Enterprise Products Partners LP said Wednesday it would ramp up its infrastructure in the prolific Permian Basin to increase capacity and meet expectations of long-term demand for natural gas and other fossil fuels.

The Houston-based company, alongside strong second quarter 2022 earnings, announced several new growth projects management said are necessary to keep pace with robust global demand for oil and gas. Russia’s war in Ukraine – and Western sanctions against the Kremlin’s energy complex in response – further necessitate new investments, executives said Wednesday on the company’s earnings call.

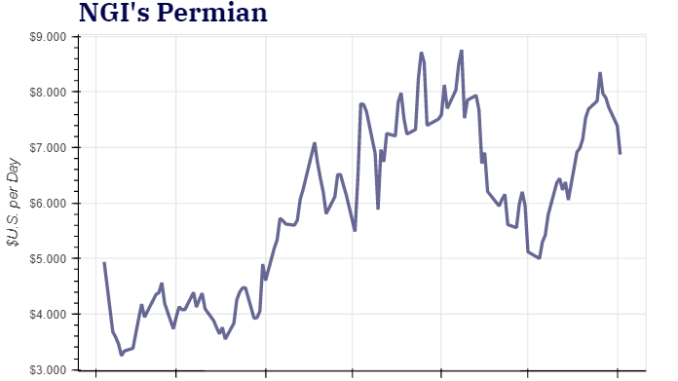

“In this environment, we’re not having any trouble keeping our systems full,” said Enterprise co-CEO Jim Teague during the call with analysts. “Our Permian processing plants are running at capacity.”

Amid the Ukraine conflict, the United States and Europe have imposed embargoes on Russian oil, and European countries are moving with haste to distance themselves from Kremlin-backed natural gas as well. This has bolstered global demand for oil and LNG from the United States and other countries.

Within the Permian, in the Delaware sub-basin, Enterprise plans to add a third plant at its Mentone cryogenic natural gas processing facility in Loving County, TX. The project would increase capacity at Mentone by 300 MMcf/d and allow Enterprise to extract an incremental 40,000 b/d of natural gas liquids (NGL).

The expansion is supported by long-term capacity agreements, the company said, and is expected to begin service early in 2024. Upon completion, Enterprise would have a total nameplate natural gas processing capacity in the Delaware of 2.2 Bcf/d and more than 300,000 b/d of NGL extraction capabilities.

In the Midland sub-basin, also within the Permian, Enterprise said it is expanding its network of natural gas processing assets acquired with the purchase of Navitas Midstream in February. That $3.25 billion deal gave Enterprise an additional 1 Bcf/d of natural gas processing capacity.

Building on the acquisition, Enterprise said it would add its seventh natural gas processing plant in Midland County, TX. That plant, supported by long-term acreage dedication agreements, is to have a processing capacity of 300 MMcf/d and would be able to extract more than 40,000 b/d of NGLs. Following its completion at the end of 1Q2024, Enterprise would have a total of 1.6 Bcf/d of processing capacity and more than 220,000 b/d of NGL extraction capabilities in the Midland Basin, the company said.

Increasing production in the Permian, Teague said, creates the need for additional transportation capacity. Enterprise plans to expand its Shin Oak NGL pipeline system, as a result, by looping and modifying existing pump stations. This expansion would add up to 275,000 b/d of NGL capacity, with completion expected in the first half of 2024.

“We now have powerful options as it relates to takeaway for NGLs out of the Permian,” Teague said.

Big picture, he said, further expansion across the industry is needed.

“Oil and gas will be in high demand for decades. People who say otherwise are either extremely naive or have their own agenda,” Teague said. “Demonizing fossil fuels over restrictions on investments and massive layers of regulation that are designed to keep it in the ground will only create chaos in the form of ever-increasing shortages and high prices. We need to learn from the mistakes of our friends in Europe and avoid risky dependence on unreliable or unfriendly suppliers for our oil and gas or for the materials and equipment needed for cleaner energy.”

That noted, Teague continued on the call, the U.S. has “abundant” sources of crude, NGLs and liquefied natural gas. “We have tremendous hydrocarbon potential.”

However, U.S. “potential is unattainable, not by economics or resource, but by massive amounts of laws and regulations that are vague at best and consistently applied inconsistently,” he added.

“In addition to being the only short-cycle resource the world has, our energy is environmentally superior. It’s much cleaner because it comes from shale and is produced here in the U.S. under environmental and safety standards that are second to none. It’s not an oil and gas versus renewable debate here, as so many make it out to be,” Teague said. “Enterprise’s view has always been, we are absolutely going to need it all, and what most call energy transition is actually going to be badly needed energy additions that will take place gradually.”

Enterprise’s total capital investments for the second quarter were $383 million, which included $301 million of organic growth projects and $82 million of sustaining capital expenditures. With the new projects announced Wednesday, Enterprise expects 2022 growth capital investments to be around $1.6 billion and sustaining expenditures to total $350 million.

For 2023, it projected growth capital spending of $2 billion.

Enterprise reported 2Q2022 net income of $1.4 billion (64 cents/share), a record for the company and up from $1.1 billion (50 cents) a year earlier.

The company’s transported volumes of NGLs, oil, refined products and petrochemicals totaled 6.6 million b/d in 2Q2022, up from 6.5 million b/d in the year-ago period. Natural gas pipeline volumes jumped nearly 19% from a year earlier, driving the momentum.

Natural gas processing volumes climbed 21% to 5.1 Bcf/d.

The company said its second-quarter gross operating margin from its natural gas pipelines and services segment increased 13% to $229 million.

Source: Naturalgasintel.com