Weekly Daily Standup Top Stories

New Zealand to lift oil drilling ban amid blackout fears in blow to Starmer

New Zealand was on Saturday night expected to revoke a ban on drilling for oil and gas amid fears of blackouts, as Labour plans to impose a similar crackdown on the North Sea. The country’s coalition government […]

The Price of Going Green Is High

1: People around the world are beginning to object to the increasingly expensive costs of the “energy transition” being pushed by their governments and some businesses. 2: A paper by the Climate Policy Initiative (CPI) […]

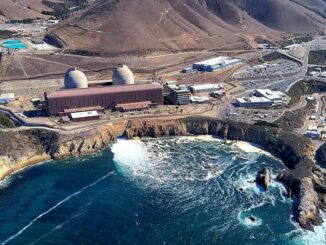

California’s Impossible War on Oil and Gas

Determined to save the world from climate change, California has nearly shut down its oil and gas industry, though the Golden State currently gets 50 percent of its total energy from oil and another 34 percent from […]

California set to crank gas power and emissions to keep cool

LITTLETON, Colorado, June 6 (Reuters) – Scorching temperature forecasts for the western U.S. over the coming days look set to kick-start the high season

The Myth of the Inevitable Rise of a Petroyuan

In diplomacy, what’s left unsaid often matters more than what’s said. After Chinese President Xi Jinping met the king of Saudi Arabia in December, both nations issued lengthy readouts extolling the burgeoning Saudi-Sino relationship in […]

Houston energy company to build largest new refinery in half a century

A Houston company will construct the largest new refinery in the last 50 years in Brownsville, Texas. Element Fuel Holdings LLC is spending between $3 and $4 billion on the project, which will produce more than 160,000 […]

Highlights of the Podcast

00:00 – Intro

01:49 – New Zealand to lift oil drilling ban amid blackout fears in blow to Starmer

06:34 – The Price of Going Green Is High

10:36 – California’s Impossible War on Oil and Gas

12:50 – California set to crank gas power and emissions to keep cool

13:48 – The Myth of the Inevitable Rise of a Petroyuan

16:32 Houston energy company to build largest new refinery in half a century

17:56 – Outro

Follow Stuart On LinkedIn and Twitter

Follow Michael On LinkedIn and Twitter

– Get in Contact With The Show –

Video Transcription edited for grammar. We disavow any errors unless they make us look better or smarter.

Michael Tanner: [00:00:14] What’s going on, everybody? Welcome into a special edition here of the Energy News Beat Daily. Stand up here on June 15th, 2024, a gorgeous Saturday. We appreciate you guys taking time out on your Saturday. Whether you’re mowing the lawn, but you’re going for a little drive, whether you’re like Stu and you’re climbing underneath your house to fix some plumbing. We appreciate you. We appreciate you guys tuning in. We got a great weeks. Do lots of great articles ran this week. We saw a few deals that happened. So you know this week. [00:00:47][32.5]

Stuart Turley: [00:00:47] Unbelievable. And the the energy news is just going nuts around the world. Unbelievable. I’ve never seen as much news. [00:00:54][7.2]

Michael Tanner: [00:00:55] No it’s it’s absolutely guys. But we we appreciate it. You know as always the news and analysis you’re about to hear brought to you by the world’s greatest website, Energy News Beat.com. Hit the description below. Go ahead and check out links to all the articles that we’re about to run. Check out our new trading desk, which is where if you’re if you’re looking to buy, sell or broker crude oil, LNG, and, you know, any refined product, go ahead and hit our trading desk, fill out the form and we will get in contact with you and and route you to the right direction, whether you’re US international, whether it’s stew trying to put, you know, an extra 5000 barrels in his backyard for safekeeping. So because now Russia’s doing nuclear testing in the Caribbean, you know, you never know what you might need, but, you know, or if you’re an oil tanker and you need some oil, check us out, guys. Trading desk. You can hit the link in the description below. I don’t really got anything else to add. I’m just going to leave it up to them, you and the kids and figure out what stories to run until Monday. [00:01:48][53.5]

Stuart Turley: [00:01:49] Hey, let’s start with our buddies out there in New Zealand, but this has got one. This came out of the Telegraph, Michael, New Zealand to lift oil ban amid blackout fears. And it’s a blow to Starmer up in England. Policy reversal is a blow to Labor’s plan for similar crackdown in the North Sea. The North Sea, just had and Norway had a major natural gas shut down and it’s spiked electricity prices for the EU, I mean for the UK. So New Zealand out of this story. New Zealand was on Saturday night expected to revoke a ban for drilling in oil and gas amid fears of blackouts. As the labor plans in the UK are, similar crackdown in North Sea. The North Sea is is really got some history on that. And New Zealand faces an energy shortage which threatens our electrical system and the competitiveness of our exporters. We now urgently need to attract further investment in exploration and production, to keep the lights on our houses warm and business. This is. It’s amazing what happens that chart in their North Sea decline when you compare. Look at this, Miss producer, if you could bring that up that chart 2221 2223 and then you take a look at the forecast. It is declining. What I see is also a loss of tax revenue that these chowder heads are not figuring out. Oh wait a minute. Loss of of low cost energy. Loss of tax revenue equals skyrocketing energy prices. [00:03:37][108.5]

Michael Tanner: [00:03:38] Yeah I mean in in to focus specifically on what’s going on in in New Zealand. This is a country that as of 2018 only imported about seven or only produced about 17% of its overall oil and gas needs. So they critically need access one to local domestic drilling, which they did in, was it 2021, the year that they banned it? No no no no. Yes 2018 they banned it. And that was under a previous, regime, that, that, that, that prime minister voted out actually in early 2023, a new right wing coalition came in. So that’s one of the reasons the wheels are turning to change it. But I mean, you have to and it’s not even about oil. It’s about natural gas. You know, at some point it doesn’t. [00:04:21][43.5]

Stuart Turley: [00:04:22] Matter to 2018. [00:04:23][1.1]

Michael Tanner: [00:04:23] Are because you’ve got to go out and get energy to be able to supply your grid. You either get it from elsewhere, which can be extremely expensive in that premium relative to where you’re going to purchase it. On top of the cost. It would, it, you know, producers are going to need in order to at least get their money back, maybe less than the fact that even though you might make you might not make that much money on it, you’re going to make more profit margin relative to producing yourself relative to importing it. So I think it’s a really interesting shell game you have going on here. Specifically in New Zealand. I mean, they have a lot of gas there. It’s they have a decent amount of gas there. They got about 2.2, or 2.1, you know, gosh, I don’t even know. PJ, I think is what. And to Jules, I don’t even know what that terminology is. I’m just reading off Wikipedia here. They got a lot of they got a lot of remaining gas. They could go get out there. So good for New Zealand to dive back in. And it just goes to show you that, a lot of these a lot of these decisions that are being made are getting reversed quickly as people starting actually read the data. I mean, we all like to joke that everybody’s stupid. Everybody is not stupid when there’s a gun to their head and I’m not in the proverbial gun to your head. His lights are going to be turned off. You’re going to have no power. That is the proverbial gun to your head. [00:05:33][69.9]

Stuart Turley: [00:05:34] What? The people are waking up, Michael, to the deindustrialization of the Green New Deal. The Green New Deal equals deindustrialization. [00:05:41][6.8]

Michael Tanner: [00:05:42] Yeah, the Green New Deal did not happen in New Zealand, but. [00:05:44][2.0]

Stuart Turley: [00:05:45] They. [00:05:45][0.0]

Michael Tanner: [00:05:46] Were realizing, as Michael. [00:05:47][0.8]

Stuart Turley: [00:05:47] Yes, it did. If you take a look at another article that was posted out on this, the the, other article was New Zealand’s party, the government, the it said and they stopped it in in 2018 under then leader Jaclyn Ardern, but continued to allow other ones so they could bolster their renewable, energy. [00:06:13][26.2]

Michael Tanner: [00:06:14] So essentially the Green New Deal those specifically relates to what would happen in the United States. It’s happening all around the world in. [00:06:21][6.8]

Stuart Turley: [00:06:21] The generic term. Now, the Green New Deal, the Greens and the Greens in the party, I was referring to a green. People are referring to it, the Green New Deal around the world. Michael, I’m not sure why the price of green is going high. There are five key bullet points to this one, and when you sit back and take a look at the article, Michael, first one, people around the world are beginning to, object to the increasingly expensive cost of the energy transition being forced on them by their government and businesses. Number two, a paper by the Climate Policy and initiative, the CPI advocates for much heftier expenses for consumers by recommending a seven fold increase in money spent on programs to achieve you in goals, reaching 9 trillion annually by 2030 annually. We can’t the world can’t afford that and increasing after that. CPI is an international group with an initial funding from George Soros that advocates for aggressive climate actions. Number four, Europe has already begun to de industrialize, and with Germany leading the way as they want to retreat from some of their costliest plans under pressure. Number five states in the United States, such as California, have led the green initiatives are also beginning to push back on some green policies. We’re seeing that in the next hour in the in our last article for Virginia. [00:08:02][101.1]

Michael Tanner: [00:08:04] That’s just I mean, I mean, clearly, I mean, again, let’s go back to this, the climate policy initiative. They think that we need to go from 1.3 trillion of funding to 9 trillion. I mean, that’s just a redistribution. It’s just a redistribution of wealth. And whether or not that number is true or not, the question is, can we actually do that? And if we spent $9 trillion, would we be better off than we are now? That’s I think what people who don’t understand is there’s always a there’s always an opportunity cost. You know, I’m an economist. So I think of the I think of these things all the time. If I’m going to do X, what’s the opportunity cost of not doing Y. And if the opportunity cost is less we’ll go do x. In this case, if the opportunity cost of not moving to renewables is less than the opportunity cost of moving timetables, you might as well do it. The problem is they look at a small sliver and they’re using this word. And I’m using quotes for a podcast listeners, climate science, to make this argument that the opportunity cost is way more than it is way more, when if you actually look at, you take into account other things like the economy, people’s well-being, all this other stuff, and you group it all into more of a meta analysis with the answer becomes a lot more muddied than just, oh, we’re going to save it exactly from two degrees. So it’s the second, third, fourth order effects. I mean, when they throw these big 9 trillion, 10 trillion numbers, right. The first thing I think of, they’re just trying to redistribute the wealth from one group of, I mean, at the end of the day, it’s redistributing wealth from one group of rich people to another group of rich people. So I’m not concerned for either one of them, per se. But it is interesting how I write more of what they’re trying to do. It’s trying to get the people they like the money and not the people they don’t. [00:09:49][105.1]

Stuart Turley: [00:09:49] Exactly. Here’s here’s a paragraph in here. This is right above the conclusion, Michael Illinois’s, which is requiring 50% of its electricity to be renewable by 2030, had its power regulator reject grid improvement plans from two utilities, stating the state’s household should not be unfairly asked to show. Undue costs, tied to the state’s energy transition. The CEO of one of those Illinois’s utilities, Exelon, protested because requirements is going to cost money. The question is, who’s going to pay if the state does not? Utilities could go out of business, thereby transmitting no power to residents who expect lights on 24 by seven. It’s a complicated problem. [00:10:35][45.6]

Michael Tanner: [00:10:35] It’s extremely complicated. [00:10:36][0.7]

Stuart Turley: [00:10:37] California’s impossible war on oil and gas. They can not get enough of that. Brutalizing what’s keeping their lights on? The assault on oil and gas has been relentless. Relentless? In September of 2020, three. California Attorney General Robert Bonner sued ExxonMobil, shell, Chevron, ConocoPhillips and BP for causing climate change. Well, has anybody bothered to tell California that the only reason that they reduced any chance of their CO2 output was because of their natural gas, generation? They are they’ve got about 42% of their power is between nuclear and natural gas. But yet they’re trying to shut down all of their natural gas that they possibly can and import more oil from Iran, China and Russia. And it is just despicable. And they’re doing more harm to the UN, environment and to the, in, than they possibly can. So when you take a look at energy trends, based on the Statistical Review of World Energy published annually in the 2023 edition, current data, equates to 2288 giga joules per capita in the United States and a mere 67 giga joules per capita in the rest of the world by 2050. That’s giving that number is going to be off a ton when you consider AI and data centers. So California’s climate war warriors may, succeed in a quest to eliminate fossil fuels in their state, but it will become a grievous, cost to their fellow residents. As an example for the rest of the world cannot possibly emulate. So you know what? California. I feel sorry for anyone. I love California, I love the times that I visit there. Will not live there. But I’ll tell you what. I just feel sorry for the folks that are stranded and can’t get out of that state. California to set, set to crank gas power and emissions to keep cool. So they have got some serious, power problems. Listen to this. Between 2021 and 2023, Casio operators boosted gas, powered plants by an average of 72% during the June to August window from the average levels of the previous three months. They have got to have the natural gas to keep the load, balanced. There you can have an oversupply of solar, but at the transition time between solar and night, you’ve got to have the emergency or the stable grid stabilization of natural gas plants. The steep climb in solar, has just really caused a problem with the balancing authorities in keeping it up. So an excellent article and this is from Reuters. The myth of the inevitable rise of the Petroyuan. I’ll tell you, Michael, I have been, you know, with bricks in the advent of our stupidity in our management of our country. I’ve been saying it’s been coming, and this article is quite the opposite. Let me give you a couple of highlights here. Astonishing as it is, quote, the narrative is an illusion. First, if you believe in conspiracy theories, the introduction of the Petroyuan and the ensuing collapse of the Petro dollar would be the first domino, potentially weakening the entire whole U.S. financial system. Very serious. A redrawing of the global economic map. The backdrop to global wars and crisis. Now, the author of this article goes on to say that it’s not going to happen and that the Petro dollar is going to hang on, and that the Petro line is not going to, because of the agreement with Riyadh. And China mentioned nothing in there about Petroyuan I missed that totally. MDAs did not want the Petroyuan So I’m I’ve got to the last line in this article. Ironically the only new Petro currency to emerge of late as. Has been the Durham of the United Arab Emirates India to using it to settle some oil transactions with Russia, bypassing U.S. sanctions. Also, the ruble, which is not mentioned in this article, as well as some others, but this guy is saying that the petrodollar is here for a while. What do you think? [00:15:31][294.9]

Michael Tanner: [00:15:32] Well, I it’s I think it’s it’s going to be a lot harder than we think to migrate off the, the, the Petro dollar from standpoint. It there’s a lot of business already wrapped up in that. I do think the Petro yarn is coming slowly. It’s all about the supply chains and how, you know, we’ve talked at nauseam about how the supply chain shifting to exclude the United States. When that happens, there’s no need for the dollar if you’re never going to go back to the United States. And as more isolated nations get as Russia, Russia has shown you can do it. You can have a stable economy and not have access to any of the western banks and all that jazz. [00:16:12][40.2]

Stuart Turley: [00:16:13] So the Swift system, yes. [00:16:14][1.4]

Michael Tanner: [00:16:15] It’s not needed anymore. So no, I, I’m a firm believer that yes, the Petro region is coming, but it may not even be the Petro one. It’s just going to be the Petro not dollar Johnson dollar. [00:16:27][11.8]

Stuart Turley: [00:16:28] How cool is that, Michael? I like the way you phrase that the Petro not dollar Houston Energy Company to build the largest refinery in half a century. Listen to this. It will process more than 160,000 barrels of gasoline, diesel and jet fuel from shale oil production. Pretty interesting. Element Fuel Holdings is spending between 3 and 4 billion on the project, which will produce more than 160,000 barrels per day of diesel, jet fuel. And that’s pretty cool. [00:17:02][34.4]

Michael Tanner: [00:17:03] What’s also crazy is that Element Fuel Holdings is a relatively new company. They also say they intend to produce enough hydrogen and supply all the refineries power needs, which is going to apparently, a quarter of them significantly reduce their emissions compared to the old refineries. Again, this is a Houston based firm. You know, I would have expected a bigger boy to get one of these. You know, this isn’t a shell. This isn’t an Exxon. This isn’t a Chevron. I mean, this is a smaller company. It’s good to see. I’m glad they went ahead and got this approved down there in Brownsville. But I it goes to show you how necessary new refineries are and how new you can make them, especially if you can produce enough hydrogen where you don’t have to. You can run itself to self-perpetuating refinery. [00:17:42][39.5]

Stuart Turley: [00:17:43] And and the fact that we got a new one since it 50 years that to me is out of the park huge. [00:17:49][6.0]

Michael Tanner: [00:17:49] It’s it’s pretty. [00:17:50][0.4]

Stuart Turley: [00:17:50] Good to provide a thousand new jobs. We like jobs. [00:17:54][4.6]

Michael Tanner: [00:17:55] We love jobs. That’s the key. [00:17:55][0.0][1044.3]

– Get in Contact With The Show –