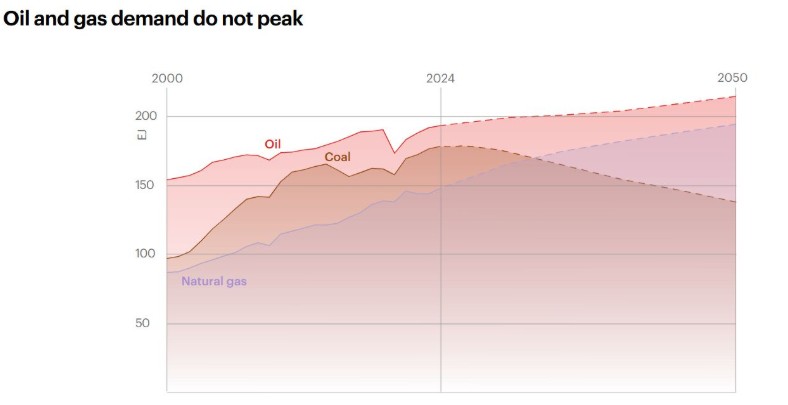

The International Energy Agency (IEA) has released its World Energy Outlook 2025, painting a nuanced picture of global energy trends that challenges earlier narratives of a swift transition away from fossil fuels. In a revived scenario based solely on current policies and regulations—known as the Current Policies Scenario (CPS)—demand for oil and natural gas is projected to continue growing through mid-century, with no peak in sight before 2050.

Under this outlook, oil consumption could climb to around 113 million barrels per day by 2050, marking a roughly 13% increase from 2024 levels.

Natural gas demand, particularly liquefied natural gas (LNG), is expected to surge by 50% by 2030, driven by industrial growth in emerging economies and limited policy shifts toward renewables.

This contrasts with the IEA’s other scenarios. In the Stated Policies Scenario (STEPS), which incorporates governments’ announced energy targets, fossil fuel use is still on track to peak before 2030, assuming those pledges are met.

However, the CPS revives a more conservative view, reflecting only implemented regulations without assuming future commitments will hold. This adjustment acknowledges persistent political and economic support for coal, oil, and gas in many regions, leading to extended growth in fossil demand.

The report highlights how recent events, including energy security concerns and slower-than-expected adoption of clean technologies, have prompted this recalibration.

Implications for Investors

For investors, the IEA’s latest projections signal sustained opportunities in the oil and gas sector, potentially extending well beyond previous expectations of an imminent peak. If demand grows as outlined in the CPS, upstream investments in exploration and production could remain profitable for decades, supporting higher valuations for major producers.

This scenario underscores risks in over-relying on aggressive net-zero transitions; delays in policy implementation or technological hurdles could prolong fossil fuel dominance, benefiting companies with strong reserves and efficient operations.

Conversely, the report implies headwinds for renewable energy investments if fossil fuels crowd out capital. While the Announced Pledges Scenario (APS) and Net Zero by 2050 (NZE) pathways show steeper declines in oil and gas use, the CPS serves as a reality check: global energy demand is rising faster than clean alternatives can scale in some markets.

Investors should diversify, hedging against policy uncertainties by balancing portfolios with both traditional energy giants and emerging green tech firms. The emphasis on LNG growth, for instance, points to lucrative plays in infrastructure and export facilities, particularly in the U.S., which the IEA notes as a key supplier.

Comparing Shareholder Returns: Oil & Gas vs. Renewables

To contextualize these projections, let’s examine historical stock performance as a proxy for investor returns in these sectors. Using representative global ETFs, we can compare price appreciation from January 1, 2020, to November 12, 2025—a period encompassing the COVID-19 crash, recovery, and recent market volatility. Note that these figures reflect closing price changes and do not include dividends, which are typically higher in oil and gas, potentially boosting their total returns further.

|

Sector/ETF

|

Description

|

5-Year Price Return (%)

|

|---|---|---|

|

Oil & Gas (IXC)

|

iShares Global Energy ETF (focuses on major oil and gas companies worldwide)

|

+38.7

|

|

Wind (FAN)

|

First Trust Global Wind Energy ETF

|

+41.8

|

|

Solar (TAN)

|

Invesco Solar ETF

|

+57.6

|

|

Hydrogen (HYDR)

|

Global X Hydrogen ETF

|

-63.8

|

The IEA’s own chart.

Insights from the WSJ Article and Broader IEA Critique

A recent Wall Street Journal article highlights the IEA’s revival of the CPS, noting that it projects no peak in oil and gas demand this decade under existing policies.

This raises a pertinent question: Is the IEA becoming more aligned with empirical data rather than influenced by its funding sources? Historically, the agency—funded primarily by OECD governments with strong renewable agendas—has faced accusations of overly optimistic projections on clean energy adoption, underestimating fossil fuel resilience to push a transition narrative.

Until the technology changes, we will continue to use coal, natural gas, and oil to manufacture the wind and solar components.