Oil advanced to the highest intraday level in more than a month as a combination of declining U.S. petroleum product supplies and signs of stronger demand buttressed expectations for a revival in global consumption.

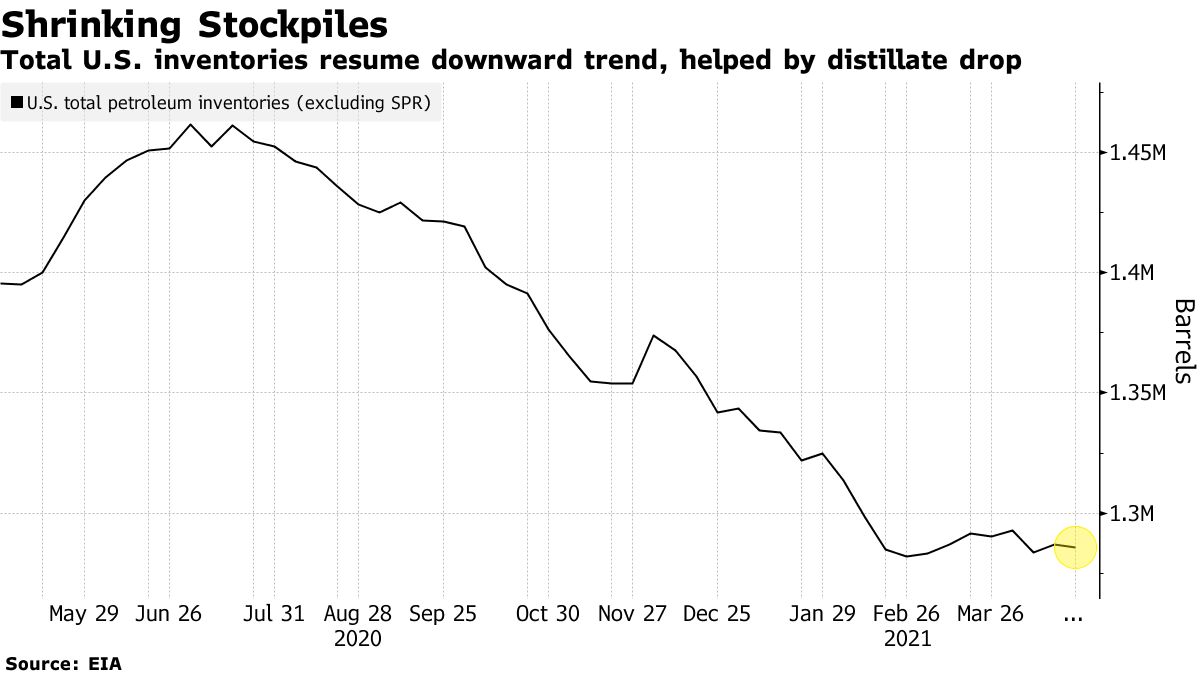

Futures jumped as much as 2.2% in New York on Wednesday. A U.S. government report showed total petroleum stockpiles dropped last week, led by the biggest weekly decrease in distillate inventories since early March. A gauge of demand for overall petroleum products rose to the highest in more than two months. Meanwhile, Goldman Sachs Group Inc. is forecasting an unprecedented jump in global oil demand as vaccination rates rise.

“Seasonally, this is the time we should be seeing big crude inventory builds,” said Matt Sallee, portfolio manager at Tortoise, a firm that manages roughly $8 billion in energy-related assets. “There’s a lot of green shoots in demand.”

The hefty decline in U.S. distillate supplies comes as robust freight demand drives a trucking boom, providing another sign of the recovery underway in the world’s largest oil-consuming country. However, a resurgence of the pandemic in countries such as India and Brazil are still raising concerns around a full-fledged global demand recovery in the near-term.

“The market expects a major revitalization for global oil demand from this summer onwards,” said Bjornar Tonhaugen, head of oil markets at Rystad Energy. “As vaccination campaigns progress and as lockdowns are set to soon be lifted in Europe and other recovering economies, the need for road and jet fuels will increase and the result will be felt.”

| PRICES |

|---|

|

The Energy Information Administration report also showed domestic crude inventories rose by 90,000 barrels last week, smaller than the 4.32 million barrel increase reported by the industry-funded American Petroleum Institute on Tuesday. Gasoline inventories grew for a fourth straight week, the EIA data showed.

The risks to the demand outlook are starting to show up in gauges of market health, however. The structure of the Middle Eastern Dubai benchmark slumped on Wednesday to only a shallow backwardation — an indication that tightness in crude supplies may be easing.