Rumors that a deal on Iran’s nuclear activities could be signed within 72 hours sent oil prices lower on Thursday morning after Brent and WTI had hit nine and 11-year highs, respectively, in earlier trade.

“I have received definitive news that within the next 72 hours the nuclear deal will be signed in Vienna. Even if it might take a couple of days more or so, what appears to be certain is that the deal will be reached. #Iran’s #oil is returning to the market under golden circumstances,” Iranian energy journalist Reza Zandi tweeted on Thursday.

Traders reacted to the possibility that Iran could soon add barrels to the market, which is very tight, with few buyers willing to take Russian crude after Putin invaded Ukraine.

Earlier on Thursday, as of early morning trade in Europe, WTI Crude had jumped by 5.16% to $116.44, the highest level since 2011, while Brent Crude had rallied by 5.89% at $119.77, the highest since 2013.

As of 9:40 a.m. ET, WTI Crude was down 1.19% at $109.38, and Brent Crude traded down 0.45% at $112.32 after rumors of an Iranian nuclear deal emerged.

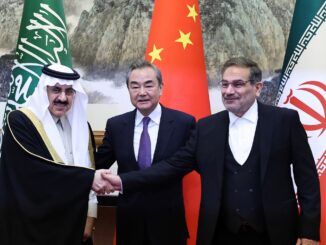

The Iran nuclear talks are in their final critical stage, and negotiators are looking to “finish the job.”

At the end of last month, sources closely connected to the current negotiations between the ‘P5+1’ group of nations (U.S., UK, France, China, and Russia, plus Germany) and Iran exclusively spoken to by OilPrice.com, the mechanism to achieve this – a new iteration of the Joint Comprehensive Plan of Action (JCPOA) – is “tantalizingly close to being done,” Simon Watkins reported early this week.

If Iran and the U.S. return to the so-called nuclear deal, the U.S. is set to ultimately remove the sanctions on Iranian oil exports. These additional barrels from Iran—estimated at around 1.3 million bpd—would be sorely needed on the market, where few buyers dare touch Russian cargoes right now. Still, a return from Iran cannot replace the loss of Russian oil, analysts say.

“While some remain transfixed with the idea that an Iran agreement will provide much needed relief (from rising oil prices), we again caution that the deal is still not done and the sums entailed would simply be too small to backfill a major Russian disruption,” RBC Capital analyst Helima Croft wrote in a note cited by Reuters on Thursday.