Oil prices rebounded today from earlier losses as fears over tight supplies once again became top of mind for many as ‘peak hawkishness’ overtook ‘China demand fears’. Oil was also helped by a weaker dollar…

“Oil prices, in the short term, are locked in a bit of a trading range,” said Phil Flynn, senior market analyst at The Price Futures Group, in a daily report.

“We are still in shoulder season and we’re still being influenced by concerns about the global economy and interest rates.”

For now, algos switch attention to API’s report for signs of that demand destruction…

API

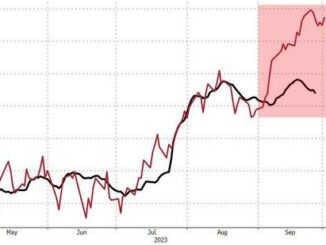

Crude +4.52mm (-800k exp)

Cushing +740k

Gasoline -2.278mm (-1.6mm exp)

Distillates +635k (-1.5mm exp)

Analysts expected a second consecutive small crude draw last week, but instead API reports a major crude build (and unexpected build in distillates stocks also)…

Source: Bloomberg

WTI was hovering just below $85 ahead of the API print and held its gains after…

Finally, The Price Futures Group’s Flynn noted that the oil market “tries to ignore the dollar but it can’t. When the dollar shows strength, it has put downward pressure on oil,” and today saw dollar weakness lend a hand to oil bulls.

Still, as the market gets into the winter season, “we’ll see a disconnect between the dollar/oil relationship because oil is going to be needed.”

The Sevens Report Research analysts said oil’s new trading range spans “between support in the upper $70s and resistance in the low $90s, as traders assess the outlook for demand amid growing recession concerns but still-tight global supply dynamics.”