Eagle Ford Shale pure-play Penn Virginia Corp. plans to maintain its current two-rig program through 2021 to grow production after it temporarily suspended drilling last year because of the Covid-19 pandemic.

During a conference call Wednesday to discuss 4Q2020 results, CEO Darrin Henke said continuing with two rigs “makes sense” in light of the recent rise in oil prices. The company is primarily an oil producer, with natural gas making up only 10% of its 4Q2020 sales volumes and natural gas liquids (NGL) making up 12%.

“We’re going to pay close attention obviously to the service cost environment, and if we see significant inflation or anything that concerns us around being able to deliver the returns we’re talking about, we would consider maybe slowing down the program if that made sense,” Henke said.

The Houston-based independent, like most of its peers, abruptly halted its drilling program last April after oil prices cratered. Activity resumed in the third quarter as the commodity environment stabilized. Prior to the pandemic, Penn Virginia was running one rig on its acreage.

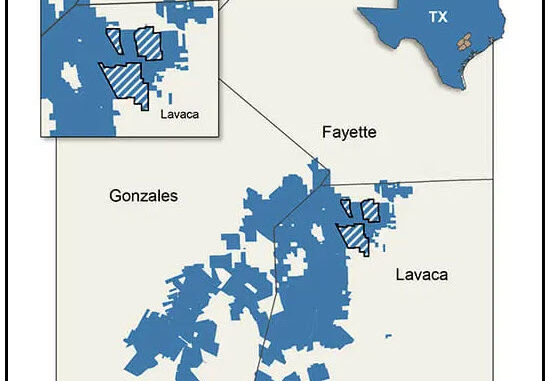

The company, which holds about 90,100 net acres in South Texas, reported total sales volumes for the fourth quarter of 1.98 million boe, or 21,502 boe/d. For the full year, Penn Virginia sold 8.89 million boe, or 24,281 boe/d, 77% of which was crude oil.

Based on the two-rig program, the company anticipates 1Q2021 oil sales volumes of 15,400-16,200 b/d. The volumes take into account about 120,000 bbl that was shut-in or constrained because of Winter Storm Uri. For comparison, the company sold 16,719 b/d in 4Q2020.

Looking ahead, Penn Virginia expects to produce 18,700-20,700 b/d in the final three months of this year, with on average 17,200-19,000 b/d for the full year.

Penn Virginia expects to spend $205-235 million this year on drilling and completion activity. In March 2020, it slashed its capital budget by 30% from $265-295 million to cope with the pandemic.

The company in January received a $150 million investment from Juniper Capital Advisors. The splash was accompanied by an additional contribution by Juniper of oil and gas assets for an equity stake in a Penn Virginia subsidiary valued at $38.4 million.

Penn Virginia booked a quarterly net loss of $135.5 million (minus $8.92/share) compared with a loss of $310.6 million (minus $20.46) in the same period a year ago.