Buoyed by high prices and rising energy demand, offshore operators and international oil companies are advancing plans for field development projects, and 2023 looks to be a busy year for offshore construction projects.

With that in mind, the editors of Offshore have compiled the following Top 5 field development projects to keep an eye on this year.

The projects were selected primarily on the basis of an expected or upcoming FID, but other parameters included notable aspects such as size of reserves; infrastructure scale and scope; unique milestones such as first deepwater production; or inclusion of renewable energy components or emissions reductions technologies.

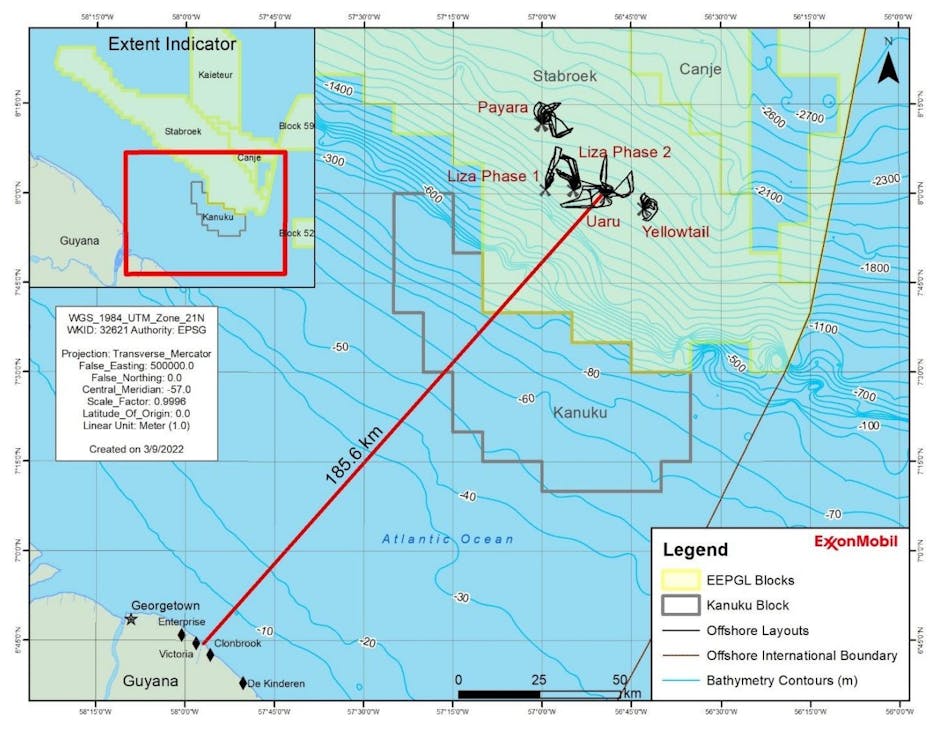

Uaru project, offshore Guyana

ExxonMobil’s Uaru project is targeting more than 1.3 billion barrels of oil, making it the largest ever project to date, offshore Guyana, by cost and volume of resources to be produced.

The project, expected to cost $12.7-billion, will tap into the Uaru, Mako and Snoek fields in the eastern portion of the Stabroek Block. This is the first time the group will tie three fields into a single project.

The project calls for 40-76 development wells; related subsea umbilicals, risers, and flowlines; all tying into an FPSO vessel. The proposed FPSO vessel will be a new-built facility with double-hull protection.

The oil production rate is set at 250,000 barrels per day, but the FPSO’s basic design has an upper oil production limit of 263,000 b/d, and the production rate could be revised upward. The project is expected to produce crude for at least 20 years, starting late 2026/early 2027.

As of press time, a final investment decision was expected within 1Q 2023.

Trion project, Gulf of Mexico

The Trion project, developed by Woodside Energy in partnership with Pemex, is a major greenfield development that would represent the first oil production from Mexico’s deepwater area in the Gulf of Mexico.

The Trion development scheme calls for extensive subsea well facilities, a semisubmersible floating production unit, a floating storage and offloading vessel, and a 130-km gas lateral pipeline.

Late last year, the partners issued competitive tenders for drilling rig, subsea equipment and installation scopes for the subsea facilities, floating production unit (semi FPU), and the floating storage and offloading vessel.

In addition, Woodside received confirmation from Mexico’s National Hydrocarbons Commission that it had completed the minimum work program obligation associated with the Trion license was completed. Woodside Energy has said that it will make a final investment decision on the Trion project this year.

Rosebank project, North Sea

Equinor is expected to make the FID on its Rosebank field development project sometime this year. Plans suggest that at peak, the field—around 81 miles (130 km) northwest of the Shetland Islands in 3,500 ft water depth—could produce 69,000 bbl/d of oil, equivalent to 8% of the UK’s entire output between 2026 and 2030. It would also deliver about 44 MMcf/d of gas in its first 10 years.

To reduce costs and cycle time, Equinor plans to redeploy an FPSO from Shell’s recently shut down Knarr field in the Norwegian sector. Development plans for Rosebank call for the oil to be offloaded into tankers from the FPSO, while part of the produced gas will be utilized for power generation in the FPSO. The remainder of the gas will then be exported to the Shetland Islands through a new pipeline that will connect to bp’s existing West of Shetland pipeline.

The Petrojarl Knarr FPSO will undergo life extension work as well as modifications to enhance energy efficiency for electrification. The work will be performed via joint venture with Drydocks World-Dubai, and the upgrade will take place in Dubai, UAE. The engineering, procurement, and construction contract is a combination of work with new build, demolition, and life extension (hull, marine systems, and topsides) required for the FPSO to be kept on the field for 25 years without drydocking.

Perhaps most notably, Rosebank could be among the first UK offshore field developments powered from the start by renewable electricity, with reduced reliance on gas-powered generators.

According to OEUK, options to power the development include offshore windfarms and running power cables to shore. The project could help establish the infrastructure necessary for electrification of all oil and gas operations west of Shetland.

Rosebank was first discovered in 2004 and has since been appraised with five wells. Front end engineering design studies were commenced by the then operator, Chevron, in 2012. In 2018 Equinor purchased Chevron’s 40% interest in the field and took over as operator. First oil is expected in 2026.

Dorado project, Australia

Project developers Santos and Carnarvon Energy had planned to make an final investment decision on the Dorado project offshore Australia last year. In February, Australian regulator NOPSEMA accepted Santos’ proposal for the Dorado field development project, which is located in the Bedout basin offshore Western Australia.

Santos plans a phased project, initially focused on recovery of liquids with gas re-injection followed by development and export of the gas to the Western Australian domestic and LNG markets.

The Dorado phase 1 development plan includes multiple production and injection wells, and a wellhead platform supplying an FPSO. Other discoveries in the area such as last year’s Pavo would be included within the area covered by the project proposal to sustain production through the offshore facilities.

The project developers have said that FEED studies are nearly complete, but they decided to delay issuance of the FID last year amidst rising costs and growing supply chain issues. But with the preliminary engineering work nearly complete, Dorado could get the FID anytime this year.

Cambo project, North Sea

A final investment decision is also expected to be issued for Ithaca Energy’s Cambo field sometime this year.

The Cambo field, which has seen multiple operators over the past few years, is located off the Shetland Islands in the UK North Sea in approximately 1,100-m waters. The field sits on the Corona Ridge geological structure and its main reservoir comprises the Tertiary Hildasay sandstone. The offshore field is estimated to contain approximately 800 million barrels of recoverable oil reserves.

Plans call for the Cambo field to be developed in two phases, with multiple wells tied back to an FPSO. Crude oil will be offloaded into tankers and the gas will be exported through the West of Shetland Pipeline.

Plans call for the FPSO to have a circular hull design without turret, based on the Sevan cylindrical FPSO design. Modern equipment designed to operate without the need for routine flaring or venting of hydrocarbons will be used to reduce emissions. When production commences, the field is expected to produce less than half of the amount of CO2 for each barrel produced than the average UK field. The development will be built electrification-ready.

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack