By Stuart Turley, Energy News Beat

In a dramatic turn of events that has sent shockwaves through global energy markets, oil prices surged nearly 3% on February 18, 2026, following the abrupt collapse of peace talks between Russia and Ukraine in Geneva.

Brent crude futures climbed 2.7% to $69.15 per barrel, while West Texas Intermediate (WTI) crude rose 2.8% to $64.05 per barrel, reversing recent declines amid renewed geopolitical tensions.

This spike underscores the fragility of oil supply chains tied to the ongoing Russia-Ukraine conflict, now in its fourth year, and highlights the broader implications of sanctions and enforcement actions on Russian oil exports.

The breakdown in negotiations has reignited fears of prolonged disruptions to Russian oil supplies, which account for about 10% of global exports.

As markets digest the news, attention is turning to the reasons behind the stalemate, the escalating enforcement against Russia’s “dark fleet” of tankers, and the ripple effects on shipping costs. For investors navigating this volatile landscape, understanding these dynamics is crucial.

Why Did the Talks Break Down?

The U.S.-mediated discussions in Geneva, marking the third round of talks after earlier meetings in Abu Dhabi, ended after just two hours on February 17, 2026.

Ukrainian President Volodymyr Zelenskiy described the session as “difficult,” accusing Russia of deliberately stalling and dragging its feet rather than pursuing a genuine resolution.

Russia’s chief negotiator, Vladimir Medinsky, countered that the talks were “business-like” and indicated a new round would follow soon, without specifying a date.

At the heart of the impasse are Russia’s unwavering demands, which echo its pre-invasion ultimatums from 2021. These include territorial concessions in the Donetsk region (approximately 2,000 square miles), a ban on “Ukrainian nationalism,” renunciation of NATO aspirations, and drastic cuts to Ukraine’s armed forces.

Zelenskiy has pushed back against U.S. pressure to concede, arguing it’s unfair to force compromises on Ukraine while Russia faces none, potentially handing victory to President Vladimir Putin.

Divisions within Ukraine’s delegation—between those favoring a swift U.S.-led deal and skeptics influenced by former chief of staff Andriy Yermak—have further complicated matters.

Broader context reveals the Kremlin’s commitment to its original war aims, including dismantling NATO’s influence in Europe.

Russian officials have exploited ambiguities from the 2025 Alaska Summit to claim U.S. agreements on these “root causes,” such as NATO expansion.

Meanwhile, Ukraine’s drone strikes on Russian refineries and infrastructure continue, adding to the tension.

Analysts note that while early 2026 saw some optimism for a breakthrough, reports of rushed elections under U.S. pressure have slowed progress, with time no longer favoring Moscow due to economic strains.

The failure has dashed hopes for de-escalation, with concurrent U.S.-Iran talks and Russian-Iranian naval drills in the Sea of Oman exacerbating market jitters.

As one expert put it, “Neither of the geopolitical negotiations shows any tangible progress.”

US Military Enforcement on the Dark Fleet: Impacts on Tanker Prices

Compounding the geopolitical unrest is intensified Western enforcement against Russia’s “dark fleet”—a shadowy network of aging, poorly maintained tankers with opaque ownership used to evade sanctions on Russian, Iranian, and Venezuelan oil.

This fleet, which has tripled in size since Russia’s 2022 invasion of Ukraine to about 1,468 vessels, transports roughly 17% of global seaborne crude.

U.S. forces have escalated actions, seizing tankers like the Bella I in the North Atlantic and others off Venezuela, signaling a shift from economic penalties to physical interdictions.

These measures, including secondary sanctions on buyers like India, aim to curb Russia’s war funding by driving oil revenues down—already plummeting 50% in January 2026 year-over-year.

The U.S. has targeted major Russian firms like Rosneft and Lukoil, forcing steeper discounts of over $20 per barrel.

Europe is considering intercepting shadow fleet vessels in the Baltic and Black seas, potentially affecting 3.5 million barrels per day of exports.

Russia has threatened retaliation, including naval protection and actions against European-flagged ships.

The enforcement has bifurcated the tanker market. In the dark fleet, operational costs are soaring due to reduced visibility, fraudulent flagging (e.g., shifting to Russian flags), and risks from Ukrainian drone attacks in the Black Sea.

This has led to inefficiencies, with freight rates climbing and Urals crude trading at a $27 discount to Brent—the widest since early 2023.

Analysts warn that 20% of the fleet has halted operations, straining Russia’s ability to export to key buyers like China and India.

In regular shipping channels, sanctions have tightened supply by sidelining over 1,400 vessels (a 130% increase since 2022), combined with an aging global fleet and Red Sea diversions due to Houthi attacks.

This has sustained high tanker rates into 2026, with clean and dirty tanker segments benefiting from reduced availability.

Ironically, efforts to constrain Russian revenues have inadvertently boosted freight costs across the board, as one shipping executive noted: “I don’t think anybody who imposes sanctions wanted this outcome.”

Proposals like EU bans on repairs for Russian oil carriers and automatic price cap adjustments (now at $47.60 per barrel for crude) aim to further erode Russia’s leverage, potentially without spiking global prices if enforced gradually.

What Should Investors Look For?

For energy investors, this surge is a reminder of oil’s sensitivity to geopolitics. Key indicators to monitor include:

Geopolitical Developments: Watch for progress in upcoming Russia-Ukraine rounds or U.S.-Iran talks. Any de-escalation could ease prices, but escalations—like more Ukrainian strikes or Russian retaliations—may drive further gains.

Sanctions Enforcement: Track U.S. and EU actions against the dark fleet. Increased seizures or price cap tightenings could widen Russian oil discounts, benefiting buyers like India and China while pressuring Moscow’s budget (oil/gas revenues down 22% in 2025, expected to fall 30% in 2026).

Supply and Demand Shifts: Monitor Russian export volumes, especially to Asia. India’s potential pivot to U.S. or Venezuelan oil could strain Russia’s finances further.

Global inventories, per API/EIA reports, will signal if stockpiles build amid disruptions.

Tanker Market Metrics: Freight rates remain a bellwether. Sustained highs in VLCC or Aframax segments indicate ongoing supply tightness, potentially supporting upstream investments in non-sanctioned producers.

Economic Indicators in Russia: Inflation (up to 6.4% in January 2026), GDP growth (just 1% in 2025), and budget deficits signal if sanctions are biting, possibly forcing Russia to negotiate.

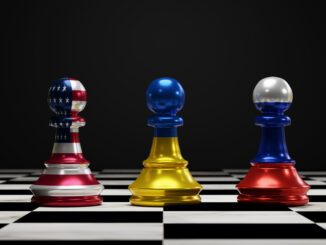

In summary, while the talks’ failure has fueled short-term price spikes, long-term trends point to weakening Russian oil dominance. Investors should diversify into resilient assets, hedging against volatility in this high-stakes energy chess game. Stay tuned to Energy News Beat for updates.

Sources: oilprice.com, understandingwar.org, insurancejournal.com

Get your CEO on the podcast: https://sandstoneassetmgmt.com/media/

Is oil and gas right for your portfolio? https://sandstoneassetmgmt.com/invest-in-oil-and-gas/

Be the first to comment