Singapore — 0307 GMT: Crude oil futures fell during mid-morning trade in Asia March 23, as the market remained concerned over the third wave of the coronavirus in Europe given that extended mobility restrictions in the region threaten to constrict oil demand.

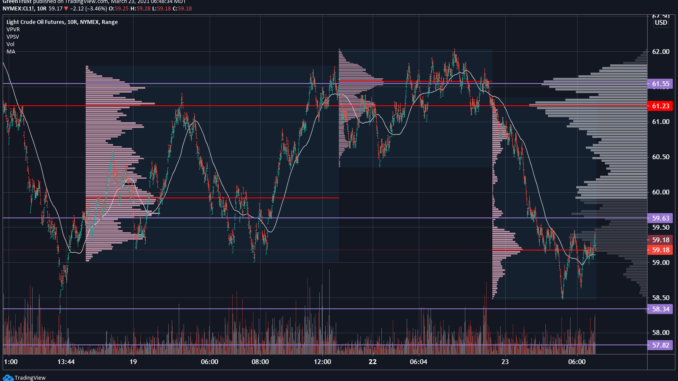

At 11:07 am Singapore time (0307 GMT), the ICE Brent May contract fell 73 cents/b (1.12%) from the March 22 settle to $63.89/b, while the May NYMEX light sweet crude contract was down 72 cents/b cents/b (1.17%) to $60.84/b.

The oil complex has been struggling to gain an upward momentum as the market is beset by worries over the progress of the pandemic in Europe. France and Poland have already announced new lockdown measures to combat rising COVID-19 infections, with Germany joining the list after its federal and state governments agreed to extend the country’s lockdown by three weeks to April 18 on March 22.

“Oil prices are edging lower today due to ongoing concerns surrounding the third viral wave in Europe, which may dampen the recovery outlook and energy demand,” Margaret Yang, DailyFX strategist, told S&P Global Platts on March 23.

The rise in COVID-19 infections in Europe have been particularly concerning to investors, as the region has been troubled by vaccine politics, one of the reasons why these countries are struggling to get their vaccination programs off the ground.

“Sentiment continues to run cool as Europe seems determined to find a way to trigger another virus surge, consistently aiming at their own feet rather than their citizen’s arms,” Stephen Innes, chief global market strategist at Axi, said in a March 23 note.

Meanwhile, Yang noted a tinge of anticipation in the market, as it awaits the joint appearance of Jerome Powell and Janet Yellen in a testimony before the US House Financial Service Committee later March 23. With the fortunes of the oil complex closely tied to the US economic recovery, the market will be looking for clues on monetary and fiscal policy guidance.

“Policymakers are likely to address an improved recovery outlook in the US and maintain monetary policy accommodative for as long as it takes to achieve a full recovery,” Yang said.

In inventory data, commercial US crude stocks are expected to have declined 1.7 million barrels to around 499.1 million barrels in the week ended March 19, as refinery runs continued to normalize in the aftermath of the mid-February freeze in southern US states, analysts surveyed by Platts said.

The draw would be the first since mid-February, when severe winter weather took as much as 4.4 million b/d of US Gulf Coast refinery capacity offline and cratered demand, and would narrow the surplus to the five-year average of US Energy Information Administration data to 5.6%, Platts reported previously.