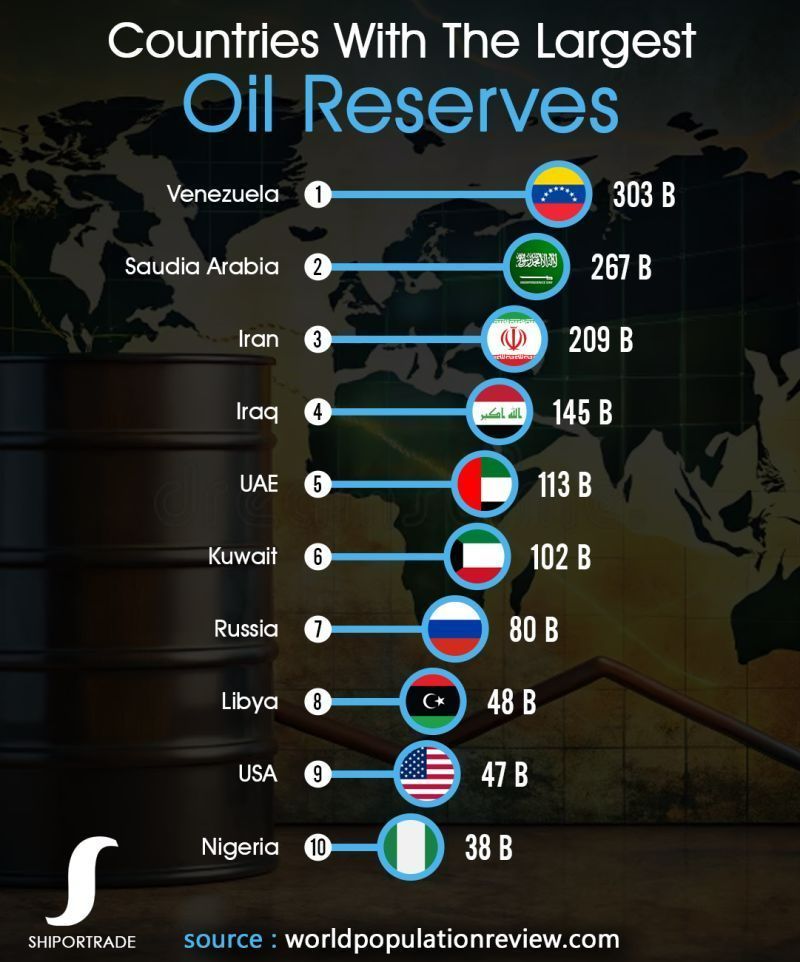

Venezuela, home to the world’s largest proven oil reserves, has long been a pivotal player in global energy dynamics. However, years of political turmoil, economic mismanagement, and stringent U.S. sanctions have crippled its oil industry, reducing production from peaks of around 2 million barrels per day (bpd) in the mid-2010s to roughly 900,000 bpd today.

With the Trump administration back in power in 2025, escalating tensions and a potential regime shift away from President Nicolás Maduro could dramatically reshape oil markets, unlocking vast reserves and altering global supply chains.

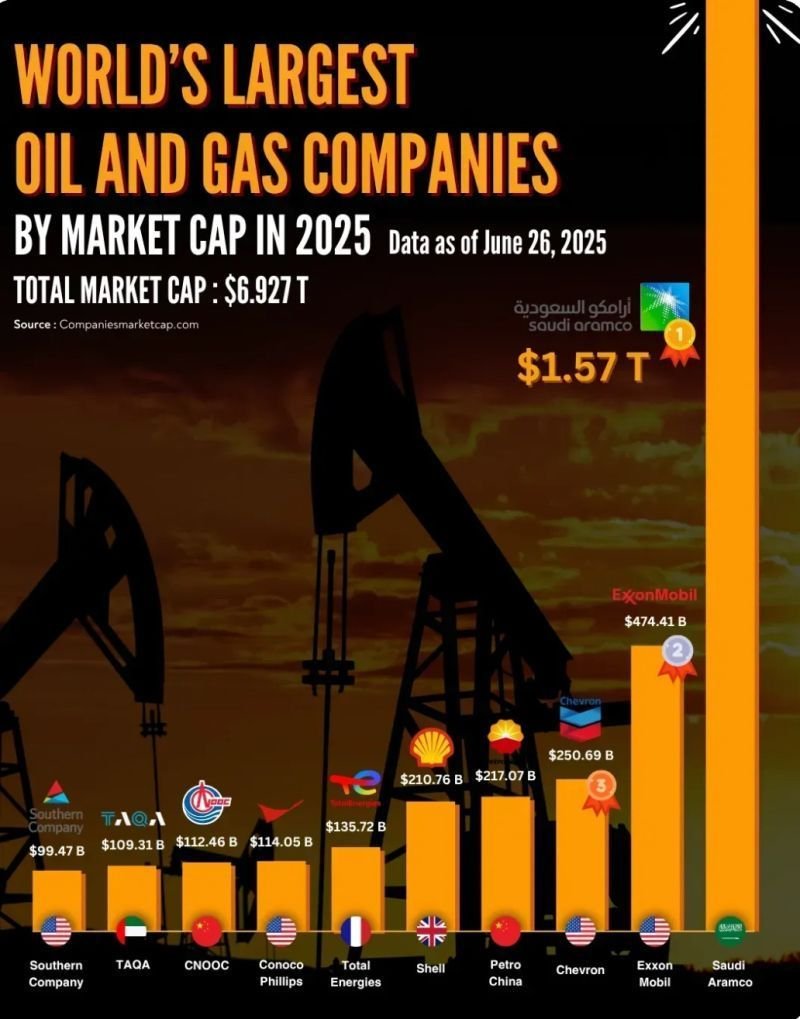

Now look at the top producers by Market Cap and Energy Policies.

The Current State of Venezuela’s Oil Sector

Venezuela’s oil woes stem largely from U.S. sanctions imposed to pressure the Maduro regime, which have limited foreign investment and technology access. Currently, only Chevron operates in the country under a special U.S. waiver, while state-owned PDVSA struggles with dilapidated infrastructure.

Despite these constraints, exports have rebounded to nearly 880,000 bpd, thanks in part to a shadowy network known as the “dark fleet” – aging tankers that evade detection through tactics like ship-to-ship transfers, flag changes, and obscured identities.

This fleet, shared among sanctioned nations like Russia, Iran, and Venezuela, allows PDVSA to ship crude to buyers in Asia, primarily China, bypassing Western restrictions. Recent developments highlight the dark fleet’s role. Two such vessels, operating under the pseudonyms “Crag” and “Galaxy 3,” recently docked at Venezuela’s Jose port to load nearly 4 million barrels of Merey 16 heavy crude destined for Asian markets.

Their identities were hidden with rags covering ship names, a common evasion tactic. A third tanker, the Aframax Nave Neutrino chartered by Chevron, shared the berths, underscoring the mix of sanctioned and licensed operations at Venezuelan ports.

This loading operation demonstrates the ongoing challenge for U.S. enforcement, as only about 30% of Venezuela’s exports – roughly 300,000 bpd – are estimated to be vulnerable to direct interventions.

The Trump Administration’s Approach to the Dark Fleet

The Trump administration has signaled a hardline stance against Venezuela’s oil evasion tactics. On December 10, 2025, U.S. forces seized the sanctioned tanker “Skipper” off Venezuela’s coast, carrying Venezuelan crude, marking a bold escalation in targeting the shadow fleet.

This move is part of a broader crackdown, including new sanctions on Maduro’s family members, a close business ally, and six tanker-operating companies aimed at choking off regime revenues.

Officials are preparing to seize more tankers in Venezuelan waters, focusing on vessels in the dark fleet that transport sanctioned oil to buyers like China.

Tracking data reveals the scale of the issue: Of the approximately 80 tankers waiting to load Venezuelan barrels, around 30 are under sanctions, presenting prime targets for U.S. action.

The administration has also introduced 25% tariffs on countries acquiring Venezuelan oil, pressuring buyers and potentially forcing deeper discounts on black-market crude.

Analysts warn that the dark fleet’s opaque nature – with many ships uninsured, aging, and barely seaworthy – complicates full interdiction, risking environmental disasters but providing economic lifelines to regimes like Maduro’s.

Without international cooperation, experts say complete shutdowns are unlikely, but these measures could temporarily squeeze supplies and starve the regime of funds.

Implications of a Regime Change

A U.S.-backed regime change could transform Venezuela’s oil landscape. Eased sanctions would invite renewed foreign investment, particularly in the Orinoco Belt, where up to $20 billion over a decade could add 500,000 bpd through joint ventures.

Short-term gains might come quicker: With operational tweaks and workovers on existing wells, production could surge to 2 million bpd within 1-2 years, without massive new capital.

This influx of heavy crude would suit U.S. Gulf Coast refineries, bolstering American energy security and potentially lowering gasoline prices – a priority for Trump. On the global stage, a pro-U.S. Venezuela might shift OPEC dynamics, aligning more closely with Saudi Arabia and the UAE while weakening Russia’s influence.

OPEC, which produces 40% of world oil, currently exempts Venezuela from production cuts due to sanctions; reintegration could stabilize prices but introduce new competition. However, short-term escalations under Trump risk supply disruptions, potentially spiking oil prices amid already volatile markets.

Conclusion: A Turning Point for Energy Geopolitics

As the Trump administration ramps up pressure on Venezuela’s dark fleet and Maduro’s inner circle, the stage is set for significant shifts.

The ongoing loading of tankers like “Crag” and “Galaxy 3” underscores the regime’s resilience, but U.S. seizures and tariffs signal a determination to dismantle these networks. A regime change would not only revitalize Venezuela’s oil output but also realign global energy flows, enhancing U.S. influence in Latin America and potentially easing pressures on consumers worldwide. For oil markets, the coming months could mark a pivotal chapter, where geopolitical maneuvers dictate supply and prices. Stay tuned to Energy News Beat for updates on this evolving story.

Energy Security starts at home, and as Spiderman’s Uncle said, “with great power comes great responsibility.” Corruption has been running rampant for years in Venezuela. If the oil and natural resources had been marketed and used for the benefit of all Venezuelans, they would not be in the current state of potential regime change.

Sources: bbc.com, oilprice.com, pbs.org,