In a move that has heightened tensions in the Middle East, Iran announced the temporary partial closure of sections of the Strait of Hormuz on February 17, 2026, to conduct naval exercises by its Islamic Revolutionary Guard Corps (IRGC).

The drills, dubbed “Smart Control of the Strait of Hormuz,” involved live-fire exercises and were described by Iranian state media as measures to ensure maritime safety and security.

This brief shutdown, lasting several hours, prompted an immediate uptick in global oil prices, with Brent crude edging up to around $67.50 per barrel amid renewed fears of supply disruptions in one of the world’s most critical energy chokepoints.

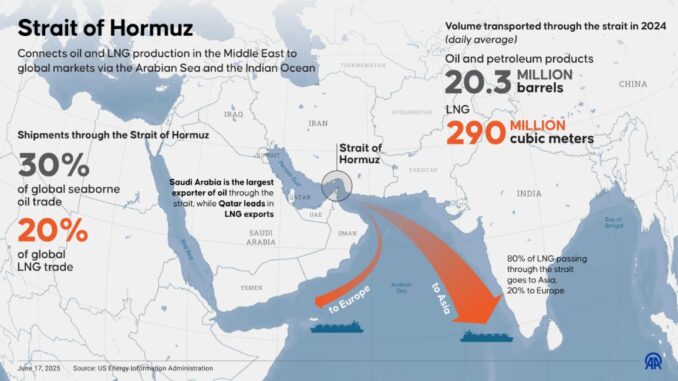

The Strait of Hormuz, a narrow waterway connecting the Persian Gulf to the Gulf of Oman and the Arabian Sea, serves as a vital artery for global energy trade. Any interruption here reverberates across international markets, given its role in facilitating the movement of vast quantities of oil and liquefied natural gas (LNG).

The Scale of Oil Transit Through the Strait

According to recent data from the U.S. Energy Information Administration (EIA), approximately 20 million barrels per day (bpd) of oil and petroleum products flowed through the Strait in 2024, representing about 20% of global petroleum liquids consumption.

This volume has remained relatively stable into early 2025, with crude oil and condensate making up the bulk of shipments. Additionally, around 290 million cubic meters of LNG pass through daily, accounting for roughly 20% of the world’s LNG trade.

The strait handles shipments equivalent to 30% of global seaborne oil trade, underscoring its strategic importance.

Disruptions, even temporary ones like today’s drills, can inject volatility into markets by raising concerns over tanker safety and potential blockades.

Key Exporters and Importers: Who Ships and Who Buys?

The oil transiting the Strait primarily originates from major Persian Gulf producers. Saudi Arabia leads as the largest exporter, accounting for about 38% of crude flows (around 5.5 million bpd in 2024), followed by Iraq, the United Arab Emirates (UAE), Kuwait, and Iran itself.

Qatar dominates LNG exports, contributing significantly to the strait’s gas traffic.

On the demand side, Asia is the dominant destination, absorbing about 84% of crude oil and condensate and 83% of LNG passing through the strait.

China is the top importer, receiving roughly 5.4 million bpd, followed by India (2.2 million bpd), Japan (1.8 million bpd), and South Korea (1.5 million bpd).

These nations rely heavily on Gulf supplies: for instance, Japan sources 80% of its crude imports via the strait, while South Korea gets 70%.

Europe and the U.S. receive smaller shares, with the U.S. importing just 0.5 million bpd from the region in 2024.

Any prolonged disruption could severely impact these importers, leading to higher energy costs, supply shortages, and economic ripple effects. For Asian economies, already grappling with post-pandemic recovery, this could exacerbate inflation and slow growth.

Is the Geopolitical Risk Premium Too Low?

Despite the ongoing U.S.-Iran nuclear talks in Geneva and recent military posturing, analysts argue that the current geopolitical risk premium embedded in oil prices—estimated at $5-8 per barrel—may be undervalued given the strait’s vulnerability.

Prices have stabilized around $67-68 per barrel for Brent, but some market observers warn that traders are underestimating the potential for escalation.

The brief closure for drills caused a modest rise, but a more sustained threat could add $10-15 per barrel or more, depending on the scenario.

This “fear premium” persists due to uncertainties around sanctions enforcement and Iran’s rhetoric, including threats to fully close the strait if provoked.

While global supply gluts from non-OPEC producers like the U.S. provide a buffer, the strait’s chokehold on Gulf exports means risks remain elevated. If premiums are indeed too low, a sudden flare-up could catch markets off guard, pushing prices toward $80 or higher.

Potential Escalation: What If the IRGC Attacks U.S. Ships?

The drills coincide with indirect U.S.-Iran negotiations, but escalation remains a real concern. If the IRGC were to attack U.S. military vessels—potentially in retaliation for perceived aggressions—analysts predict a sharp spike in oil prices.

Limited strikes might push Brent to $80 per barrel, while broader conflict involving the strait’s closure could drive prices to $100 or beyond, disrupting 20% of global oil supply.

Historical precedents, such as the 2019 tanker attacks, show how quickly prices can surge—up 5-7% in a day—before stabilizing if no major supply loss occurs.

A full blockade would ratchet up shipping costs, delay deliveries, and force rerouting via limited alternatives like Saudi and UAE pipelines, which can only bypass about 2.6 million bpd.

This could lead to global economic fallout, with higher fuel prices hitting consumers and industries worldwide.

As the Energy News Beat Channel continues to monitor developments, the situation underscores the fragile balance between geopolitics and energy security. With talks ongoing, the market’s response will hinge on whether diplomacy prevails or tensions boil over. Stay tuned for updates on how this evolves and its implications for global energy dynamics.

Get your CEO on the podcast: https://sandstoneassetmgmt.com/media/

Is oil and gas right for your portfolio? https://sandstoneassetmgmt.com/invest-in-oil-and-gas/

Be the first to comment