riches, is managed by the central bank. Any decision to alter its mandate needs to be approved by parliament in a process that can take years. One of the first public statements by Nicolai Tangen, the fund’s chief executive since September, was to point out that the renewable energy assets the investor was finally freed to start buying had become too pricey.

ESG “is a sector that should concern Norway especially given the source of its wealth,” Lopez said in an email. “It is difficult to make incursions without being able to act in private markets, really.”

While the fund “spends time in the parliament and seeking public consent, smaller and nimbler investors are able to take advantage of unique investment opportunities that are already out there,” Lopez said. He characterized the governance framework as one of the most important areas concerning the fund’s ability to function well in the future.

Tangen, the 54-year-old former hedge fund manager appointed last year following a drawn-out nomination drama, has made sustainable investing an explicit focus of his strategy. His expectations around ESG skills extend to the external managers, who now oversee about $60 billion of the fund’s total assets.

Without needing to change any mandates, the fund can improve performance in ethical investing by digging deeper into how companies actually run their businesses, he told Bloomberg Television last month.

The fund didn’t immediately respond to a request for comment. Hans Andreas Limi, a member of parliament for the opposition Progress Party, said “it’s important that the parliament provides overall guidelines.” But he also said the chamber shouldn’t “control” the fund “in detail.”

Svein Roald Hansen, a lawmaker with another opposition force, the Labor Party, said the fund must maintain its moderate risk profile and beware of potential setbacks in capital markets despite good returns in past few years by avoiding a “short-term perspective on individual investments.”

Norway’s wealth fund generated $123 billion in returns last year, marking the second-best performance in its history. Its performance was boosted by its holdings of tech stocks, while oil and U.K. holdings led to losses.

Bloomberg