A spectre is haunting Europe — deindustrialisation.

A combination of record interest rates, slowing global demand, massive Chinese and US industrial subsidies, and, most importantly, high energy prices are laying waste to Europe’s industrial base: industrial output is falling, factories are closing, and manufacturing jobs are disappearing.

Business leaders argue that the way to exorcise the spectre is obvious: The EU should reduce companies’ regulatory burden, strengthen the single market, and allow the “invisible hand” of the market to work its magic.

“I’m very concerned that the political instinct in Brussels and in most capitals still is to achieve change by prescriptive regulation,” Martin Brudermüller, the CEO of BASF, a Germany-headquartered chemicals giant, said in Brussels on Monday (18 March).

“And this will not work… The very real magic of the invisible hand is more than enough.”

Brudermüller’s remarks were echoed on Wednesday (20 March) by Markus Beyrer, the director general of BusinessEurope, a major lobby group, who claimed that European industries are currently facing a regulatory “tsunami”.

“Don’t misunderstand me, there is a necessity for good European legislation,” Beyrer said. “[But] we need to make sure that we get this balance right again, and that we reduce the regulatory burden for companies because this is a clear competitive disadvantage we have towards the world.”

The business community’s emphasis on “cutting red tape” is also increasingly being mimicked by European policymakers.

Belgian Finance Minister Vincent Van Peteghem — whose country currently holds the rotating presidency of the Council of the EU — recently noted that the US Inflation Reduction Act (IRA) is superior to current European industrial initiatives by virtue of leaner regulations.

“If you compare indeed the United States and the IRA to other continents you feel the red tape is not there, that it goes much faster and much easier,” Van Peteghem said. “That is not something that we will be able to deal with overnight [but] it is something we need to focus on in the coming years.”

Upon reflection, however, the enormous emphasis placed on reducing companies’ regulatory burden is rather puzzling.

As Brudermüller himself noted, the principal cause of Europe’s industrial malaise is high energy prices, not an overregulated economy. Is the push to “cut red tape”, then, supposed to help lower the cost of energy?

Business leaders would argue that this is intended only to mitigate the effect of high energy prices. Indeed, they often explicitly note that energy prices also need to come down in order for European industry to remain globally competitive.

“We will need to find ways to reduce the cost of energy in Europe and specifically also to reduce the gap we have to our major competitors,” Beyrer of BusinessEurope noted on Wednesday.

“The cost is now less bad than it was at the height of the exogenous shock which came via the Ukraine war. But the gap to our major competitors, especially to the US, has widened. So this is something we need to address.”

This, of course, raises the question: How can it be addressed? Moreover, how can Europe address the other causes of its industrial malaise — namely high interest rates, lack of government investment, and slowing Chinese demand for European industrial goods?

Unfortunately, it seems that Europe’s ability to tackle most — or perhaps even all — of these challenges remains extremely limited.

To force the European Central Bank to cut rates would threaten its legally protected independence. To compete with Chinese or American industrial subsidies would likely require the EU to jettison its newly agreed fiscal rules. To reverse Beijing’s lack of demand for Europe’s industrial products is politically impossible.

Indeed, one often suspects that EU and business leaders are so focused on reducing companies’ regulatory burden precisely because it is one of the few relevant factors that they could feasibly tackle.

Such suspicions were arguably confirmed on Wednesday when the EU’s competition chief, Margrethe Vestager told MEPs that they should focus on strengthening the single market because it “actually doesn’t cost much”.

“What it costs is the willingness in our heads to look for the barriers and to take them down,” she told the European Parliament’s Economic and Monetary Affairs Committee.

The question, of course, is whether such “low cost” policies are ultimately sufficient to surmount the colossal challenges now confronting Europe’s industry.

What is certain is that if they aren’t, European businesses, leaders, and workers will pay an exceedingly high price.

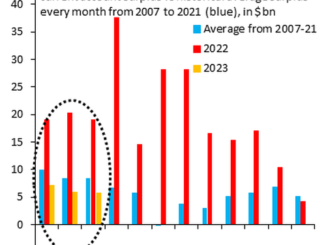

Chart of the Week

BASF CEO Martin Brudermüller also told Euractiv earlier this week that he would refrain from characterising Europe’s industrial decline as deindustrialisation because the “very harsh” word implies that “everything has disappeared”.

“Deindustrialisation means: there’s no industry left,” he said.

Marek Dabrowski, a non-resident scholar at Bruegel think-tank, similarly told Euractiv that he dislikes using the word deindustrialisation because it is an “emotional concept” which describes a perfectly “natural” process.

“Most of the world, except some emerging market economies, is in the process of fast deindustrialisation,” he said.

“Now, even China is deindustrialising in terms of the share of industry and GDP.”

As our graph of the week shows, Dabrowski is certainly correct that industry’s share of GDP has declined in China, the US, and Europe in recent decades.

Whether Brudermüller is correct on the more narrow, semantic point, however, is more debatable. (If one is decelerating, has one also stopped moving?)

Economic Policy Roundup

The European Investment Bank (EIB) is ready to ‘stretch’ lending criteria as it waits for EU Council’s call to arms. The EU’s lending arm is preparing to put forward a concrete action plan to “stretch” its investment remit beyond its current dual-use definition if EU leaders from the 27 member states give it the formal mandate to do so. The EIB would be looking into three different scenarios for amending its traditional investment remit, not ruling out the more markedly hawkish one of rotating into direct funding for ammunition and weapons. The most conservative option that it could present would remain within the perimeter of the dual-use definition – which implies that the Bank continues to invest in projects that can have a double civilian- and military- application, but skews it towards the latter. The second option would go beyond dual-use projects, widening the Bank’s investment remit to “defensive military assets”. Read more

EU Single Market report: Letta wants to mimic US tax credits. Former Italian Prime Minister Enrico Letta, tasked with authoring and presenting a high-level report on the future of the EU’s single market to EU leaders on 17 April, has laid out some ideas of what the report might entail to business leaders at a conference in Berlin on Tuesday (19 March). In his speech, he highlighted the bloc’s faltering competitiveness against the US, and announced that he would like Europe to mimic the US’s use of tax credits to incentives domestic investments. Tax credits would be a “way to be automatic, fast, and to go straight to the point to give the entrepreneur the responsibility to choose mission, targets and objectives” Letta said. Read more.

The EU’s auditing body warns that the European Commission’s strategy of relying on member states to ensure the money of the pandemic recovery fund is properly spent is heightening the “risk of irregularity or even corruption”. The European Court of Auditors (ECA) expressed “serious reservations” about the disbursement of the bloc’s €723.8 billion Recovery and Resilience Facility (RRF) — with President Tony Murphy arguing the EU executive is not monitoring it the same way it scrutinises regular budget expenditure. “There is less control and self-policing [by member states], so there is a higher risk of irregularity or even corruption,” Murphy said. “There is a lot of money in the system, so we would naturally be worried.” Read more.

Real wages in the EU decline for the second successive year in 2023 as nominal salary increases fail to keep up with persistent inflation – amid bumper profits in many corporate sectors including the fossil fuel, banking, and arms industries. According to a report organised by the European Trade Union Confederation (ETUC), which represents 45 million European workers, real wages — which take into account inflation — slid by 0.7% in 2023, after falling by 4.3% in 2022. ETUC General Secretary Esther Lynch stressed: “Working people have suffered a second consecutive fall in their purchasing power at the same time as the richest have enjoyed the benefits of inflation-busting profits,” Lynch said, alluding to the fact that corporate earnings have been a major contributor to Europe’s inflation crisis in the past two years. Read more.

Estonian Prime Minister Kallas warns Germany against ‘dependence’ on state aid. Speaking in Berlin on Tuesday (19 March), Estonian Prime Minister Kaja Kallas warned against increasing reliance on state subsidies, as it posed the risk of taxpayers having to underwrite company losses, while profits were kept private. EU countries have “understandably shifted to crisis mode,” during the Covid pandemic and the energy crisis, she said, but should not create the expectation among companies that every loss would be mitigated through state support. Read more.

The EU’s industrial output as a share of total GDP will decline as a result of persistently high energy prices, the head of the world’s largest chemicals company says. “What we will see definitely is that the share of industry contributing to GDP [will] most probably go down,” said Martin Brudermüller, CEO of Germany-headquartered giant BASF, on Monday (18 March). “This is particularly [true] for the energy-intensive industries, and the chemical industry is one of them, but there is cement, there is steel, [and] there are several others,” he added. Read more.

Lobby groups call for business-friendly turn of the EU Green Deal. Both the EU’s main business lobby BusinessEurope, and the German Chamber for Industry and Commerce (DIHK) have put forward their respective key demands for the next legislative cycle this week. While both associations underlined that they don’t want the EU to turn away from its climate objectives, they argued it should be made simpler for companies to comply with them. While the DIHK took particular aim at the rise of reporting obligations, many of which would follow similar purposes, BusinessEurope’s director general Markus Beyrer also pointed at the impact of rising carbon prices for European competitiveness. Read more.