No one expected the transition from fossil fuels to be easy. But a year after President Joe Biden’s landmark climate law promised billions of dollars for America’s switch to clean energy, some of the nation’s most ambitious renewable power projects have been shelved, electric car sales are missing targets and investors are fleeing the sector in droves.

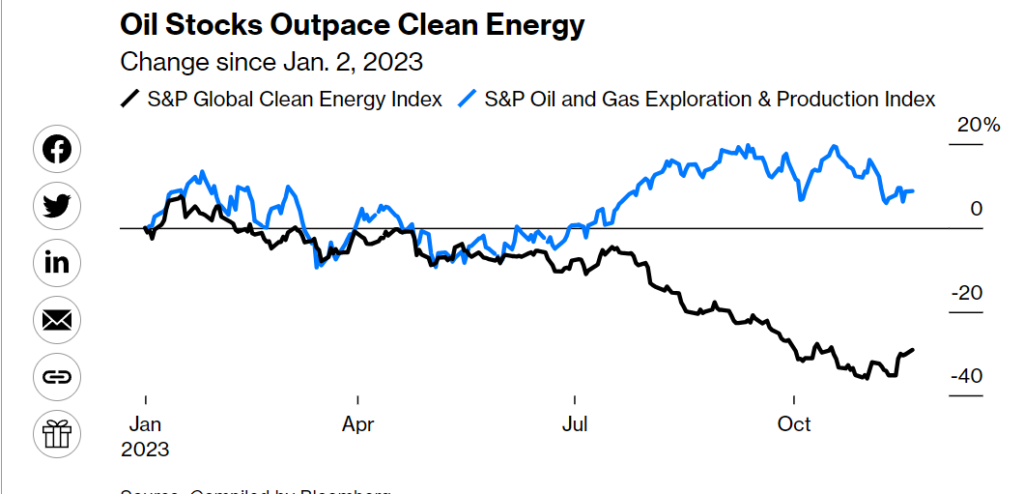

The result is a $30 billion collapse in US clean energy stocks in the last six months—a market many investors expected to flourish in the aftermath of the law’s passage.

Few industries have been unscathed by soaring interest rates, but perhaps none has been harder hit than renewable energy. For a sector that builds big, expensive facilities such as solar plants and wind farms, high rates cut profit margins enough to sink projects and bankrupt companies. The giddy enthusiasm that followed the Inflation Reduction Act’s passage evaporated, wiping out a quarter of the market value of US companies in the S&P Global Clean Energy Index in the six months ended Nov. 27.

It’s a meltdown that underscores the obstacles standing in the way of Biden’s ambitious climate goals.

Along with sky-high financing costs, clean energy companies face the problems of winning over potential neighbors for their projects, securing government permits and plugging into a creaky power grid unable to handle all the renewable power that’s planned. Oil and gas producers, meanwhile, are doubling down on plans to keep pumping.

The warnings are clear: America’s road to achieving a zero-carbon electricity grid by 2035 is getting rockier by the day.

“We’re in the moment of realization now where some of the euphoria has worn off and we’re starting to realize it’s still not going to be easy,” says Eric Scheriff, senior managing director at Capstone, a Washington, DC-based consulting firm.

The specter of bankruptcies now haunts the sector. Electric bus maker Proterra Inc. filed for Chapter 11 protection earlier this year, with solar financing firm Sunlight Financial Holdings Inc. following soon after. Deals are falling apart: Private equity-backed Ares Acquisition Corp. abandoned its planned merger with nuclear power technology company X-Energy Reactor Co. in October.

And projects have been canceled: Utility owner Avangrid Inc. shelved wind projects in Connecticut and Massachusetts this year, while NuScale Power Corp. abruptly terminated its plans for the first small modular reactor in the US—a technology seen as key to the sector’s potential revival.

For anyone who remembers the last cleantech bust more than a decade ago, it’s easy to fear a repeat.

“In the final analysis, green investing has to be based on economic realities,” says Jerome Dodson, the now-retired founder of Parnassus Investments, one of the world’s largest sustainable investment firms, with $42 billion in assets. He sold his stake in the business in 2021—at the “top of the market,” as he puts it—and predicts that wind and solar stocks could fall an additional 15% to 20% in the next six to eight months.

It was only two years ago that Wall Street investors and bankers headed to Scotland for a global climate meeting, waxing lyrical about net-zero emissions goals and the profits to be made from the shift to cleaner energy. That’s a stark contrast to the current mood as the world convenes again for climate talks at the COP28 summit this week in Dubai.

American clean energy companies aren’t the only ones struggling. China’s biggest solar and wind turbine manufacturers recently reported shrinking profits. A fault in thousands of wind turbines forced Siemens Energy AG to seek a €15 billion ($16.2 billion) backstop led by the German government. And Danish wind developer Orsted A/S is fighting to recover from a $4 billion writedown stemming from two abandoned US wind projects.

In many ways, though, the problems are most surprising in the US.

Biden’s sweeping climate law offers at least $374 billion in tax credits and other incentives to spur the energy transition. Many saw it as a grand experiment to test whether subsidies, rather than top-down government mandates, would be enough to accelerate a change the planet desperately needs.

Instead, the US remains far off track for reaching Biden’s goal of a net-zero economy by 2050. Researchers at BloombergNEF estimate the IRA will get the country only halfway there, cutting annual greenhouse gas emissions from 5.3 gigatons to 2.3 gigatons by midcentury.

Most analysts don’t expect clean energy’s current difficulties to completely derail the transition. Lawmakers remain committed to the shift, even if the results of their actions to date have fallen far short of their goals. Corporations are also lining up clean energy supplies for their offices and data centers.

But missing targets will still have major implications for the planet and the global economy, as the extreme weather events that are propelled and magnified by climate change continue to cause enormous damage.

The US is the biggest carbon emitter of all time, responsible for about a quarter of historical greenhouse gases, and it holds the No. 2 spot for today’s levels. It has also been seen as one of the biggest offenders in rich nations’ failure to collectively marshal funds to the developing countries that often experience climate change’s worst impacts.

While Bank of America Corp. analysts estimate the global cost for confronting climate destruction will be roughly $75 trillion—or $2.7 trillion a year—between now and 2050, the price tag for inaction is much higher. Doing nothing to address extreme heat, disasters and rising sea levels brings an expense of $178 trillion, the analysts wrote in a recent report.

“My nervousness is that we have high interest rates for a long time, and that slows the transition,” says Chat Reynders, co-founder of Reynders, McVeigh Capital Management, which oversees $3.5 billion in Boston.

While the International Energy Agency recently predicted for the first time that global demand for oil will peak this decade, it also said that “an undulating plateau lasting for many years” will follow, with emissions remaining too high to limit global warming to 1.5C, a critical tipping point for averting more extreme consequences of global warming.

For its part, the Organization of the Petroleum Exporting Countries predicts oil demand will keep growing for decades. Exxon Mobil Corp. and Chevron Corp. just spent more than $110 billion combined on two megadeals to secure future oil production.

“The timeline we have to get to net-zero is quite short,” says Garvin Jabusch, chief investment officer at Green Alpha Advisors, which oversees about $400 million. “Everything that’s invested in new exploration, new discovery, new extraction, new burning, new internal combustion engines, new fossil-fired electricity plants—all these long-life assets—puts us much further away from any climate goals.”

Nowhere are the problems facing clean energy more apparent than in the offshore wind industry. Biden’s climate plans call for building enough wind farms along the nation’s coasts in the next six years to generate 30 gigawatts of electricity, roughly the output of 30 nuclear reactors. But wind developers have seen their component costs rise as inflation ripples through their supply chains. High interest rates compound the problem.

Over the next decade, surging costs threaten to add about $280 billion in capital expenditures for the global offshore wind sector, according to researchers at consulting firm EY. Both BloombergNEF and S&P Global Commodity Insights have lowered their projections on how much wind can be added to the grid by 2030.

There are also hurdles in the switch to electric transportation. Higher borrowing costs have made electric vehicles even more expensive, dampening sales. Tesla Inc. has seen its stock price tumble about 20% from its 52-week high in July. The companies that deploy EV chargers, such as Blink Charging Co. and ChargePoint Holdings Inc., are nearing penny-stock status. ChargePoint shares plummeted in November after posting a preliminary revenue miss and replacing its longtime chief executive officer.

Biden has grand plans for hydrogen, meanwhile, casting it as a clean-burning fuel that can decarbonize heavy industries such as steel and shipping. Companies such as Plug Power Inc. are building hydrogen production plants, but potential users have been slow to sign supply deals, since switching from natural gas to hydrogen usually means installing expensive new equipment. In mid-November, Plug Power issued a going-concern warning, an accounting term that means the business may be illiquid within 12 months.

There are some bright spots, including large-scale solar. Panel costs have been dropping, which squeezes margins for equipment makers but can help increase the speed of installations. Researchers at BNEF estimate that installed capacity jumped more than 50% this year to a new record. Falling panel costs will also help drive growth for home installations, according to the researchers.

Funding for climate tech rose to the highest rate in almost two years in the third quarter, according to BNEF. And BlackRock Inc. CEO Larry Fink, who’s been a vocal proponent of embedding environmental objectives in investment decisions, is attending climate talks in Dubai after sitting them out last year, as green investing faced backlash from Republican lawmakers.

“The trends remain in favor of clean energy, even if we’re seeing some minor growing pains at the moment,” says Sonia Aggarwal, CEO of consulting firm Energy Innovation, who helped develop the IRA while serving as a special assistant to President Biden.

Nevertheless, even with federal support and expectations that interest rates will fall next year, big obstacles remain. Take, for example, the US grid.

The energy transition requires vast changes to the interconnected networks of generating plants, transmission lines and substations that make up the grid, which is still designed largely for fossil fuel generation. BNEF estimates the global cost of adapting and expanding grids to meet net-zero needs at around $21.4 trillion.

And there’s a massive bottleneck when it comes to the process for approving additions of power to grids. In August more than 1,700GW of wind and solar power projects were stuck in approval queues across the US, according to a federal estimate.

“You need all of the ingredients to make the cake,” Capstone’s Scheriff says. “We gained a few ingredients we needed with the IRA, but we’ve still got to get the others.”

Bloomberg