ENB Pub Note: This was originally published on the Hot Take of the Day Substack by David Ramsden-Wood, or as I call him, “DRW”. I have thoroughly enjoyed all of my podcasts with DRW, and he has been a great friend to the Energy News Beat Channel. We highly recommend subscribing to his Substack.

I will reach out to him to get him on a podcast, as this is a critical topic! And I agree with DRW that Chris Wright is one of the smartest men in the room, and I am thrilled that he is our Energy Secretary.

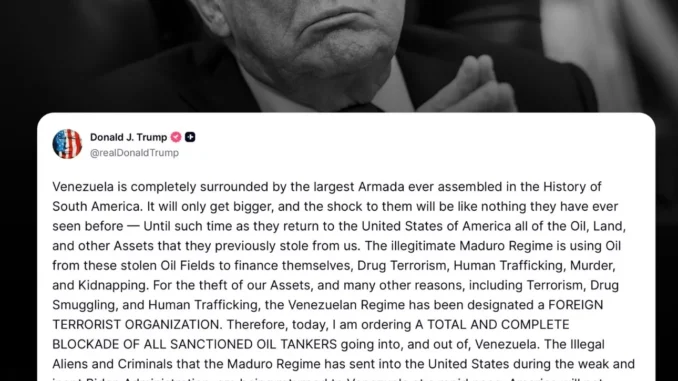

Yesterday, President Trump escalated an already escalating situation in Venezuela. I imagine his speech to the nation this evening will give us a lot more details, but if you strip out the politics, perhaps President Trump finally understands this is just supply math.

Let me reiterate: at $55 oil, the U.S. does not have energy independence. Producers aren’t saying a word publicly; but Chris Wright is no dummy. In fact, he’s pretty F’ing smart. So let’s assume for a moment that Chris is using his knowledge of the industry and sharing privately what we all know.

The U.S. has accelerating decline. Without continuous (over) reinvestment, production falls 25–35% annually. Off almost 14 mmbo/d, that’s a lot of oil. And, at current prices, reinvestment doesn’t clear any economic hurdles, no matter what Exxon says about its Permian position. They are one of the highest cost operators in the country so … no… they aren’t correct. And quietly, rigs are getting racked, completions aren’t being executed, and service rigs and directional drillers are headed home. On the current trajectory, the U.S. risks losing 1.5–2.0 mmbo/d over the next 6-9 months if prices stay here.

If that happens, oil doesn’t grind higher. It reprices violently.

It’s hard to know for sure but I don’t believe there is real spare capacity once you net out OPEC under-delivery, sanctions, and the possible reality that “spare capacity” over the last few years was political, not physical. If the U.S. rolls over while demand stays flat to modestly higher, $100 oil isn’t a call — it’s arithmetic.

Maybe Trump has finally been told this. Drill, baby, drill is about the death of EVs, it could never be about U.S. production growth.

And maybe that’s why Venezuela suddenly matters. Yes, this is about Maduro but it’s also about time and control. The administration has spent months deliberately reframing Venezuela as a narco-terror state: blowing up drug-running boats, designating gangs as terrorist organizations, and escalating rhetoric toward the regime itself. That framing isn’t accidental.

Cutting 900 mbo/d out of the markets and away from China while increasing sanctions on Russian energy might shift sentiment to support prices, buying shale a reprieve before budgets and declines becomes irreversible.

Again, President Trump for all his bluster is smart. His cabinet is arguably the best ever assembled. The story of why he picked Chris Wright in the first place is because Chris was (and is) one of the smartest executives on full energy and human thriving that oil and gas has ever produced. I don’t say this lightly. And Chris has to know that U.S. shale is not the 2030 solution. To wit, the U.S. refining system is built for heavy crude. Canada helps, but it’s not enough at $55. The Middle East is constrained. Iran and Iraq are non-starters for rule of law, American style energy deals. But Guyana is coming on fast — and that’s exactly why Exxon and U.S. energy dominance in the Americas matters. Guyana is the proof: with rule of law, U.S. majors, and scalable offshore barrels, the U.S. is well supplied out to 2050. Net zero my ass. Venezuela is the heavy-crude endgame after Guyana.

By isolating the current regime and signaling a post-Maduro pathway, the U.S. creates a future where American companies — Exxon, Chevron — can bid, operate, and secure supply under enforceable contracts. That’s a post-2028 supply strategy, protecting the next administration — very likely Vance’s — from inheriting a shale cliff with no backup. The Republicans are in trouble. Oil at $100 would be a disaster.

Add to the backdrop migration. Millions of Venezuelans have left the country, with a large population now living in the U.S. under various temporary protections. A Venezuela that can actually absorb labor and capital reduces migration pressures out of South and Central America over time. That’s not humanitarian rhetoric — it’s economic gravity in a worsening U.S labor market.

If Trump does nothing, shale declines and prices spike at the worst time — and he owns the chaos. If he moves now on Venezuela, perhaps prices rise for an identifiable reason, U.S. small cap producers survive, and the U.S. quietly secures its post-shale future.

This isn’t escalation. It’s prevention. Maybe Trump is actually listening.

🔘Trump Orders Total Blockade on Sanctioned Venezuelan Oil Tankers

🔘US Crude Oil Inventories Stay Low Amid Ongoing Draws

🔘Pemex Awards Five New Contracts, But Fails to Attract Major Players

🔘Escalating US-Russia Energy Sanctions: More of the same game of musical chairs… pic.twitter.com/VSHCeJWLvv— Anas Alhajji (@anasalhajji) December 17, 2025