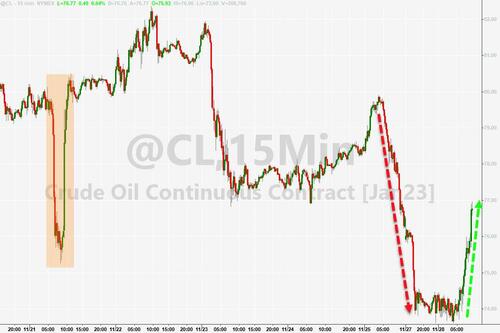

Last week we saw oil prices dump and pump on rapidly denied rumors (reported by WSJ) of an OPEC production hike. At the time we tweeted our expectations…

Fast forward a few days and we see a headline, via Eurasia Group, claiming that discussions of OPEC production cuts are under discussion…

“Given overall market conditions, OPEC+ will seriously consider a new production cut at its upcoming meeting, particularly if crude prices fall much below their current level in the next week,” analysts at Eurasia Group say in report.

“Ultimately, the decision will depend on the trajectory of the oil price when OPEC+ meets and how much disruption is evident in markets because of the EU sanctions”

To be frank, this is just pure speculation and not even a qualified ‘fake leak’ strawman from OPEC (like the WSJ article last week), but it has prompted a response in oil markets.

WTI is trading back at $77, up almost 1% on the day now, after the overnight puke on the heels of the chaos seen in China raising anxiety about demand…

The chart also shows last week’s ‘rumor’ that OPEC would actually increase production (which was rapidly denied) and the fact that WTI is back into that range once again now.