Some are hot, some are cold. And a special look at employment in oil & gas drilling and in mining.

By Wolf Richter for WOLF STREET.

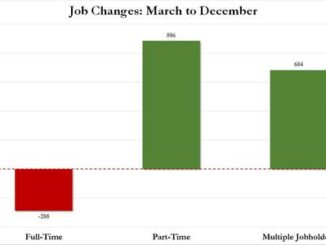

in the jobs data for December on Friday, we saw what we’d expect from an economy that is plugging along just fine, and we saw that wage increases have been reheating again for the past few months, despite the Fed’s 5.5% policy rates. But not every industry is in the same boat. In some industries, employment hit new highs, according to data by the Bureau of labor Statistics. In others, such as Information, employment had dropped sharply since mid-2022 but started picking up again in recent months. And in other industries, employment is on a long-term decline because of structural changes. And then there are the jobs in federal, state, and local governments that we’ll take a closer look at.

The month-to-month changes are expressed in three-month moving averages (3MMA) which iron out the monthly squiggles that are just noise.

The categories are by work location. The surveys are sent to business facilities by address. The primary activity at that facility is what determines the category. Just to illustrate: A worker at an Amazon fulfillment center counts under “transportation and warehousing”; a driver operating out of an Amazon delivery center also counts as “transportation and warehousing”; a worker at an office of Amazon’s AWS division would count under “Professional and business services”; a worker at a location that deals with the retail aspects of Amazon’s business would count under “Retail”; a worker at an office that primarily works on the software aspects of Amazon’s ecommerce business might count under “Information.”

The private sector.

Construction, all types of construction, from single-family housing to highways. Employment has been rising to new all-time highs for two years. The construction industry also has a record number of job openings.

Total employment: 8.06 million, new all-time high

3MMA growth: +17,000

Oil & Gas Extraction is a fun one. First a word about the boom in fracking that we at Wolf Street have followed with fascination since our beginning in 2011.

US become the largest oil and gas producer in the world. Due to the boom in fracking, first natural gas production has grown from all-time high to all-time high, turning the US into the largest natural gas producer in the world, and exporting large quantities via LNG terminals and pipelines.

Then oil production has grown from all-time high to all-time high, turning the US into the largest oil producer in the world. The US has become a net exporter of petroleum and petroleum products.

Constant and relentless technical innovation, driven by the terrible economics of early fracking, have made fracking vastly more productive and more cost-efficient – including labor costs. So here we go.

Employment in oil & gas extraction are the people who actually work out in the oil field, not the engineers, coders, specialists, lawyers, administrators, etc. in offices and other facilities. And so employment in the oil field has dropped due to technical innovation despite the historic boom in oil and gas production, and the number of people actually working in the oil field has become small:

Total employment: 119,000

3MMA: +0

Mining, excluding oil & gas: There also have been innovation and automation. But coal mining descended into mayhem when the price of natural gas collapsed in 2009 due to the fracking boom.

In terms of coal mining, roughly two-thirds of production comes from surface mines, and one-third from underground mines (EIA data). Total production peaked in 2008. By 2009, the nascent fracking boom caused the price of natural gas to collapse, and together with combined-cycle natural gas powerplants with thermal efficiencies of over 60%, natural gas become far cheaper to generate electricity with than coal. Power generators dispatched more generation to their natural gas plants, and built combined-cycle natural gas plants while retiring old coal plants in large numbers. In recent years, the falling costs of wind and solar power have caused power generators to shift more generation away from coal, and demand for coal for power generation has plunged.

From 2008 through 2020, coal production plunged by 54%. But in 2021 and 2022, coal production increased by 11% on increased exports, driven by metallurgical coal.

In the overall mining sector, in all types of mines and quarries, employment has sharply increased from the low point in 2020. But since 2008, employment is still down by 17%.

Total employment: 188,000 – highest since late 2019.

3MMA 1,000

Healthcare and social assistance:

Total employment: 21.9 million, new all-time high

3MMA: +74,000

Manufacturing: Employment has plateaued all year, except during the strikes in the auto industry in October, when employment dipped, and then recovered back to the plateau.

Total employment: 13.0 million

3MMA: -2,000

6MMA: +1,000

Wholesale Trade:

Total employment: 6.1 million, new all-time high

3MMA: +6,000

Arts, Entertainment, and Recreation includes spectator sports, performing arts, amusement, gambling, recreation, museums, historical sites, and similar:

Total employment: 2.5 million, new all-time high

3MMA growth: +11,000

Financial activities (finance and insurance plus real estate renting, leasing, buying, selling, and management). Employment peaked in August and September and since then tapered off just a tad.

Employment in mortgage lending has taken a massive hit since 2021 when mortgage rates began to rise and refi volume, a big part of the business, collapsed and purchase-mortgage volume plunged.

Total employment: 9.15 million

3-MMA growth: -2,000

Leisure and hospitality – restaurants, lodging, resorts, etc.

Total employment: 16.8 million, almost back to pre-pandemic levels.

3MMA growth: +26,000

“Information,” a small sector that includes work sites by some of the tech and social media companies. Other tech company work sites are included in Professional and business services (below), or other categories.

Information includes facilities where people primarily work on web search portals, data processing, data transmission, information services, software publishing, motion picture and sound recording, broadcasting including over the Internet, and telecommunications.

Total employment: 3.05 million

3MMA growth: +6,000

Professional and business services. Largest sector by employment. It includes facilities of some tech and social media companies; others are in “Information” (above) or in other categories.

The category includes facilities whose employees work primarily in Professional, Scientific, and Technical Services; Management of Companies and Enterprises; Administrative and Support, and Waste Management and Remediation Services.

Total employment: 22.95 million

3MMA growth: -11,000

Retail trade includes workers at brick-and-mortar retail stores – malls, auto dealers, grocery stores, gas stations, etc. – and other retail locations such as markets. It does not include the tech-related jobs of ecommerce operations, drivers, and warehouse employees. A big portion of this sector has been under heavy pressure from ecommerce operations:

Total employment: 15.5 million

3MMA growth: +3,000

Transportation and Warehousing: You can see the decline after the huge boom in 2021 and 2022:

Total employment: 6.6 million

3MMA growth: -19,000

Jobs in government.

First, we’re going to look at total government jobs – federal, state, and local – as a percent of total employment. Some things to note:

Spikes occur every 10 years in federal employment when the census is taken.

When total employment collapsed in early 2020, government employment did not collapse as much, and the percentage of government jobs to the collapsed total jobs spiked briefly.

A majority of local government jobs and a portion of state jobs are in education, from preschool to state universities, and include community colleges, trade schools, etc.

Federal government civilian employment: the spikes occur every 10 years when the census is taken.

Total civilian employment: 2.96 million

3MMA growth: +5,000

Federal employment as percent of total employment (1.9% in December):

Federal employment in millions of employees:

State governments (includes education, such as at state universities).

Total employment: 5.3 million

3MMA: +13,000

Local governments – employment is dominated by education. After the lockdowns of schools, districts struggled with large-scale teacher shortages. Employment is finally back where it had been before the pandemic.

Total employment: 14.7 million

3MMA growth: +32,000

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack