For months, as Iran-backed groups attacked U.S. forces and allies in the Middle East, the Biden administration hailed its efforts to restrict Iran’s oil revenue — and the country’s ability to fund proxy militias. The Treasury secretary told Congress that her teams were “doing everything that they possibly can to crack down” on illegal shipments, and a senior White House adviser said that “extreme sanctions” had effectively stalled Iran’s energy sector.

But the sanctions failed to stop oil worth billions of dollars from leaving Iran over the past year, a New York Times investigation has found, revealing a significant gap in U.S. oversight.

The oil was transported aboard 27 tankers, using liability insurance obtained from an American company. That meant that the U.S. authorities could have disrupted the oil’s transport by advising the insurer, the New York-based American Club, to revoke the coverage, which is often a requirement for tankers to do business.

Instead, the 27 tankers were able to transport shipments across at least 59 trips since 2023, The Times found, with half the vessels carrying oil on multiple journeys.

The Treasury Department did not respond to a question about whether it was aware the ships had transported Iranian oil while insured by the American Club.

The tankers exhibited warning signs that industry experts, and the Treasury, have said collectively warrant greater scrutiny. Among other red flags, the ships are: owned by shell companies, older than average vessels and use a tactic called “spoofing” to hide their true locations.

It is unclear who the U.S. government considers primarily responsible for identifying suspicious tankers. The Treasury is tasked with administering sanctions by investigating and blacklisting individuals or companies participating in illicit activities. But it places some of the burden on insurers to monitor for suspicious behavior through the regular release of advisories and alerts.

To identify the shipments of Iranian oil, The Times built a database of thousands of tankers and their whereabouts using maritime data and satellite imagery. Vessels whose voyage paths showed irregularities were cross-referenced with information provided by Samir Madani, co-founder of TankerTrackers.com, a company that monitors oil shipping.

SynMax and Pole Star, two other companies that monitor shipping, provided additional data.

In late-January, several weeks after the American Club was mentioned at a Congressional hearing titled “Restricting Rogue-State Revenue“, coverage for many of the tankers identified by The Times abruptly ended. The company said that the stoppages were the result of its own internal investigations. Five of the vessels are still insured by the company, according to data listed on its website; the American Club said it is still investigating those ships.

The Times’s findings come as the Biden administration is under increasing scrutiny from lawmakers and advocacy groups for its handling of sanctions on Iran.

“It is very concerning,” said Senator Maggie Hassan, a Democrat of New Hampshire, who has filed a bill to strengthen the enforcement of sanctions on deceptive ships.

“The United States must use every tool at its disposal to identify, stop and sanction these bad actors,” she said. “These new revelations highlight the stakes.”

In response to Times findings, a Treasury spokesperson said in a statement: “Treasury remains focused on targeting Iran’s sources of illicit funding, including exposing evasion networks and disrupting billions of dollars in revenue.”

The spokesperson added that this month the department had taken action against what it called a Hong Kong-based front company, which U.S. officials said had funded Iran’s Revolutionary Guards Corps.

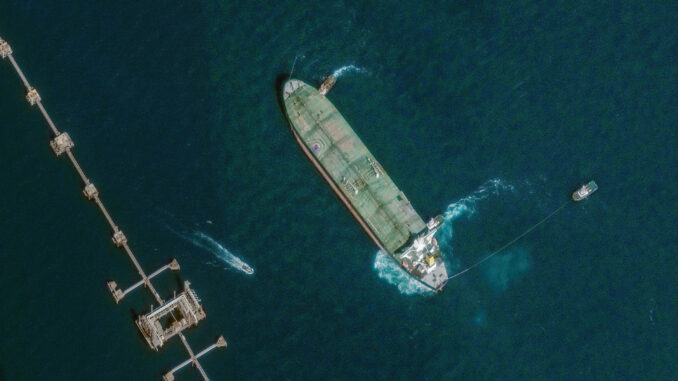

Kharg Island, pictured in 2017, is one of Iran’s main oil terminals where many of the American Club-insured tankers loaded oil.

Fatemeh Bahrami/Anadolu Agency via Getty Images

The insurance provided by companies like the American Club is a key factor in the tankers’ ability to move oil; industry insiders call it a vessel’s “ticket to trade.” Most major ports insist that ships have proof of liability coverage, among other requirements, before they can enter and do business.

The American Club is one of only 12 major insurers of its kind, and the only one based in the United States. Specifically, the company says, its policies cover third parties affected during an accident caused by a ship’s negligence.

Because of these insurers’ importance to shipping, they have been consulted by the U.S. government when developing sanctions on Russian oil sales.

Daniel Tadros, the American Club’s chief operating officer, said his company has one of the most stringent compliance programs in the industry. But he said that the company’s six-person compliance team was overwhelmed each month with hundreds of inquiries about potentially suspicious vessels, and that investigating even a single case takes time.

“It’s impossible for us to know on a daily basis exactly what every ship is doing, where it’s going, what it’s carrying, who its owners are,” Mr. Tadros said. “I would like to think that governments have a lot more capability, manpower, resources to follow that.”

He added that the U.S. government had only recently suggested the use of satellite imagery for maritime-related businesses looking for sanctions evasion. Satellite imagery has been used as a ship-tracking tool in the industry for at least a decade.

Shipowners willing to skirt trade restrictions can make more than their normal commissions. But to maintain business connections with the West, including with insurers, they may resort to using deceptive tactics.

Since the start of 2023, the 27 vessels moved roughly 59 million barrels of oil, according to a Times analysis. The calculation is based on a tanker’s depth in the water before and after the oil was loaded, a measurement used by industry analysts.

There is no official source detailing the amount of oil that leaves Iran. According to estimates from Kpler, a company that monitors global trade, the oil carried by the tankers would amount to roughly 9 percent of Iran’s oil exports over that period.

Many of the tankers ultimately ended up in China, which has tripled its imports of Iranian oil over the past two years.

Some of the shipments continued into the fall, as one Iran-backed group, Hamas, led the Oct. 7 assault on Israel, and other Iran-aligned militants, like the Houthis in Yemen, launched attacks on shipping routes and U.S. forces in the region.

By then, the tankers had transported at least $2.8 billion in crude oil, based on the lowest reported prices of Iranian oil in 2023.

That dollar amount could be higher. The Times found eleven more tankers, anchored off Iranian oil ports last year, that used deceptive practices and carried American Club insurance. Although there is little other reason for the ships to hide their presence, The Times could not verify whether they loaded oil.

Where contact information was available, The Times sought comment from more than 40 entities linked to the tankers involved in moving Iranian oil. None replied.

Some experts expressed doubt that the American Club was doing everything it could to identify deceptive ships.

“Responsible, reputable insurers waste no time in confronting their clients or club members,” Mr. Madani of TankerTrackers.com said.

David Tannenbaum, a former sanctions compliance officer for the Treasury Department who now works as a consultant for a compliance advisory company, said his research showed that the American Club covers a large proportion of deceptive vessels when compared with similar insurers.

“While we’ve seen spoofers infiltrate almost all of the major protection and indemnity clubs, they are definitely a leader,” he said.

Last week, Bloomberg reported that the American Club had insured more ships suspected of violating sanctions than other comparable insurers, according to data from United Against Nuclear Iran, a privately funded group advocating stronger sanctions on Iran.

(Many of the vessels noted by the group were also identified by The Times. Mr. Tadros, the American Club executive, said his company had removed insurance for the claims it could corroborate. He said in some cases United Against Nuclear Iran presented flawed evidence, which The Times also concluded for one of the accused tankers.)

The Times was able to use satellite imagery and information available to the shipping industry, such as signals that ships transmit to report their purported locations, to identify the tankers.

The tankers’ deception mainly involved a practice known as “spoofing” in which vessels broadcast fake route information to hide their true locations. Last August, for example, the tanker Glory broadcast that it was off the coast of the United Arab Emirates when it was really loading oil in Asaluyeh, Iran.

In some cases, tankers also conducted ship-to-ship transfers, exchanging goods with another vessel at sea. The practice is common, but can be used to conceal a cargo’s origin, especially when used with spoofing. Ship-to-ship transfers near Iran frequently occurred just off the coast, such as when the tanker Shalimar took on oil in October. For each transfer, The Times traced the cargo back to Iranian oil terminals.

The Times also found some tanker crews altering the physical appearance of their ships. On one spoofing vessel, a red tarp was spread over its green deck in an apparent effort to disguise itself from satellites.