In a stark warning that underscores the growing tensions between global energy suppliers and the European Union’s ambitious green agenda, Qatar’s Energy Minister Saad al-Kaabi has stated that his country may cease doing business in the EU—including vital liquefied natural gas (LNG) shipments—if the bloc does not further amend its corporate sustainability regulations. This comes at a time when Europe is already grappling with energy security challenges, having largely severed ties with Russian gas supplies following the 2022 invasion of Ukraine. Qatar, which supplies 12-14% of Europe’s LNG through long-term contracts with companies like Shell, TotalEnergies, and ENI, argues that the rules expose it to unacceptable financial risks.

The United States, under President Trump, is poised to back Qatar in this dispute, aligning with its broader push against what it views as burdensome EU climate policies. This support could further complicate Europe’s energy landscape, potentially leading to a scenario where the continent loses access not only to Qatari and Russian LNG but also to substantial U.S. supplies. Below, we break down the details of the EU law in question, Trump’s likely response, and the dire economic implications for the EU if these key suppliers pull back.

Details of the New EU Law: The Corporate Sustainability Due Diligence Directive (CSDDD)The law at the center of the controversy is the EU’s Corporate Sustainability Due Diligence Directive (CSDDD), adopted in 2024. This directive mandates that large companies operating in the EU—including foreign entities like QatarEnergy—must identify, prevent, and mitigate human rights violations and environmental harms across their entire global supply chains. Non-compliance can result in hefty fines of up to 5% of a company’s global revenue.

Key requirements include:

Due Diligence Obligations: Companies must conduct thorough assessments of their operations, subsidiaries, and business partners to address issues like labor rights, deforestation, and climate impacts. This extends to indirect suppliers, creating a broad web of accountability.

Climate Transition Plans: Firms are required to develop and implement plans aligned with the Paris Agreement’s goal of limiting global warming to 1.5°C. Failure to do so could trigger penalties, as these plans must demonstrate concrete steps toward reducing emissions.

Reporting and Remediation: Annual reporting on sustainability efforts is mandatory, and companies must remedy any identified harms, potentially including financial compensation.

Timeline: The directive is already in force, with phased implementation starting in 2024. Full enforcement for the largest companies begins in 2027, but preparatory obligations, such as risk assessments, are active now.

Qatar’s minister described the law as “overreaching,” arguing it could unjustly penalize state-owned entities like QatarEnergy for global operations outside EU jurisdiction. Recent amendments by the European Parliament’s legal committee have watered down some aspects—such as reducing the scope of supply chain coverage—but Kaabi insists these changes fall short, failing to address core risks like the 5% revenue fines.

This directive intersects with other EU regulations, such as the Methane Emissions Regulation (Regulation (EU) 2024/1787), which specifically targets methane leaks in the energy sector. That rule requires importers to report methane emissions starting May 2025, with verification mandates by 2027 and intensity limits by 2028. While the CSDDD is broader, the methane rules add another layer of scrutiny for fossil fuel importers, amplifying supplier concerns.

U.S. Support for Qatar and President Trump’s Likely Response

The U.S. has emerged as a vocal ally to Qatar in this spat, viewing the EU’s regulations as barriers to free energy trade. U.S. Energy Secretary Chris Wright has publicly urged Europe to rethink its methane curbs, warning they could hinder American LNG exports.

This stance aligns with broader Trump administration efforts to pressure the EU into weakening climate rules, including during trade talks where U.S. LNG interests have lobbied to dilute methane intensity limits.

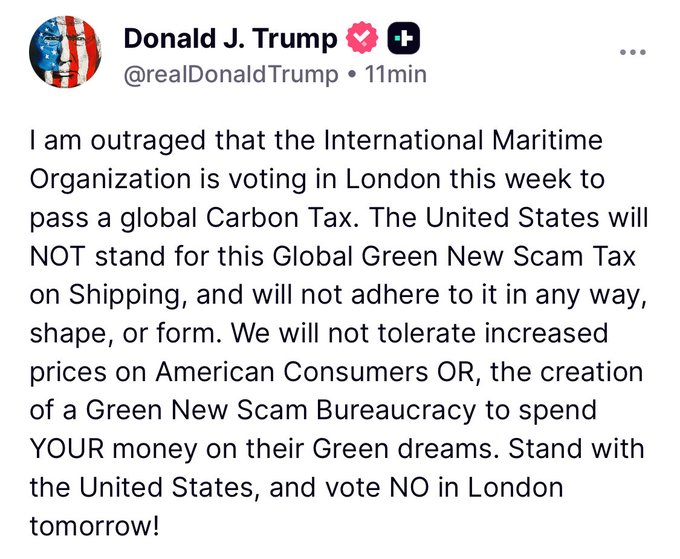

As President Trump already told the UN, we will not participate in the shipping regulations. I will fully expect him to have a similar response to the EU.

President Trump, known for his pro-energy policies and criticism of international climate agreements, would likely respond forcefully. Based on his administration’s recent actions—such as rejecting a global carbon tax on shipping and ramping up campaigns against EU climate mandates—Trump could publicly blast the CSDDD as “job-killing overregulation” that harms allies like Qatar and the U.S.

He might offer increased U.S. LNG exports as an alternative but condition them on the EU dropping or exempting such rules, emphasizing energy affordability over green mandates. Trump has previously pushed Europe to buy more American energy while ditching Russian supplies, and this scenario fits his “America First” playbook, potentially using tariffs or trade leverage to force concessions.

In essence, Trump would frame the issue as the EU shooting itself in the foot, urging a rollback to protect global energy markets.

Impact on the EU’s Economy Without LNG from the US, Qatar, or Russia

Losing LNG from these three major suppliers would be catastrophic for the EU’s economy, exacerbating an already precarious energy situation. Russia, once providing over 40% of Europe’s gas, has been largely phased out due to sanctions, dropping to about 11% by 2024 (including pipeline and LNG).

The U.S. has filled much of the gap, supplying around 55% of EU LNG in 2025, while Qatar contributes 12-14%.

Without them, energy prices could surge 400-500%, as seen in past crises, leading to widespread industrial shutdowns, higher inflation, and reduced GDP growth.

Key economic effects:

Energy Price Shock: Spot gas prices could quadruple, forcing energy-intensive industries like chemicals, steel, and manufacturing to curtail production or relocate. Germany’s economy, heavily reliant on affordable gas, could shrink by 2-3% annually in a severe shortage.

Inflation and Consumer Costs: Households would face skyrocketing heating and electricity bills, eroding purchasing power and fueling inflation above 5-7%.

Recession Risk: Overall, the EU could enter a deep recession, with GDP contracting by 1-2% in the first year alone, as supply chains disrupt and exports decline.

Long-Term Competitiveness: High energy costs would make EU firms less competitive globally, accelerating deindustrialization and job losses in the millions.

Europe’s recent winter without full Russian gas demonstrated resilience through diversification and storage, but that was with U.S. and Qatari inflows intact. A total cutoff would overwhelm these buffers.

asuene.com

What’s Left: Limited Alternatives and Their Challenges

With the big three out, the EU would turn to a patchwork of smaller suppliers, but options are slim and insufficient to fully replace lost volumes:

|

Supplier

|

Type

|

Current Share/Capacity

|

Challenges

|

|---|---|---|---|

|

Norway

|

Pipeline Gas

|

~30% of EU total gas; up to 120 bcm/year

|

Already at near-max capacity; no significant expansion possible short-term. statista.com

|

|

Algeria

|

Pipeline/LNG

|

~10% of EU gas; potential to increase to 20 bcm/year LNG

|

Political instability and infrastructure limits; competes with domestic needs. statista.com

|

|

Azerbaijan

|

Pipeline Gas

|

~10 bcm/year via Southern Gas Corridor

|

Limited scalability; geopolitical risks in the region.

|

|

Australia

|

LNG

|

Global top exporter, but EU share small (~5%)

|

Long shipping distances raise costs; most output committed to Asia. sciencedirect.com

|

|

Nigeria/Other Africa

|

LNG

|

~5-7% of EU LNG; potential growth to 15 bcm/year

|

Infrastructure underdevelopment; security issues in export regions.

|

|

Domestic/Renewables

|

Various

|

EU production declining; renewables growing but intermittent

|

Cannot replace baseload gas quickly; requires years of investment.

|

These alternatives could cover perhaps 60-70% of the shortfall at best, forcing rationing, blackouts, or emergency coal/oil switches—ironically increasing emissions. Long-term, the EU might accelerate renewables and hydrogen, but near-term pain would be unavoidable.

In summary, Qatar’s warning highlights the fragile balance between Europe’s climate ambitions and energy realities. With U.S. backing and Trump’s probable hardline stance, the EU faces a pivotal choice: ease regulations or risk economic turmoil. As winter approaches, the bloc’s leaders must navigate this high-stakes energy chess game carefully. The EU will most likely fail as it pushes the UN climate agenda forward. You will see more countries move to exit the EU as these types of overreach become permanent.

As for investors, it would be best to invest in the US, Qatar, Saudi Arabia, or even Russian assets that are not following the crowd on the Climate Crisis.

Got Questions on investing in oil and gas? Or do you have a Tax Burden in 2025?

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack