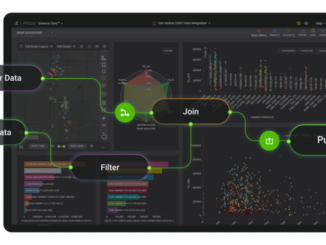

What is going to drive the 2022 energy markets? Well, Dane tells us. There are vast amounts of data that Enverus evaluates before making market predictions. If you need to make a decision in the energy market, make that decision based on data. If you need data, go to Enverus.

Thank you Dane for stopping by the ENB Podcast. I had an absolute blast and look forward to our next update.

Please connect with Dane at his LinkedIn address Here:

The following is an automatic transcript, and we disavow any errors unless it makes us sound smarter or more intelligent.

Stuart Turley: [00:00:04] Hey, Everybody. Today is a Wonderful day. Welcome to the Energy News Beat podcast and we’re here recording it. [00:00:12][8.0]

Stuart Turley: [00:00:12] And I’ll tell you Enverus is always a great company and if you want data and you got to make a decision, go to in various and I’m here and. [00:00:22][10.0]

Stuart Turley: [00:00:23] I’m here with Dan Gregarious I’m sure I butchered that name up but I’ll tell you what we are ready for talk. You’re up in Calgary Arent you? [00:00:30][7.7]

Dane Gregoris: [00:00:31] That’s right, yeah. Based in Calgary, Alberta. Yeah. [00:00:34][3.1]

Stuart Turley: [00:00:35] And you’re a managing director up there, correct? [00:00:37][1.8]

Dane Gregoris: [00:00:38] That’s right. Yep. Of the research group. [00:00:39][1.4]

Stuart Turley: [00:00:40] And we were just kind of talking about how you got to Enverus a little while ago and you’ve been you were at the company formerly known as in Canada and it kind of like the artist formerly known as Prince. [00:00:56][16.2]

Stuart Turley: [00:00:58] Tell us a little bit about your background and how you got to in various. [00:01:01][3.1]

Dane Gregoris: [00:01:02] Yeah, absolutely. Yeah, I yeah, I guess I got sucked into the Energy industry from eastern Canada. [00:01:08][6.3]

Dane Gregoris: [00:01:09] I went to school out there, did an engineering degree and and and, you know, as they say, kind of moved west pretty quickly after I graduated. Got a job at, as you mentioned in Canada at the time,. [00:01:22][13.2]

Dane Gregoris: [00:01:23] I was working in central Alberta on, you know, some really kind of old coal bed methane fields but sort of cut my teeth on production engineering, which was awesome. [00:01:31][8.4]

Dane Gregoris: [00:01:32] And shortly after that, you know, I wanted to really understand the industry from a higher level think about, you know, why companies make decisions, what drives financial markets and so. [00:01:45][12.4]

Dane Gregoris: [00:01:46] I moved over to a job with a company called ITG at the time, and it was the Calgary office of IPG, which was an energy kind of only equity research desk and based in Calgary here. And so. [00:01:59][13.4]

Dane Gregoris: [00:02:00] I’ve really been in the same job since that time the company sort of changed its names a bunch of times but yeah, I started as a as a research associate and worked with, you know, a lot of the same folks that I started with today but the company certainly changed its names. [00:02:15][14.1]

Dane Gregoris: [00:02:15] We were carved out of ITG in and that was, I guess, 2016 as to, to be our standalone business, our s energy group and then ah as energy group was, was acquired in 2020 I believe by inverse. So. [00:02:32][16.8]

Dane Gregoris: [00:02:33] It’s been a good it’s been a great ride and, and always you know fascinating to to follow the industry through to the last almost decade. [00:02:40][6.9]

Stuart Turley: [00:02:41] Well I’ll tell you what then those that survive that many transitions of people being bought by a company says a lot for you. [00:02:49][7.7]

Dane Gregoris: [00:02:50] Oh, I think we’re lucky we’re in the people business being in that sort of a research business and a, you know, data and analytics company now. Yeah, certainly a little bit asset light versus the, you know, ENP sectors that we follow. [00:03:04][14.3]

Stuart Turley: [00:03:05] Oh, All right. Let’s go over just a little bit. You just put out a report as a managing director. [00:03:10][4.7]

Stuart Turley: [00:03:11] Tell us a little bit about the report that you just put out. It was Energy Market Insights 2022 themes. Tell us a little bit about your thought process and your team working on this. [00:03:23][12.2]

Dane Gregoris: [00:03:24] Yeah, absolutely so this is a this is a piece sort of a culmination of of, you know, a ton of work that we’ve done over the past year to give you, you know, a sense of the scale of the the research or intelligence team out in various today,. [00:03:38][14.5]

Dane Gregoris: [00:03:40] It’s about 100 people and so it’s a massive organization from a research perspective, if you look at like relative size of other different kind of industry research groups out there. [00:03:51][11.0]

Dane Gregoris: [00:03:51] So we’re able to take, you know, all the data that was available to our clients and, you know, compare that with what we’re seeing in financial markets and commodity markets and then come up with opinions on how we think, you know, the next year is really going to play out. [00:04:08][17.4]

Dane Gregoris: [00:04:10] And so the this 2022 themes that we’re sort of anticipating are going to drive energy markets is what the research report is, is on. [00:04:21][11.1]

Stuart Turley: [00:04:22] And when we sit here and we take a look at valuations that reset, one of your quotes in here was valuations have reset across the new energy subsectors,. [00:04:31][8.5]

Stuart Turley: [00:04:34] Particularly in the EV charging and energy storage. Can you allude to a little bit more on the heavy side in the storage? [00:04:42][8.6]

Dane Gregoris: [00:04:44] Yeah, sure. So the what we’ve seen, you know, with the a lot of the discussion about high inflation through sort of the back half of 2021 and subsequent conversations with the Federal Reserve and other global central banks talking about, you know, the necessity to to raise rates. [00:05:03][19.7]

Dane Gregoris: [00:05:05] It’s really pushed a lot of the valuations for what we probably refer to as kind of like new energy companies that were recently public, you know, have super high growth profiles driven by, you know, the necessity to reduce carbon emissions and ultimately, you know, get to net zero at some point in the future. [00:05:23][18.4]

Dane Gregoris: [00:05:24] So if you think about the the preference for the equity markets to like companies that have, you know, super high growth profiles versus companies that are maybe relatively flat burning a lot of cash, which would be more of kind of the old energy economy. [00:05:39][15.3]

Dane Gregoris: [00:05:42] It really preferred in sort of the back half of 21 and then specifically in 22? There really there’s been a strong preference for the the cash flowing, you know, oil and gas companies rather than these really kind of new energy, but high growth companies. [00:05:58][15.8]

Dane Gregoris: [00:05:59] So the valuations have reset on on the the growth side for sure and that’s trickled down into these like energy transition equities and we think that presents, you know, good opportunities you know, at some point,. [00:06:12][13.5]

Dane Gregoris: [00:06:13] If there’s a lot of a lot of companies out there, a lot of capital that has been raised or will probably be continue to be raised so it’s going to be it’s going to be super fascinating to watch. [00:06:23][10.6]

Dane Gregoris: [00:06:24] I don’t think it’s I don’t think it’s clear to anybody who’s going to be the huge winners or huge losers but certainly the size of the prize is big and so,. [00:06:31][7.3]

Dane Gregoris: [00:06:32] You know, entering or looking at the sector now, they may be really fruitful just given the the downdraft and valuations that we’ve seen across those energy transition type equities. [00:06:44][12.7]

Stuart Turley: [00:06:46] You know, when you sit back and take a look at energy in in energy’s needed in everything, I mean you’re talking energy to heat your house which is kind of cold up in Calgary it’s kind of cold here in Texas as well as Oklahoma. [00:07:02][16.1]

Stuart Turley: [00:07:04] But how come some of the prices are going through the roof When we sit there and think about the prices of natural gas in New England is just going nutty and the price is only $5, but they’re up and around $180 equivalent up in New England. I mean, isn’t that kind of weird? [00:07:26][22.0]

Dane Gregoris: [00:07:27] Totally. Yeah, I think. Yeah. This year’s been. That’s a good way to put it. I think maybe a weird year for for commodity prices. a lot of things driving that, you know,. [00:07:41][13.4]

Dane Gregoris: [00:07:41] In the winter, particularly when it’s a little bit colder than expected like if we start back to December, there’s a lot of forecasting always going to be a super mild winter so the expectations kind of coming into January were pretty low from from any sort of, you know, expecting any sort of big cold snaps. [00:08:00][18.6]

Dane Gregoris: [00:08:00] And so when you do get a cold snap, which the last couple of weeks has been pretty cool, the Northeast, which is the biggest sort of demand center for natural gas. [00:08:06][5.8]

Stuart Turley: [00:08:07] Right. [00:08:07][0.0]

Dane Gregoris: [00:08:07] Um, you get you get weird pricing for sure and it’s, it’s you know, if you look back in history and you can sort of see on a cold winter’s like, you know, especially in New England or you know, other parts of the Northeast, you just get these really, really big prices and essentially is because there’s a ton of demand, as you were, you know, to heat their homes. [00:08:28][20.4]

Dane Gregoris: [00:08:28] And as and it’s either need to get it through LNG, I think in some cases or different different pipeline routes that just aren’t really there and so they need to pull on storage and other supply sources to get it. [00:08:46][17.6]

Stuart Turley: [00:08:47] Oh yeah. The outside supply sources for LNG up in New England is kind of funny they’re coming in from Russia and Norway and so we’re we’re paying for those. [00:09:00][12.8]

Stuart Turley: [00:09:00] And I would rather buy everything from Canada. And because Canada has got some fantastic regulations up there as far as ESG. [00:09:08][7.7]

Dane Gregoris: [00:09:09] So why don’t you think they need it? They need it from Canada. I mean, they have the other source right there. [00:09:14][5.2]

Stuart Turley: [00:09:15] Oh, yeah. [00:09:15][0.5]

Dane Gregoris: [00:09:16] So there’s not even Yeah, they wouldn’t even need to go cross-border, too but it is difficult to build pipelines anywhere really. I mean, we just heard I think it was last week about the Mountain Valley pipeline being sort of stopped again by courts so it’s a very sort of structural theme. [00:09:37][20.7]

Dane Gregoris: [00:09:38] And it’s something that we’ve been talking about about Appalachian Gas, you know, beyond MVP, just given how much of a headache this pipeline has been and, you know, subsequent pipelines before then or I guess precedent pipelines before then, it’s like it’s unlikely to really see another pipeline, natural gas pipeline being built out of the northeast. [00:09:55][16.6]

Dane Gregoris: [00:09:56] And a lot of people are saying ever, which is kind of hard to think about but it’s it’s it’s just that difficult to add infrastructure. [00:10:03][7.6]

Stuart Turley: [00:10:05] Don’t you think it’d be a it’s a bit of a hypocrisy for folks saying we want ESG, but yet they’re buying from importing from Russia oil, I mean, and Russia, natural gas and LNG. I mean, it just seems kind of odd to me. [00:10:20][15.0]

Dane Gregoris: [00:10:20] But yeah, it’s a Global market. So I mean, you can if you’re willing to pay certain prices for things and mean you get them and so. [00:10:28][8.0]

Dane Gregoris: [00:10:29] I do think there’s yeah, like an intuitive kind of strangeness about it, but at the same time you that if you need it, if you need gas or you need oil or you need any sort of commodity, you can just go out there and bid sort of a high price and and get it in in short order. [00:10:48][19.3]

Stuart Turley: [00:10:49] With OPEC plus meeting this week, what are your thoughts on Libyan Opec+? [00:10:55][5.7]

Dane Gregoris: [00:10:57] Yeah, we think you know they look they’ve done a really since the bottom of COVID right. So if you think about in in sort of 2020, maybe like June I think was the big announcement where they were going to cut 10 million barrels a day out of the market as sort of their economy was grinded to a halt and oil demand, you know, cratered at least five, 10 million barrels a day through instantaneously. [00:11:22][24.9]

Dane Gregoris: [00:11:24] They’ve really ever since that point, they really have done a fantastic job sort of managing the oil market right,. [00:11:29][4.8]

Dane Gregoris: [00:11:30] Taking supply off, adding a bit of supply only as prices really started and sort of and demand really started to recover and so we think they are acting in their own interests in terms of driving higher prices. [00:11:47][16.4]

Dane Gregoris: [00:11:47] I mean, certainly they could have been more, I guess, or less accommodative from a price standpoint and just added a bunch of supplies to whenever they wanted but they have been pretty thoughtful. [00:11:58][10.8]

Stuart Turley: [00:11:59] Right. [00:11:59][0.0]

Dane Gregoris: [00:12:00] And so, yeah, it’s led to, you know, that their policy decisions and among other different factors on the supply side has obviously led to very strong pricing for for oil globally today we’re sitting here, I think it ticked over $90 for the first time since 2014. [00:12:20][19.6]

Dane Gregoris: [00:12:21] Just like that. [00:12:21][0.4]

Stuart Turley: [00:12:21] Wow. [00:12:21][0.0]

Dane Gregoris: [00:12:22] Which is pretty wild. [00:12:23][0.6]

Stuart Turley: [00:12:24] That is just crazy. And this sounds kind of odd, but my team has put together numbers for, you know, various reasons for $120 oil this year. [00:12:37][13.1]

Stuart Turley: [00:12:38] And I’m showing 9018 and there’s some serious problems that that does bring in and Nat gas is looking at $4.92 right now so that and Brant was actually less than it’s 8939 unless I’m reading that wrong and I am old and that’s quite possible. [00:13:09][31.7]

Dane Gregoris: [00:13:10] So yeah, I’m not sure that it is true and usually brands like yeah. [00:13:15][4.8]

Stuart Turley: [00:13:15] So and so when we sit back and take a look in various has got great data, you’ve got great reach on your foresight and everything else. [00:13:28][13.1]

Stuart Turley: [00:13:29] What do you see natural gas coming around for? For the U.S. and for Europe. I mean, because that’s not I mean, over there. What are your thoughts on worldwide pricing and or pricing for natural gas? [00:13:43][14.2]

Dane Gregoris: [00:13:44] Yeah, for sure. I think the one when you know, the team looks at, you know, we have an entire team that that looks at the commodity market on a on a daily basis and they’re sort of refreshing all the data we’re ingesting and, and changing models to to better reflect what we think sort of the best guess the future will be. [00:14:01][16.8]

Stuart Turley: [00:14:02] Right. [00:14:02][0.0]

Dane Gregoris: [00:14:02] And and really for both commodities, both oil and gas we do think that you’re going to see some softening like there’s prices are really high an unsustainably high. [00:14:13][10.4]

Stuart Turley: [00:14:14] And in Europe in Europe,. [00:14:16][2.0]

Dane Gregoris: [00:14:17] This should be oil, globally oil and then U.S. natural gas prices. [00:14:21][4.4]

Dane Gregoris: [00:14:22] I can’t really comment on on European pricing. [00:14:24][2.3]

Stuart Turley: [00:14:25] Okay. [00:14:25][0.0]

Dane Gregoris: [00:14:25] I don’t have a strong view one way or the other today. [00:14:27][2.2]

Dane Gregoris: [00:14:29] But certainly we expect European pricing is going to be much higher than U.S. pricing, which will incentivize LNG and that’s that’s sort of been a really critical kind of fixture to the U.S., you know, natural gas prices and U.S. natural gas market. [00:14:46][16.5]

Dane Gregoris: [00:14:46] And so we still see that there’s a ton of opportunity for more LNG to get built out. However, in the next couple of years, you have also a lot of supply getting added to the market. So. [00:14:57][11.0]

Stuart Turley: [00:14:58] Right. [00:14:58][0.0]

Dane Gregoris: [00:14:58] The Haynesville, there’s about 50 rigs running in the Haynesville today. There are certain operators, one private one in particular that I think is running last I checked, 13 or 14 rigs. [00:15:09][11.4]

Dane Gregoris: [00:15:11] And then so if you take that plus Southwestern plus Chesapeake, that’s like 60 to 70% of the rigs running in the play today. [00:15:17][5.6]

Dane Gregoris: [00:15:17] So the Haynesville is an interesting story because if you take out maybe a few those private operators and keep production flat, all of a sudden now North American gas pricing looks rather interesting and it could stay relatively high. [00:15:31][14.1]

Dane Gregoris: [00:15:32] But if you have the Haynesville adding, you know, to be a day a year for the next couple of years. [00:15:36][4.1]

Stuart Turley: [00:15:37] Right. [00:15:37][0.0]

Dane Gregoris: [00:15:37] You know, the gas market doesn’t necessarily look as short as it does today from an inventory perspective so you start to sort of add to the supply and that helps kind of bring prices down to a more reasonable kind of level in the in the 3 to 350 range. [00:15:52][15.1]

Dane Gregoris: [00:15:53] So that’s what we’re anticipating is things was going to grow. You also have associated gas with the Permian that’s going to grow a lot, too. [00:15:58][5.3]

Dane Gregoris: [00:15:59] Like I think we heard ConocoPhillips talk about today that they they’re a bit worried about Permian supply growth again and it’s sort of this funny situation we’re in where I think last year everyone said, you know, supply growth in the U.S. is over they’re never going to grow again. [00:16:12][13.6]

Dane Gregoris: [00:16:13] But certainly that’s not the case. You know, we’re expecting almost a million barrels a day of growth out of the Permian and two Bcf D growth out of the gas side of the Permian. [00:16:20][7.8]

Dane Gregoris: [00:16:21] The Permian is big gas play. [00:16:22][1.1]

Stuart Turley: [00:16:23] Yeah, the EIA just put out Permian oil output forecast to hit record high in February. So yeah. [00:16:29][6.4]

Dane Gregoris: [00:16:30] It’s probably it’s there for sure already. [00:16:31][1.4]

Stuart Turley: [00:16:33] And so when you take a look at the Haynesville, Haynesville down in the Louisiana area, down near the Gulf Coast is a wonderful place for like Cheniere. [00:16:40][7.6]

Stuart Turley: [00:16:41] And after they got their training six on that so that they can start putting out that LNG to Europe, there’s some profit. I mean that was also kind of goofy. [00:16:51][9.2]

Stuart Turley: [00:16:51] Just recently they had all of the LNG ships being, you know, one was in Hawaii, can you believe that they got turned around and went to Europe and it’s what, $300,000 just to go through the Panama Canal? Holy smokes, That’s a lot of extra money they’re willing to pay just to get a load of LNG. [00:17:13][22.3]

Dane Gregoris: [00:17:14] Interesting. Yeah. I mean, three underground is probably a drop in the bucket with these vessels, but yeah, it’s. [00:17:19][5.1]

Stuart Turley: [00:17:20] Yeah, my credit card goes that high, you know but, you know, we sit here and we think about the Haynesville. [00:17:26][5.9]

Stuart Turley: [00:17:26] The Haynesville is the gift that keeps on giving and you know, in, in the mart, the when you take a look at the Marcellus up there, it just is a shame the Marcellus is such a gas rich field and they can’t have the take away going to the US markets. It just is mind boggling to me. [00:17:48][21.4]

Dane Gregoris: [00:17:48] Yeah, no doubt. I mean, if you look at the Northeast, Marcellus and Utica, the takeaway is probably if not the most important part of the economics decision for an operator standpoint, right? [00:18:03][14.4]

Dane Gregoris: [00:18:05] I mean, it’s pretty f indie is pretty cheap, right? Like your drill cost per molecule at it is not very expensive, but it costs you, you know, in some cases a dollar, if not more, to get it to market. [00:18:15][10.6]

Stuart Turley: [00:18:16] Right. [00:18:16][0.0]

Dane Gregoris: [00:18:18] So it’s it’s a bit of a it’s a different play pressure from from that perspective and so every you know, these big companies in Appalachia that have grown dramatically, you know, been the drivers of the, practically 0 to 35 Bcf a day play that it is today are sitting on, you know, great assets and they’re generating a lot of cash flow. [00:18:42][24.1]

Dane Gregoris: [00:18:44] But if there was a, you know, high gas prices or a reason to to to continue to grow, it’s the calculus is a little different there than it is in the Haynesville because if you add a bunch of production,. the differentials that you’ll receive on the rest of the gas that you produce is is going to be the pricing you’ll receive is going to be rather low just because differentials will widen significantly. [00:19:07][22.9]

Dane Gregoris: [00:19:07] And we think that’ll probably happen a little bit in 2022. Just an even we think it’ll probably happen in the Haynesville on a short term basis. [00:19:14][6.3]

Stuart Turley: [00:19:15] Okay. [00:19:15][0.0]

Dane Gregoris: [00:19:15] So you need to see the golf run pipeline come online at the very end of this year. And we think the Haynesville will sort of outpace capacity at some point this year so there’s always sort of these bottlenecks that tend to happen when the industry moves back to a growth mode and certainly we do do think that there’s certain parts of the industry that are growth. Again,. [00:19:37][22.1]

Dane Gregoris: [00:19:37] Its in the private operators, the super majors are definitely adding growth in North America to offset declines elsewhere. [00:19:43][5.9]

Dane Gregoris: [00:19:45] And the publics are a bit still pretty conservative from a growth standpoint they’re not really growing in the same manner that these privates and super majors are in the in the U.S.. [00:19:57][11.9]

Stuart Turley: [00:20:00] When we take a look at the there’s a. I was reading a couple weeks ago about $1,000,000,000 natural gas plant going up into the Pennsylvania area. Do you remember which one that is or what that is? [00:20:16][16.3]

Dane Gregoris: [00:20:16] I don’t I don’t recall. Yeah, I unfortunately, I don’t. But I was having a conversation with a colleague the other day asking about, you know, what if they just built a bunch of, you know, gas plants in the Northeast and shipped power instead of shipping gas? [00:20:30][13.7]

Stuart Turley: [00:20:31] But, yeah. [00:20:31][0.8]

Dane Gregoris: [00:20:32] I know. I’m sure many people have run that math. And and there’s probably good reason why there’s not a ton of new, new ads. [00:20:40][8.1]

Stuart Turley: [00:20:41] Oh, that’s funny. I’ll tell you, you know, we need to definitely get off of coal and we do need natural gas. [00:20:49][7.5]

Stuart Turley: [00:20:49] So I think Natural gas is definitely the lowest way to help the emissions out there. [00:20:56][6.2]

Stuart Turley: [00:20:57] We got a few more minutes here and when you take a look at in various give us your last thoughts on what you think in various is going to come because you you were you were part of four purchases from I mean you had a trail to get to Enverus. [00:21:16][19.3]

Stuart Turley: [00:21:17] Where you think where do you think investors is going? And tell us what’s on the next hurdle for next corner for in Enverus. [00:21:24][7.7]

Dane Gregoris: [00:21:26] Yeah, for sure. I mean, it’s a big company today. I think the the last time we had a new private equity sponsor in 2021 that injected capital at around $4 billion valuation. [00:21:40][14.5]

Stuart Turley: [00:21:42] Wow. [00:21:42][0.0]

Dane Gregoris: [00:21:43] So it’s a big it’s a big business today, And there’s a you know, there’s a fantastic team that’s been assembled, you know, from external hires, you know, tons of internal people that have either come from different parts of of the, you know, in Enverus family kind of looking backward. [00:22:01][17.9]

Dane Gregoris: [00:22:01] And and so, you know, the whole organization, I think, is rallying around the necessity and the importance of of energy for all our livelihoods. [00:22:12][10.3]

Dane Gregoris: [00:22:13] And I think last year in particular, given the run up in commodity prices, given the run up in just pricing like inflation,. [00:22:20][6.9]

Dane Gregoris: [00:22:22] I think it’s a lot more apparent. You know, we had a European energy crisis that luckily that, you know, a warmer winter didn’t have as many negative consequences as it could have. Um,. [00:22:32][10.2]

Dane Gregoris: [00:22:33] But, but overall, there’s a, I think there’s a more kind of societal push to, to bring energy sort of the forefront of conversations and, and so everybody here is, is sort of an energy nerd, if you will, right. Like they’re super fascinated by the industry . [00:22:52][19.1]

Dane Gregoris: [00:22:52] And they want to do their part to make our clients lives like remote, which most of the time are either, you know, look to do financing in the energy industry or look to operate and develop projects, whether it’s on the upstream, midstream, downstream sides of other supply chain. [00:23:09][16.8]

Dane Gregoris: [00:23:09] So we can do a lot as a technology provider to help to make their lives easier, to help make their decisions armed with more data, and so they can make more accurate decisions about, you know, what different whether it’s, you know, supply and demand for cash, whether it’s optimizing a given unit of drilling spacing unit in the Permian Basin. [00:23:35][25.2]

Dane Gregoris: [00:23:35] You know, there’s there’s many different ways we can help but certainly that’s sort of our North Star and we’re continuing to sort of invest in our products. So ultimately, you know, all these all our our clients can can do their jobs better and deliver, you know, a reasonable cost energy mix to to the global population. [00:23:57][21.5]

Stuart Turley: [00:23:58] I’ll tell you what then that is a very good way to say everything there. And it’s if you got to make decision in the in energy space, you better make it based off of data and if a data go to in Enverus because I’m impressed with all the data resources in the products. Holy smokes. [00:24:18][19.3]

Dane Gregoris: [00:24:18] Oh yeah, for sure. It’s great. Yeah. [00:24:20][1.9]

Stuart Turley: [00:24:21] You know. Anyway, well, thank you very much for stopping by the podcast and look forward to getting this out and we’ll have your contact information in there as well too. So thank you very much. [00:24:31][9.8]

Dane Gregoris: [00:24:31] Thanks to appreciate the time today. All right. [00:24:33][1.9]

Stuart Turley: [00:24:33] Bye. [00:24:33][0.0]

Stuart Turley: [00:24:34] Bye. [00:24:34][0.0]

[1349.8]