Production, consumption by the US petrochemical industry, and exports all hit records, and the price collapsed.

By Wolf Richter for WOLF STREET.

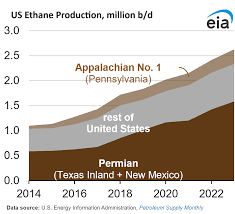

US production of ethane – one of the natural-gas liquids that are in the hydrocarbon mix at oil and gas wells – rose 9% in 2023 to a record 2.6 million barrels per day (b/d), according to the EIA.

The record ethane production was a result of the boom in natural gas production that has made the US the largest natural gas producer in the world, and in 2023, also the largest LNG exporter in the world. Natural gas production in the US is in part a result of the boom in fracking for oil, that has turned the US into the largest crude oil producer in the world, with record production and exports of crude oil and petroleum products. These oil wells also produce profuse amounts of natural gas and natural gas liquids, including Ethane.

Over 60% of the ethane is produced in the Permian, which spans part of West Texas and New Mexico and is the most prolific oil field in the US. Natural gas processing plants dehydrate the raw natural gas, remove impurities, and then separate ethane and other natural gas liquids, such as propane, butanes, and pentanes, from the gas (chart via the EIA):

Ethane is used almost exclusively as feedstock by the petrochemical industry. Consumption of ethane by the huge US petrochemical industry rose 5% to 2.1 million b/d in 2023. The EIA reported:

“Two new petrochemical crackers, located in Port Arthur, Texas, and in Monaca, Pennsylvania, ramped up operations in 2023 after coming on line in late 2022. Ethane consumption in the Gulf Coast (PADD 3), where most crackers are located, increased 4% from 2022 to 2.0 million b/d. Ethane consumption on the East Coast (PADD 1) more than doubled, averaging 38,000 b/d in 2023, a 22,000 b/d increase from 2022.”

The rest of the ethane was exported. Exports of ethane increased by 13% to a record 471,000 b/d in 2023. About 45% of those exports went to China, 16% went to India, 14% to Canada, and 10% to Norway (chart via the EIA):

The EIA credited the growth in exports to growth in demand by the global petrochemical sector, rising tanker capacity, and low prices in the US for ethane.

The boom in natural gas production since 2007 has caused prices of natural gas to collapse in the US. Natural gas futures currently trade at $1.83 per million Btu (MMBtu). From 2000 through 2008, natural gas ranged from $2 to $15 per MMBtu, much of the time above $6 per MMBtu.

US production is now doing the same thing to ethane prices. But when ethane prices are low relative to natural gas prices, operators of natural gas processing plants can leave more ethane in the natural gas stream to be sold in natural gas markets. So there’s another outlet for some of the ethane, in theory. But natural gas prices are low too.

Ethane prices at Mont Belvieu, Texas, the main pricing hub for ethane (chart via the EIA):

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

Take the Survey at https://survey.energynewsbeat.com/

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack