Oil markets experienced a degree of inflation immunity Thursday.

That’s according to Rystad Energy’s Senior Oil Markets Analyst Louise Dickson, who noted that benchmarks rose despite the U.S. Federal Reserve’s announcement that an interest rate hike will come in March – a move Dickson said would typically provide some downside pressure on prices.

“The bullish momentum is primarily driven by military tensions and uncertainty in the Middle East and Eastern Europe, where the continued uncertainty surrounding Russia and Ukraine could jeopardize a significant portion of Russian oil flows should diplomatic talks break down and energy exports sanctions materialize,” Dickson said in a statement sent to Rigzone.

“Markets should have calmed somewhat on the Fed news and the reaffirmation of the slowing of the economy … but the short supply market and geopolitical tensions kept Brent crude prices at highs not seen since the pre-oil price crash of autumn 2014,” Dickson added in the statement.

The Rystad Energy analyst noted that oil prices of $90 per barrel will not be received well by high-demand countries, adding that widespread protests in Kazakhstan over high fuel prices were a good recent example of the potential fallout.

Indicators of Economic Activity Continue to Strengthen

On Wednesday, the Federal Reserve issued a Federal Open Market Committee statement which noted that indicators of economic activity and employment have continued to strengthen.

“The committee seeks to achieve maximum employment and inflation at the rate of two percent over the longer run,” the statement read.

“In support of these goals, the committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent. With inflation well above two percent and a strong labor market, the committee expects it will soon be appropriate to raise the target range for the federal funds rate,” the statement continued.

“The committee decided to continue to reduce the monthly pace of its net asset purchases, bringing them to an end in early March. Beginning in February, the committee will increase its holdings of Treasury securities by at least $20 billion per month and of agency mortgage‑backed securities by at least $10 billion per month,” the statement noted.

The statement also highlighted that the committee will continue to monitor the implications of incoming information for the economic outlook.

“The committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the committee’s goals,” the statement noted.

Oil Bullish Through February

In a separate statement sent to Rigzone on Tuesday, Dickson stated that oil prices will remain bullish through the end of February but added that bearish blips are expected throughout the year as investors cash out and move into the strengthening U.S. equities market.

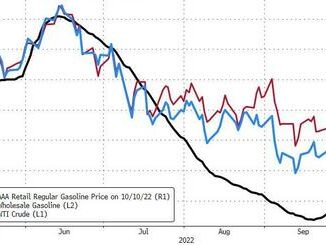

The price of Brent crude has risen from around $70 per barrel in December 2021 to around the $90 per barrel mark recently. This time last year, oil was in the mid-$50 per barrel range.

West Texas Intermediate oil has climbed from around the mid-$60 per barrel mark in December last year to around $88 per barrel recently. This time last year, the commodity was trading in the low-$50s.

Source: Rigzone