By Peter Tchir of Academy Securities

Maybe it is the new math, but is it really the G20 when neither China nor Russia show up?

I’m not sure anyone really expected Russia to show up. Leaving the borders of Russia is not the best thing that Putin could do for his own safety or security. The fact that China (Xi) did not attend is more interesting. I haven’t seen an official statement as to why he did not attend, but I have read that the reasons could include anything from “solidarity with Putin” (which seems unlikely) to “escalating tensions along the Himalayan border between China and India” (was not on my radar screen) to “a fractious tone at the recent Beidaihe meeting” (which has come up in some of our recent geopolitical discussions). There is a Nikkei article alleging that Xi was reprimanded by party elders at this year’s Beidaihe meeting. Is it possible that questions about the domestic economy kept him from the G20? I don’t know, but earlier this year China abruptly changed their zero-Covid strategy after a series of protests were reported.

I don’t know why Xi did not attend the G20, but it doesn’t strike me as a good sign for global relations.

The G18 (or G20) issued a statement about the war in Ukraine (which was apparently not critical enough of Russia) citing risks to the global economy (see The Economist Who Cried Recession) and included some climate initiatives (which I am not overly optimistic about given the fact that China didn’t attend).

Made By China

I continue to argue that one way for China to extricate itself from its current economic weakness is to sell more of their own brands (see China’s Next Move).

The following helps support that view:

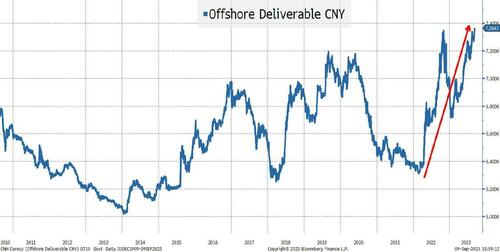

The yuan is on the cusp of record weakness.

This weakness should provide a competitive advantage for Chinese exports.

There have been reports that certain phones and products will be banned for employees of certain Chinese government entities. That would presumably create an opportunity for Chinese brands. I have not seen a confirmation of this ban, but the market certainly responded to headlines about this on Thursday.Huawei’s latest phone incorporates 7 nanometer chips made by SMIC. This is impressive technology and has reportedly caught the attention of the U.S. Commerce Department.

I continue to believe that one of the most underpriced risks (in the market and in corporate boardrooms) is the potential for rapid growth in the sale of Chinese brands. The events of the past week have only reinforced that view.

In the meantime, I’m looking for China to ramp up support for their economy in the coming days and weeks. So far, they have only done some things at the margin and markets have not been impressed.

Inflation versus a Slowdown

This week the “inflation” camp won. Yields increased across the curve and there was a small uptick in the probability of another rate hike this year (still less than 50% though). That seemed to weigh on the stock market as we are in a “good news is bad” mode.

think that the move in rates is overdone, and they should drift lower (I’m looking for 4% on 10s) which would be good for risk assets (especially if accompanied by some new and larger stimulus measures in China).

I am leaning more towards the belief that the “soft landing” view will be challenged in the coming weeks as we get new data. The anecdotal evidence seems to be pointing towards slowing spending/growth in many areas. This should show up in the data if the anecdotes are broadly representative of the state of the economy (and I believe that they are).

I’m getting nervous about the current state of the economy (there are some potentially large headwinds if I’m correct on China’s strategy), but I am still bullish risk for a trade (betting on “bad news is good news” at least until we get sub 4% on 10s).

I would have liked to see a G19 and am curious why Xi did not attend. It could be a “nothing burger” but it is curious to say the least.