Given the impact of AI and Data Center demand on a previously flat growth market, we need to examine the overallocation of resources to integrate wind, solar, and storage into a grid system not designed for intermittent power sources. Consumers in Blue states pay an average of 38% more for energy, and it is not just wind, solar, and storage; it is also the regulatory burden and program pricing. Consumers should be aware that the NERC report says we will spend a lot of money to increase the risk of blackouts.

As the host of the Energy News Beat podcast, I’m always keeping an eye on the big-picture threats to our energy infrastructure.

The North American Electric Reliability Corporation (NERC) just dropped its 2025 Long-Term Reliability Assessment (LTRA), and it’s a wake-up call for the grid’s future. This report peers into the crystal ball for the next decade, with a sharp focus on emerging risks starting as early as 2026.

Drawing from probabilistic modeling and energy risk metrics, NERC paints a picture of intensifying resource adequacy issues across North America. Let’s break it down: the key issues, what’s driving them, and how this could hit consumers where it hurts—their power reliability and wallets.

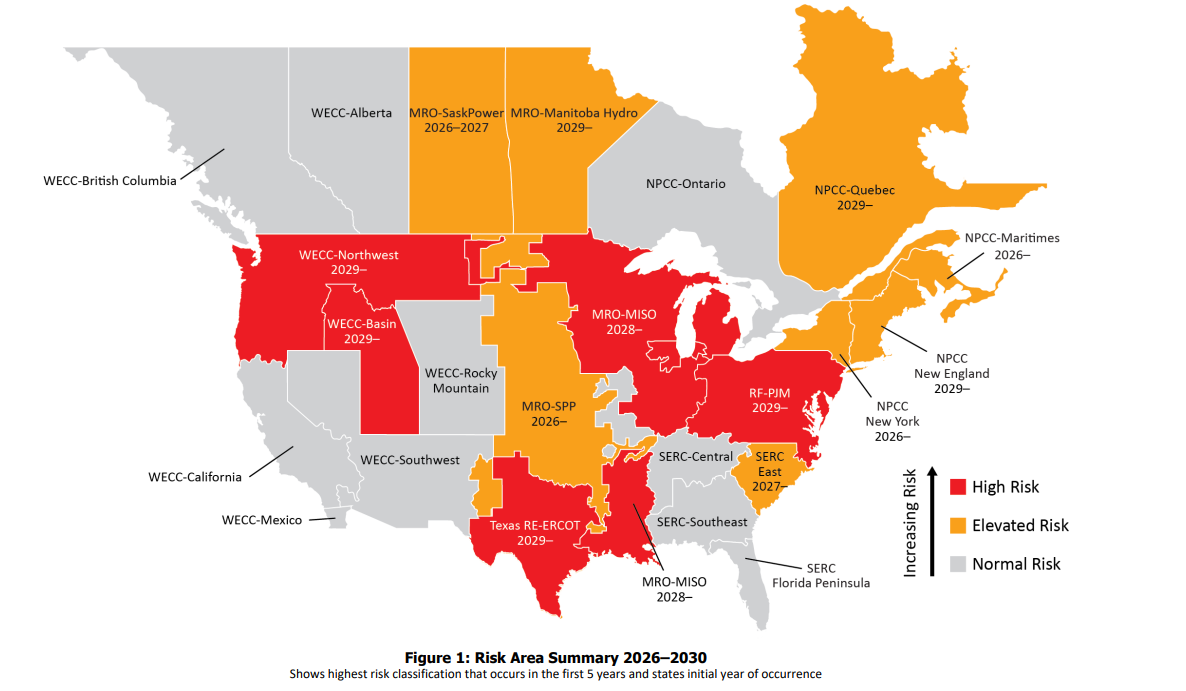

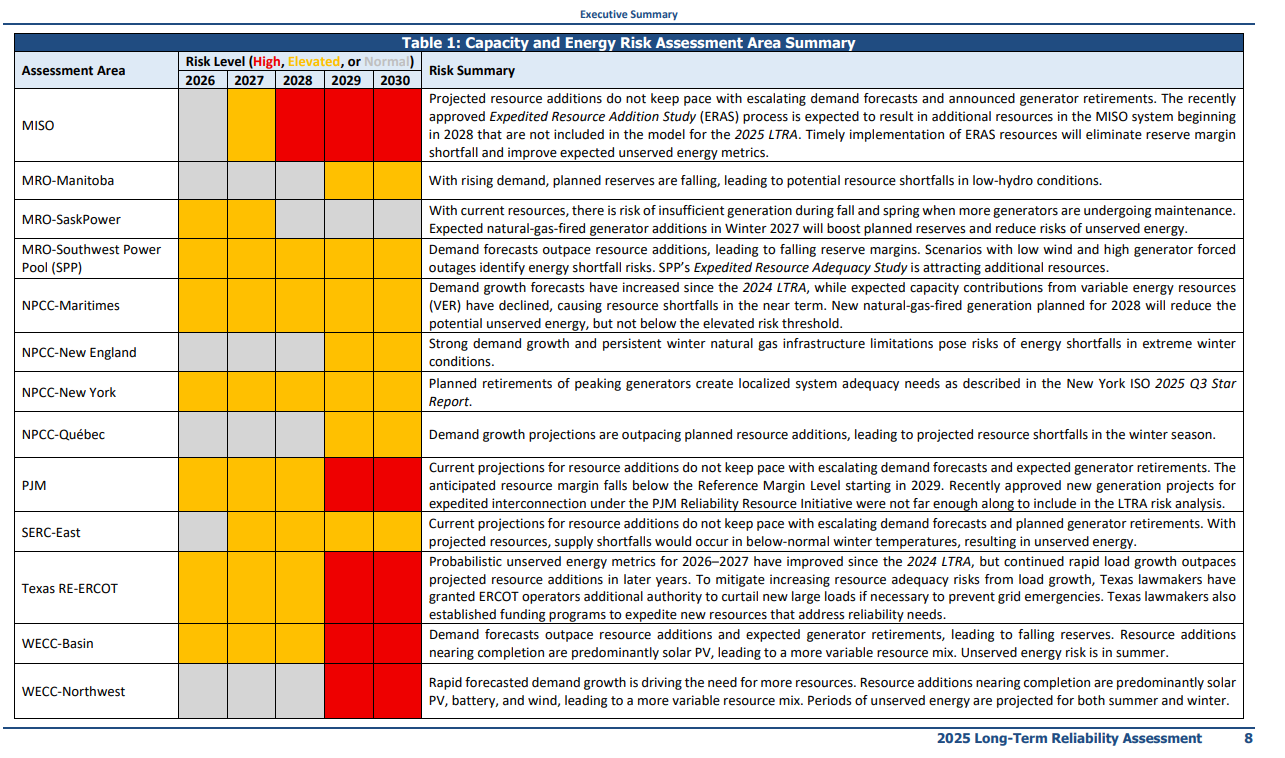

The LTRA is NERC’s annual deep dive into the bulk power system’s (BPS) ability to meet electricity demand over a 10-year horizon. For 2025, the assessment highlights a dramatic surge in projected demand, coupled with uncertainties in supply. Unlike previous years, this report incorporates advanced energy risk metrics to spotlight potential shortfalls, emphasizing that the grid is under more pressure than ever. The bottom line? Over half of North America could face elevated or high risks of energy shortfalls, with winter seasons looking particularly vulnerable as we head into 2026 and beyond.

Key Issues Identified in the ReportNERC identifies several interconnected challenges that could compromise grid reliability.

Here’s a breakdown of the major ones:

1. Explosive Demand Growth

Demand is skyrocketing, and it’s not just from population growth or hotter summers. The report forecasts a 224 GW increase in summer peak demand over the next decade—that’s over 69% higher than what was projected in the 2024 LTRA. Winter demand is even more concerning, with an expected rise of 246 GW. Why the surge? Blame it on the digital boom: massive data centers powering AI, cloud computing, and cryptocurrency mining are gobbling up electricity at an unprecedented rate. Electrification trends, like electric vehicles and industrial shifts, are adding fuel to the fire.

This growth is uneven, hitting hardest in regions with rapid tech development. By 2026, we could see initial strains as demand outpaces infrastructure buildout, leading to tighter reserve margins.

2. Generator Retirements Outpacing Replacements

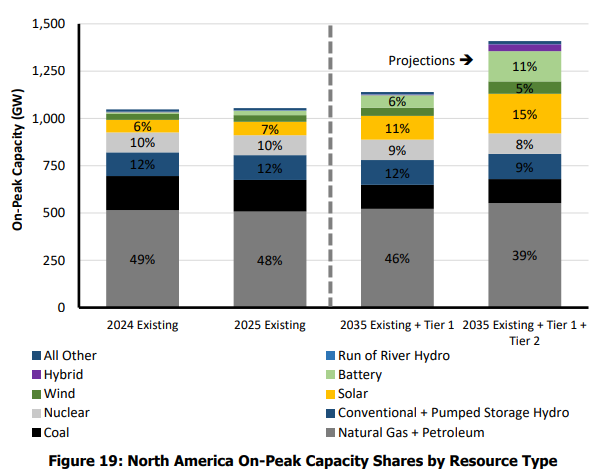

A staggering 105 GW of peak seasonal capacity is slated for retirement over the next 10 years—down 10 GW from last year’s projection, but still a massive hit. These retirements span coal, natural gas, and other thermal plants, often driven by economic pressures, environmental regulations, and aging infrastructure.

Replacements are coming, but not fast enough or reliably enough. The report notes a shift toward variable resources: solar and battery storage projects now lead the pack, with batteries matching solar in projected additions. Natural gas makes up about 15% of new capacity, while wind and hybrid systems (like solar-plus-storage) each account for 8%. However, interconnection queues—the pipelines for getting new projects online—are ballooning, creating delays and uncertainties. Many planned additions might not materialize on time, exacerbating shortfalls as early as 2026.

3. Challenges with Renewable Integration and Variable Resources

The grid’s transition to renewables is accelerating, but it’s not seamless. Solar, wind, and batteries are great for clean energy, but their output is weather-dependent and variable. The LTRA points out risks from inverter-based resources (IBRs), which can cause unexpected output reductions during disturbances, potentially destabilizing the system.

Winter risks are amplified here, as solar performs poorly in shorter days, and wind can be inconsistent during cold snaps. NERC’s probabilistic assessments show that without better energy storage and grid flexibility, these variables could lead to supply gaps during peak demand periods.

4. Transmission and Infrastructure Lags

Regional Variations and Hot Spots

While the press release doesn’t dive deep into specifics, the LTRA indicates widespread concerns across the BPS. Areas like the Midwest (MISO, PJM), Texas (ERCOT), the West (WECC), and parts of the Southeast and Northeast are flagged for elevated risks. Winter conditions could push these regions into shortfall territory by 2026, especially if extreme weather hits. For instance, data center clusters in Virginia or Texas could strain local grids, leading to dependency on imports from neighboring areas.

Impacts on Consumers

So, what does this mean for everyday folks and businesses?

The stakes are high:

Reliability Risks and Blackouts: Potential energy shortfalls could translate to rolling blackouts or emergency load shedding during peak times, particularly in winters starting 2026. Imagine a cold snap where demand spikes 25% above forecasts—consumers in at-risk regions might face hours without power, disrupting homes, hospitals, and industries.

Higher Energy Costs: Tighter supplies often mean higher wholesale prices, which utilities pass on to customers. With demand surging and retirements looming, expect upward pressure on bills. Data centers, while boosting the economy, could indirectly hike rates if their rapid growth forces costly grid upgrades.

Economic and Lifestyle Disruptions: Businesses reliant on constant power, like manufacturing or tech firms, could see downtime costs in the billions. For residential users, this might mean more calls for energy conservation during peaks, or investments in backup generators.

Long-Term Equity Concerns: Lower-income households might bear the brunt, as they have fewer options for efficiency upgrades or alternative energy sources. NERC warns that without action, these issues could widen the gap in reliable access to electricity.

NERC’s Recommendations: A Path Forward

NERC isn’t just sounding the alarm—they’re offering solutions. Key recommendations include:Speed Up Development: Planners, operators, and regulators should expedite new resources while carefully managing retirements to avoid gaps.

Harness Load Flexibility: Treat large loads like data centers as opportunities for demand response—using their flexibility to balance the grid.

Enhance Assessments: Improve the LTRA process with better wide-area analysis and risk scenarios.

Streamline Processes: Policymakers need to cut red tape on permitting for generation and transmission.

Ensure Essential Services: RTOs, ISOs, and FERC should prioritize reliability services like frequency response and voltage support.

Better Coordination: Strengthen ties between electric and natural gas sectors to avoid fuel supply crunches.

The Energy Transition is Not Happening

This chart is on page thirty-two and jumped off the page. How much will the solar and battery system add to the grid in reliable power, and what are the costs? This also looks like nuclear does not take off. If we are spending billions on nuclear and loose 2% because of retiring nuclear plants, we are doing something really wrong.

Here is the link to download the entire report.

Wrapping It Up

The 2025 LTRA is a stark reminder that our grid is at a crossroads. With demand exploding thanks to AI and electrification, and traditional resources retiring faster than replacements can spin up, 2026 could mark the start of tougher times unless we act fast. For consumers, this means bracing for potential disruptions and higher costs, but also an opportunity to push for smarter, more resilient energy policies.

We really need to implement new pricing programs that charge for wind, solar, and storage for resilience. They are paid to stand down, or natural gas and coal are forced offline, causing additional costs.

My Dad was an RF4 pilot in Vietnam, and they would land and switch out the planes with the engines running. The military counts turbine cycles for maintenance. When turbines are in motion, they are not wearing out. It is the spin-up or down that causes additional maintenance issues. I did not put the two together until I tried to calculate how much additional wear and tear costs consumers after hearing that Stargate and others are looking at using turbines from the U.S. military boneyards.

Cycling involves starting, stopping, and adjusting output, which deviates from the steady-state operation gas turbines were designed for. For instance, in regions with high renewable penetration like the Western Interconnection, wind and solar can require fossil generators to ramp up and down rapidly, leading to deeper load following and potential wear on components.

Aging infrastructure exacerbates this: turbines over 25 years old see failure rates double, with thermal stress and corrosion accelerating degradation.

In flexible operations, turbines may experience up to hundreds of starts per year, far beyond traditional baseload designs.

Gas Turbines Suffer Economic Hardships Due to Stress Placed on Them by Wind and Solar

Let’s keep the lights on, folks, and ask your congressional representatives in the House and Senate to start looking at revamping the electrical pricing in the US.

We will be covering the earnings reports from the oil majors as Chevron beats expectations this morning. More on that later.

Here is the link to download the entire report.

Sources: NERC 2025 Long-Term Reliability Assessment and associated press release.

Be the first to comment