In a world grappling with escalating energy demands driven by artificial intelligence, electric vehicles, and industrial electrification, nuclear power is emerging as a powerhouse solution. According to a recent analysis by Bank of America, the nuclear industry represents a staggering $10 trillion market opportunity, poised to address global power shortages through reliable, clean energy generation.

This resurgence comes at a critical time, as experts predict that global nuclear capacity must triple by 2050 to meet surging electricity needs, with investments surpassing $3 trillion over the next 25 years.

Timothy Fox, vice president at ClearView Energy Partners, emphasizes the momentum building around nuclear as a “firm, dispatchable, and clean” source, particularly for energy-hungry data centers.

The appeal of nuclear lies in its proven track record: it’s reliable, cost-effective, emissions-free, and safe, serving as a bridge to scale up renewables like solar and wind.

Traditional large-scale reactors have faced hurdles, including lengthy construction times and high costs, but the spotlight is now on small modular reactors (SMRs). These compact units, typically under 500 MW, promise faster deployment and lower expenses compared to gigawatt-scale plants.

Are you Paying High Taxes in New Jersey, New York, or California?

Leading the charge are companies like NuScale Power, the only U.S. firm with a licensed SMR design, targeting market entry by 2030, and Oklo, backed by OpenAI’s Sam Altman, aiming for power delivery by late 2027.

Investor enthusiasm is evident, with NuScale and Oklo shares surging over 100% and 350% year-to-date, respectively.

The U.S. Grid: Current Capacity and Looming Demands

Shifting focus to the United States, the electric grid is under immense pressure to expand and stabilize amid rapid demand growth. As of late 2023, the U.S. boasted approximately 1.19 billion kilowatts (or 1,189,492 MW) of utility-scale electricity generation capacity.

However, projections indicate a dramatic uptick in consumption: electricity demand is expected to rise 25% by 2030 from 2023 levels, potentially surging 35-50% by 2040 and 50% by 2050.

This growth is fueled by domestic manufacturing resurgence, AI-driven data centers, building electrification, and electric vehicle adoption—sectors that demand consistent 24/7 power for stability and efficiency.

Without sufficient additions, grid reliability could falter. The Department of Energy warns that blackouts might increase 100-fold by 2030 if reliable generation sources retire without replacements, highlighting the need for firm baseload power to prevent outages during peak loads or variable renewable output.

Transmission capacity alone may need a 64% expansion by 2040 to handle moderate load growth.

For manufacturing, which thrives on uninterrupted energy, this means prioritizing sources like nuclear and natural gas over intermittents like solar (currently at 220 GW, projected to reach 255 GW by 2035).

To meet these needs, nearly 469,000 MW of new generation capacity is under development nationwide, with 63 GW slated for addition in 2025 alone—led by solar and battery storage but including baseload options.

However, the real test is in approved projects for natural gas and nuclear, which provide the 24/7 reliability essential for grid stability and industrial growth.

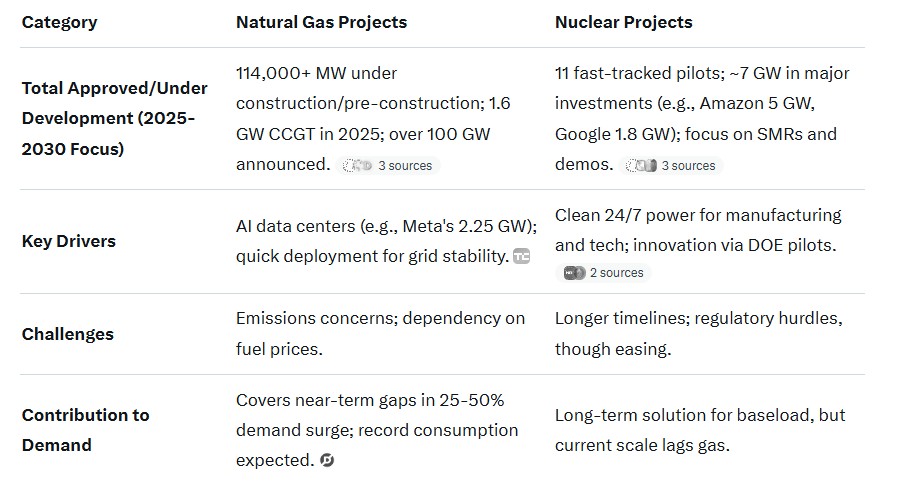

Approved Natural Gas and Nuclear Projects: A Comparison

Natural gas is seeing a robust pipeline of approvals, reflecting its role as a quick-to-deploy bridge fuel amid renewables’ slowdown. As of mid-2025, over 114,000 MW of natural gas capacity is under construction or in pre-construction phases, with much slated for 2025-2030.

Key highlights include 1.6 GW of combined-cycle gas turbines (CCGT) planned for 2025, plus major plants like the 840 MW Intermountain Power Project in Utah and the 678.7 MW Magnolia facility.

Data center demands are driving specifics, such as three gas-fired plants totaling 2.25 GW for Meta’s $10 billion facility.

Texas’s $7.2 billion loan program has greenlit two projects in two years, while announcements exceed 100 GW nationwide.

Consumption is projected to hit records in 2025, underscoring gas’s near-term dominance.

In contrast, nuclear approvals are gaining traction but remain smaller-scale and longer-lead, focused on innovation for clean baseload. The U.S. Department of Energy selected 11 projects in August 2025 for fast-tracking small nuclear test reactors, including efforts by Aalo Atomics, Oklo, and Last Energy, aiming for pilots by 2026.

TerraPower’s Natrium demonstration and Abilene Christian University’s reactor are advancing, with the Nuclear Regulatory Commission approving three new projects in recent years.

Tech giants are investing: Amazon committed $500 million to X-energy for up to 5 GW, while Google plans three 600 MW nuclear projects (1.8 GW total) for data centers.

An executive order in May 2025 further promotes advanced reactors for national security.

Bridging the Gap: Nuclear’s Role in a Stable Future

While natural gas offers immediate capacity to stabilize the grid and support manufacturing’s 24/7 needs, its fossil fuel nature clashes with decarbonization goals. Nuclear, with its zero-emissions profile, could fill this void—but approved projects total far less than gas, emphasizing the need for accelerated deployment. To avert reliability risks and fuel economic growth, the U.S. must invest in both, with nuclear scaling to meet the $10 trillion global promise. As Bank of America notes, this “rediscovery” of nuclear isn’t just timely; it’s essential for a powered-up future.

Avoid Paying Taxes in 2025

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack