“Rates have been extremely low for a long time — it’s hard to know how many investors and companies are truly prepared for a higher rate environment.”

By Wolf Richter for WOLF STREET.

Jamie Dimon, in his letter to JPMorgan Chase shareholders, was shaking up the internet a little this morning when he discussed the range of scenarios he envisioned for inflation over the longer term, and interest rates over the longer term – and the potential causes.

But he also cautioned about running a business based on “economic prognosticating.” He said: “Instead, we look at a range of potential outcomes for which we need to be prepared. Geopolitical and economic forces have an unpredictable timetable — they may unfold over months, or years, and are nearly impossible to put into a one-year forecast. They also have an unpredictable interplay: For example, the geopolitical situation may end up having virtually no effect on the world’s economy or it could potentially be its determinative factor.”

So here’s what Dimon said in his letter about inflation, interest rates, and QE/QT:

“All of the following factors appear to be inflationary:

ongoing fiscal spending, [“…occurring in boom times – not as the result of a recession – and they have been supported by quantitative easing, which was never done before the great financial crisis.”]

remilitarization of the world,

restructuring of global trade,

capital needs of the new green economy,

and possibly higher energy costs in the future (even though there currently is an oversupply of gas and plentiful spare capacity in oil) due to a lack of needed investment in the energy infrastructure. “

“Interest rates looking out a year or two may be predetermined by all of the factors I mentioned above. Small changes in interest rates today may have less impact on inflation in the future than many people believe.”

“There is also a growing need for increased spending as we continue transitioning to a greener economy, restructuring global supply chains, boosting military expenditure and battling rising healthcare costs. This may lead to stickier inflation and higher rates than markets expect.”

“It seems to me that every long-term trend I see increases inflation relative to the last 20 years. Huge fiscal spending, the trillions needed each year for the green economy, the remilitarization of the world and the restructuring of global trade — all are inflationary. I’m not sure models could pick this up.”

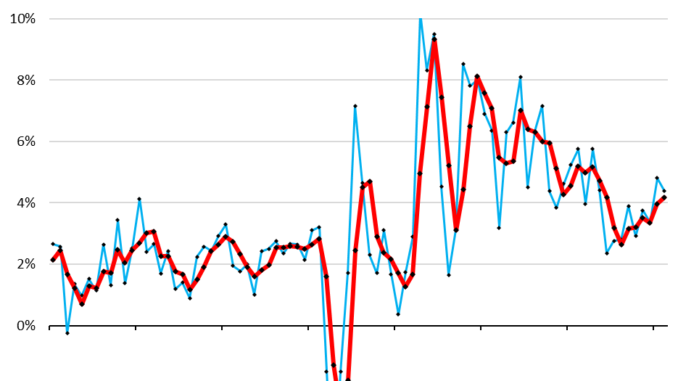

Prepared for “interest rates of 2% to 8% or even more.”

“Therefore, we are prepared for a very broad range of interest rates, from 2% to 8% or even more, with equally wide-ranging economic outcomes — from strong economic growth with moderate inflation (in this case, higher interest rates would result from higher demand for capital) to a recession with inflation; i.e., stagflation. Economically, the worst-case scenario would be stagflation, which would not only come with higher interest rates but also with higher credit losses, lower business volumes and more difficult markets.”

Beware of 6%-plus long-term rates in a recession.

When purchasing First Republic in May 2023, “we stipulated that the crisis was over provided that interest rates didn’t go up dramatically and we didn’t experience a serious recession.

“If long-end rates go up over 6% and this increase is accompanied by a recession, there will be plenty of stress — not just in the banking system but with leveraged companies and others.

“Remember, a simple 2 percentage point increase in rates essentially reduced the value of most financial assets by 20%, and certain real estate assets, specifically office real estate, may be worth even less due to the effects of recession and higher vacancies. Also remember that credit spreads tend to widen, sometimes dramatically, in a recession.”

“Rates have been extremely low for a long time — it’s hard to know how many investors and companies are truly prepared for a higher rate environment.”

About QE and QT (they’re risky):

“Quantitative easing is a form of increasing the money supply (though it has many offsets). I remain more concerned about quantitative easing than most, and its reversal [QT], which has never been done before at this scale.

“Quantitative tightening is draining more than $900 billion in liquidity from the system annually — and we have never truly experienced the full effect of quantitative tightening on this scale.”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.