The BLS uses the Census Bureau’s understated population estimates that ignore the surge of immigrants. But the CBO’s estimates pick them up. We take a look.

By Wolf Richter for WOLF STREET.

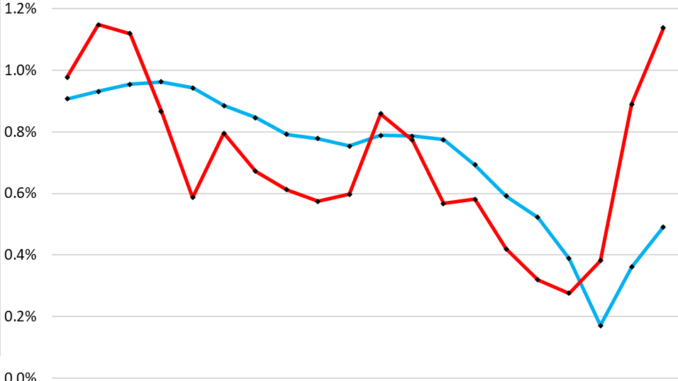

The Congressional Budget Office (CBO) and the Census Bureau have widely different estimates of US population growth for 2022 and 2023 because they have widely different estimates of immigration.

The CBO picked up on the huge wave of immigration. It estimated that net immigration in 2022 rose to 2.67 million immigrants, and in 2023 it rose to 3.30 million immigrants, the highest in its data going back to 2000, and about triple the average rate between 2000 and 2021 (1.05 million immigrants per year). So, population growth:

CBO: 0.89% for 2022 and 1.14% for 2023, the highest since 2005.

Census Bureau: 0.36% for 2022 and 0.49% for 2023.

In the past, both estimates were relatively similar, with the CBO’s estimates (red) usually being lower than the Census Bureau’s estimates (blue). But for 2022 and 2023, the divergence between them just blew out:

A big problem for the employment data in the BLS Household Survey.

The Bureau of Labor Statistics applies the results from its Household Survey – the percentage of people working and not working, looking for a job and not looking for a job, etc. – to the understated population data from the Census Bureau to produce its headline figures for the number of employed, the number of unemployed, the number of those actively looking for a job, the labor force, the unemployment rates, etc.

There is now widespread consensus that these understated population estimates by the Census Bureau have ended up understating overall employment and the labor force, and therefore overstating unemployment and the unemployment rates.

Let me explain.

Obviously, we’re astonished that we have two government agencies – the CBO and the Census Bureau – that so widely disagree with each other on this important topic of population and population growth. But we can see from various other reporting that the Census Bureau’s 2022 and 2023 estimates are way low.

And we cannot use the number of “border crossings” to help us nail down the influx of immigrants because “border crossings” numbers include people that were sent back and then crossed the border again, and were sent back again, and so they’re counted multiple times as border crossings though they’re not even in the US.

The census, taken in 2020 by the Census Bureau, produced more or less accurate figures, but the growth estimates for the years that followed, based on the Census Bureau’s formula, are just too low.

And this population data is important for all kinds of reasons, including the jobs report that the BLS releases on the first Friday of every month, with the one for March coming this Friday.

Impact on the employment data.

The BLS jobs report has two parts:

The “Establishment survey,” based on a survey of roughly 119,000 nonfarm business of all sizes, government agencies, nonprofits, etc.; it tracks the number of “jobs created,” which goes into every headline. This data set is not impacted by population estimates.

The “Household survey,” based on a survey of 60,000 households that rotate. Total employment, unemployment, labor force, labor force participation, unemployment rates, etc. are all based on the household survey. And this data is based on the population estimates by the Census Bureau.

Those two segments suddenly diverged.

There is always a substantial difference between the Establishment survey’s number of employees at nonfarm establishments and the Household survey’s overall employment which tracks everyone who is working, including the self-employed and farm workers.

So the Household survey’s number of workers (red in the chart below) is always larger than the number of employees on payrolls at nonfarm establishments (blue). In the years from 2015 until the pandemic, the difference was fairly stable at around 6.5 million workers.

But that difference has been shrinking. Over the past 12 months through February:

The Establishment survey added 2.75 million employees, which is very strong.

But the Household survey added only 667,000 workers, all of them in March and April 2023, and with employment actually falling over the past three months.

From 2015 through the beginning of the pandemic, the difference between the two was roughly stable at around 6.5 million workers. This difference has now shrunk by half:

Why? Because the household survey uses the Census Bureau population estimates.

The BLS applies the results of the Household Survey to the Census Bureau’s estimate of the population to come up with its figures for the overall number of employed, the number of unemployed, the number of those actively looking for a job, the labor force, the unemployment rates, etc.

Using the Census Bureau’s understated population then causes the BLS to understate overall employment and the labor force, and to therefore overstate the unemployment rates (people in the labor force who are unemployed and are actively looking for a job).

This huge wave of immigrants explains why the Establishment Survey of payroll jobs has been so strong: lots of immigrants got hired.

And the huge wave of immigrants also explains why, despite the strong hiring by establishments – 2.75 million workers added over the past 12 months – the labor market hasn’t tightened up further and hasn’t produced much bigger wage pressures.

And the huge wave of now employed immigrants adds to the factors why consumer spending – immigrants are consumers too – has been so strong despite the higher interest rates: “Drunken sailors” we’ve called our consumers for something like a year-and-a-half.

But the BLS employment data from its Household Survey missed all this and has fallen behind because it’s applied to the understated population data from the Census Bureau.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

Take the Survey at https://survey.energynewsbeat.com/

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack