- The U.S. is predicted to break a new record in oil production this year, with current production at 12.4 million barrels per day, primarily due to increased output in tight oil and shale gas regions.

- Despite a decline in the number of drilling rigs and depletion of wells previously drilled but uncompleted, the Permian Basin has reached a new high of 5.8 million barrels per day.

- Concerns rise as the Strategic Petroleum Reserve reaches its lowest level since 1983; oil prices in the second half of the year are largely dependent on decisions made by Saudi Arabia and OPEC.

One of my 2023 energy predictions was that the U.S. would set a new annual oil production record this year. As we approach the midpoint of the year, this prediction is still tracking toward being accurate.

The latest Weekly Petroleum Status Report from the Energy Information Administration (EIA) shows current U.S. oil production to be 12.4 million barrels per day (bpd). That’s an increase of 400,000 bpd from a year ago, but still short of the 13.0 million bpd level reached in November 2019. Nevertheless, year-to-date oil production is running ahead of the record 12.3 million bpd level for all of 2019.

The tight oil and shale gas regions continue to be the primary driver of rising U.S. oil and gas production. The Permian Basin has reached an all-time high of 5.8 million bpd, out-producing even Saudi Arabia’s massive Ghawar oilfield. However, production gains in the Permian have slowed in recent months, with new wells just offsetting the production decline in legacy wells.

According to the Baker Hughes rig count, the number of wells drilling for oil in the U.S. has declined by 5% since last year. However, the inventory of wells that were previously drilled but uncompleted (DUC) also continues to decline. Over the past year, the DUC inventory has decreased by 8%, but it’s down a whopping 45% over the past three years. For perspective, the DUC inventory is now at its lowest level in about a decade.

This means that production increases are primarily being driven by finishing previously drilled wells. Production may be able to increase a bit more as the DUC inventory continues to decline, but the rig count will likely have to increase soon for oil production to increase much from current levels.

The Strategic Petroleum Reserve (SPR) remains a concern, as the current inventory is at the lowest level since 1983. Over the past year, the level of the SPR has been depleted by 31% in an effort to combat rising oil prices. That arguably helped stem the rise in oil prices last year, but it removed a substantial cushion the U.S. had in case of a real emergency.

Of course, much of this activity is being driven by price. Oil prices have declined from $120 a barrel (bbl) at this time last year to just under $70/bbl today. In turn, average retail gasoline prices have declined from $5.11 a gallon a year ago to $3.71 a gallon at present. Gasoline prices have returned to about the level they were at prior to Russia’s invasion of Ukraine.

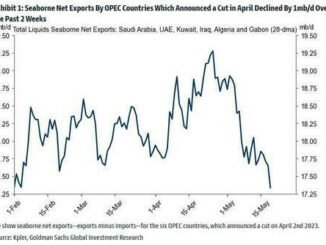

What happens in the second half of the year will largely depend upon Saudi Arabia and OPEC. They are already signaling that they feel like pricing power has shifted back in their favor. Indeed, with a reduced SPR inventory, the U.S. doesn’t have a lot of tools available for fighting an oil price surge if Saudi production cuts continue.

All of this suggests that oil prices will likely increase during the second half of the year.