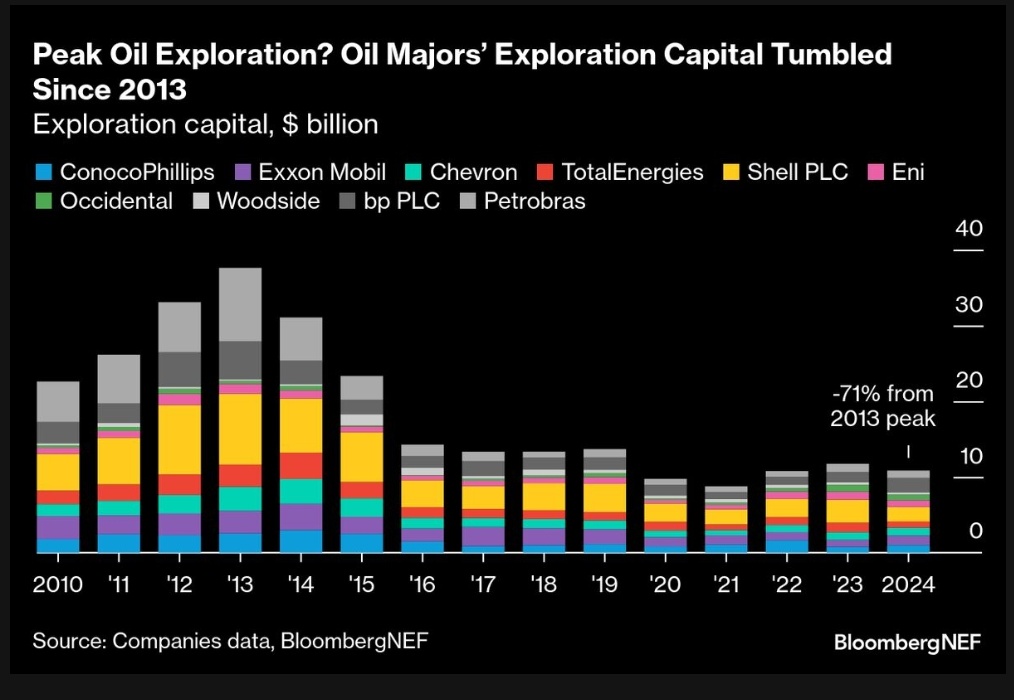

In the ever-evolving landscape of global energy, one trend stands out: the sharp decline in exploration capital expenditures (capex) by oil majors since the peak years around 2013. This pullback raises critical questions about future oil production capacity, especially as natural decline rates in existing fields demand massive investments to maintain supply. With demand from emerging giants like China and India showing resilience, and projections for steady global consumption in 2025 and 2026, the stage could be set for tighter markets and higher prices—if an anticipated oil glut fails to emerge. This article delves into the data on investment trends, required funding to offset declines, and demand forecasts to assess whether $75 per barrel oil remains a reasonable benchmark in a stable geopolitical environment.

Are you Paying High Taxes in New Jersey, New York, or California?

The Decline in Exploration Investments: A Global and U.S. PerspectiveSince 2010, the oil and gas industry has undergone dramatic shifts in capital allocation, driven by volatile prices, shareholder pressures for returns, and the growing emphasis on energy transitions. Globally, upstream capex by major oil companies—ExxonMobil, Chevron, Total, Shell, and BP—nearly halved from $88.7 billion in 2013 to significantly lower levels by the late 2010s.

This represents a strategic retreat, with exploration budgets collapsing after a quadrupling from $1 per barrel of oil equivalent (boe) in the 1995-2005 period to $4/boe during the 2010-2015 boom.

By 2020, the IEEFA noted that shrinking capex signaled an ongoing decline in the sector, as companies prioritized payouts over aggressive drilling.

In the United States, the story mirrors this global trend but with nuances tied to the shale revolution. Total capex in the U.S. oil and gas industry peaked around 2014 before declining, with upstream expenditures dropping 12% year-over-year in the fourth quarter of 2014 alone, from $87 billion to $77 billion.

From 2010 to 2023, exploration and development capex fluctuated but trended downward post-2014, reflecting capital discipline amid lower prices and investor demands.

U.S. independents have seen capex recover somewhat since 2020, but it remains below pre-COVID levels, both in real and nominal terms.

Overall, the U.S. mining and exploration investment fell 35% in 2015, underscoring a broader retreat.

This decline—estimated at 40-50% globally from 2013 peaks—has left the industry vulnerable. Existing fields naturally deplete at 5-10% annually, requiring continuous reinvestment to sustain output.

Without it, production could falter, potentially signaling a de facto peak in oil supply not from resource scarcity, but from underinvestment.

The Trillion-Dollar Gap: Investments Needed to Combat Decline Curves

To offset these natural decline curves and meet current demand, the world needs trillions in upstream investments. OPEC estimates that $18.2 trillion is required through 2050 to maintain supply and accommodate modest growth, primarily to counteract field depletions.

A similar figure from other analyses pegs it at $17.4 trillion by 2050.

In the near term, the IEA highlights that of the $400 billion in global upstream investments expected this year, $360 billion will go solely toward offsetting declines—leaving little for expansion.

If these estimates hold, underinvestment could lead to supply shortfalls. ExxonMobil emphasizes that sustained funding in new and existing fields is crucial, as declines accelerate without intervention.

The IEA’s net-zero pathways suggest no new fields are needed for balance, but real-world demand growth tells a different story, potentially requiring even more capital to avoid disruptions.

Stable Demand from China and India: A Pillar for Global Consumption

Amid these supply concerns, demand remains robust, particularly from Asia’s powerhouses. China’s oil demand is plateauing, with growth slowing due to economic shifts and electrification, but it still contributes significantly—forecast to average around 16-17 million barrels per day (mb/d) through 2026.

India, however, is poised to outpace China, with demand growth nearly double that of its neighbor in 2025 and 2026.

Projections show India’s consumption rising from 5.55 mb/d in 2024 to 5.74 mb/d in 2025, driven by economic expansion and transportation needs.

Combined, these two nations could add substantial volumes, with India alone projected to contribute 8.2 mb/d to global growth by 2050 in long-term outlooks.

Globally, barring wars or economic collapses, demand is set for steady increases. The IEA forecasts growth of 680,000 barrels per day (b/d) in 2025 and 700,000 b/d in 2026, reaching 104.4 mb/d.

OPEC is more optimistic, projecting 1.3 mb/d annual growth for both years, pushing totals toward 106.4 mb/d by 2026.

The EIA splits the difference, expecting 800,000 b/d in 2025 and 1.05 million b/d in 2026.

Non-OECD regions, led by Asia, will drive this, with overall demand plateauing around 105.5-105.6 mb/d by 2030 in some views.

This stability, fueled by China and India’s consistent needs, provides a floor for prices.

No Glut in Sight: Is $75 Oil Reasonable?

Current forecasts warn of a potential glut, with supply outstripping demand and pushing Brent prices into the $50s by 2026.

Goldman Sachs sees Brent at $53-56 per barrel amid 1.9 million b/d oversupply, while J.P. Morgan predicts $66 in 2025 and $58 in 2026.

The EIA anticipates U.S. production dipping slightly in 2026, contributing to moderate inventory builds and lower prices.

However, if the glut doesn’t materialize—due to sustained underinvestment, geopolitical tensions curbing output, or stronger-than-expected demand—$75 per barrel appears reasonable. Steady growth from China and India, combined with decline curves eroding supply without trillions in capex, could tighten markets. In a balanced scenario without major disruptions, prices could stabilize or rise, supported by the fundamentals of resilient demand and constrained exploration.

The Bottom Line:

The tumble in exploration capex since 2013 underscores a pivotal moment for oil production. With trillions needed to bridge the gap and demand holding firm, the risk of peak supply looms larger than ever. For investors and policymakers, the message is clear: ignoring these trends could lead to volatility, but addressing them might sustain the energy backbone for years to come.

The variables on the horizon include the social discord in the UK and the EU. This is a huge issue as the UK and the EU are facing a massive crossroads on social and economic problems. Net-zero energy policies have effectively deindustrialized the entire group, and the United Nations’ plans for bringing illegal migrants have set the stage for some catastrophic social unrest.

As Stu Turley on the Energy News Beat Podcast has stated, the world was bifurcating into two groups. Those following the Net Zero energy path toward fiscal collapse and deindustrialization, and those moving toward prosperity by adopting energy policies that support energy generation from unsubsidized sources. This seemed to be aligning with the United States, Russia, India, much of the Middle East, and most of Asia, leaving the EU and the UK behind. It’s unclear whether this is on the cards or in the future, as President Trump has stated he plans to impose more economic tariffs to bring President Putin to the negotiation table.

Buckle up and choose your investments wisely. Please talk with your CPA and Tax professional about all investments. As for me, I am investing in Gold, oil, and gas assets with tax advantages from sources that my team evaluates.

Avoid Paying Taxes in 2025

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack