By Michael Msika, Bloomberg Markets Live reporter and analyst

The nascent rally in European stocks is facing a hurdle later today if the region’s policy makers dash hopes for a slower pace of rate hikes.

The Stoxx Europe 600 has bounced about 6.3% since Oct. 12, buoyed by a decent start to the earnings season as well as receding energy prices that are bringing down expectations for rate increases. Excessively-bearish positioning also helped the market in finding a bottom.

“European equities are likely to remain under pressure given the high probability of recession in the region, the depth and duration of this recession, and uncertainty around the path of policy,” says Lale Akoner, senior market strategist at BNY Mellon Investment Management. She thinks the region’s economy is already in a recession, putting the European Central Bank in a bind on the speed of its hiking cycle.

Akoner expects front-loaded tightening, with another 75 basis-point rate hike Thursday. “By bringing forward hikes at this week’s meeting and again in December, the ECB are allowing room to pause early next year, when we will be able to see the longer-term impacts of the Russian oil and gas supply crisis more clearly,” she says.

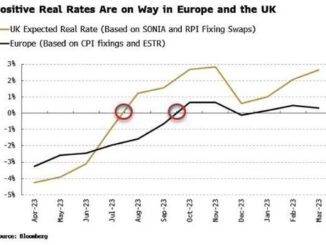

While economists and money markets both agree the ECB is likely to make a 75 basis-point move today, traders are reconsidering the outlook for the next year given Federal Reserve policy makers are already raising concerns about an aggressive rates path.

Interest-rate swaps show bets on the ECB deposit rate peaking below 3% next year, from 0.75% now. That’s down from bets for a rate above 3.25% as recently as last week. The pricing of money-market derivatives also suggests bets on about one Fed rate cut in 2023.

Yet with Bundesbank President Joachim Nagel saying last week the ECB “must not let up too soon,” any signal at today’s meeting of further big hikes could derail the rally in sectors such as tech, industrials and real estate.

Banks will also be in focus, with a political battle looming as the ECB is considering ways to limit lenders from benefiting from ultra-cheap loans that were granted at the height of the pandemic. Banks can now use those proceeds to earn higher interest rates, as the third quarter earnings season has shown for lenders including Deutsche Bank, Santander and UniCredit.

Banking executives are already shooting back, with Deutsche Bank’s CFO saying he is “disappointed” that the central bank wants to retroactively change the rules. In comments on the bank’s earnings call he said that this is hardly a windfall profit after banks battled through negative yields for years.

Another big risk is the outlook for the ECB to start reducing its stockpile of bonds built up through years of stimulus. The Governing Council may debate the timing of this so-called quantitative tightening at the meeting.

The post-Covid stocks bull market showed a striking correlation with the ballooning size of the ECB balance sheet. The ECB’s total assets are now equivalent to 65% of euro-area GDP, way more than the Fed’s 39%. While the market went up in 2012-2015 during the last unwind, the situation was different back then as the region was coming out of an economic crisis, while this time investors may be heading into a recession.

“We continue to be concerned with the speed at which monetary policy is tightening everywhere, which mechanically raises the risk of financial stability accidents,” says Gilles Moec, Axa Group’s chief economist.