-

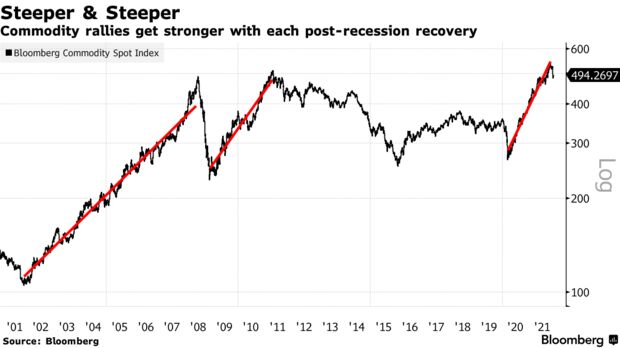

Commodity prices climb faster than in previous recoveries

-

Stocks, bond yields aren’t responding the way they used to

Commodities are climbing fast as the world recovers from the Covid pandemic. But while the speed is unique to this rally, the real difference is the price gains aren’t spilling over to other asset classes, specifically stocks and bonds.

Today’s Chart of the Day shows the Bloomberg Commodity Index on a logarithmic scale since 2000. Regression lines, which measure the speed of the moves, show how the post-pandemic recovery is distinct from the other two recoveries this century. It’s normal for the prices of oil, metals and even food to rise after recessions as a signal that the economy is expanding. But it’s usually matched by sustained growth in small-cap and cyclical stocks, Treasury yields and emerging-market assets. And that isn’t happening this time.

The Bloomberg Commodity Index is surging to levels last seen in 2015, the year that preceded two years of coordinated global growth, and in 2002, which was part of the post-recessionary price action of 2001. But investors are pulling out of more economically sensitive assets. Cyclical companies and emerging markets are quiet, and Treasury yields remain stagnant.

Naturally, the world economy has grown substantially since 2000, spurring higher demand for commodities. The Federal Reserve’s pandemic support has also helped by keeping economic activity going. But arguably the most important factor is China, the only major economy to post positive economic growth in 2020. It’s responsible for about half of the world’s copper consumption, one-fifth of wheat demand and over 40% of oil imports since 2015. As China continues to mobilize its massive population, that share is likely to only grow.

Perhaps not surprisingly, Goldman Sachs is predicting a commodities supercycle. Other Wall Street strategists see oil prices as high as $150 per barrel. Add in the U.S. infrastructure package, and commodity prices are all but guaranteed to rise. That’s what’s worrying the Fed. Chairman Powell expects inflation to fade by the second or third quarter of 2022 and is waiting for that to happen before considering further action. Wall Street strategists are betting that will be when rate hikes start. Morgan Stanley now expects the Fed to raise rates in September 2022, two quarters earlier than previously forecast.

Emerging markets, which are more exposed to the inflationary effects of commodity rallies are already addressing this concern through monetary policy. Just yesterday, Brazil’s central bank delivered hiked rates by 150 basis points for the second time. These moves aren’t exactly encouraging signs for growth. So the question for investors is whether the acceleration of the commodities rally is still a harbinger of good times — or a hurdle to overcome.

— With assistance by Daniel Curtis