ENB Pub Note: Doug Sheridan is an outstanding energy thought leader and we recommend following him on his LinkedIn.

Today, Doug brings up some great points about the huge meeting President Trump and the team had in Pennsylvania and some key issues.

The WSJ writes, some of the world’s biggest companies have pledged tens of billions of dollars to accelerate the development of AI in Pennsylvania.

Google said it would put $25B into data centers needed to train AI models and related infrastructure in the state and the surrounding region over the next two years. Private-equity firm Blackstone promised another $25B. AI startup CoreWeave announced a $6B investment. Amazon committed $20B to similar projects in the region last month.

Power companies FirstEnergy and Constellation Energy are part of a group pouring billions more into increasing electricity generation in the area. Google said it would put more than $3 billion into two hydropower facilities in Pernnsylvania.

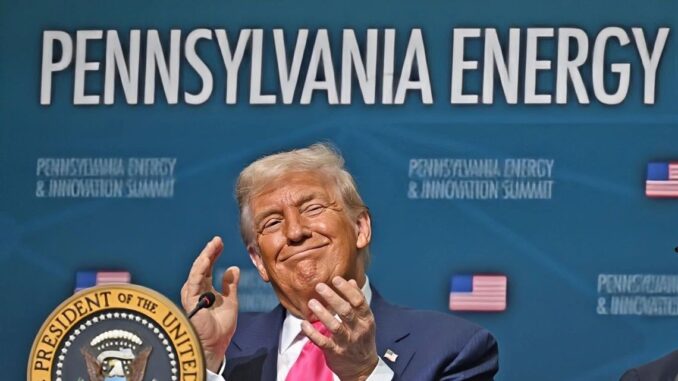

The commitments are part of a campaign to transform the Pittsburgh and surrounding areas into a tech hub. Trump touted the new investments in comments at an AI and energy summit on Carnegie Mellon University‘s campus.

Trump’s emphasis is on producing the power needed to run data centers given Pennsylvania’s position as a leading energy producer. The tech industry is expected to gravitate to parts of the country and world with the most data centers and suitable power infrastructure. Execs from Google, Meta Platforms, and software firm Palantir Technologies attended the event.

Pennsylvania’s robust energy resources and power infrastructure make it a unique location for data centers, Commerce Sec Howard Lutnick said. “It’s the combination of technology, investment and power accessibility that makes a location key and successful,” he said.

Increasing power generation is expected to be a focus of Trump’s plan to lead the world in AI. The AI action plan, as it is officially called, will likely discuss accelerating permitting for tech infrastructure projects. Officials emphasize the pith the copious amounts of natural gas in Pennsylvania, the nation’s second-biggest producer.

Energy analysts warn the US won’t be able to meet data-center demand unless it boosts production of both renewables and fossil fuels. Trump’s tax and spending bill removed some incentives for wind and solar power, adding to concerns among some in the tech industry about meeting future demand.

Our Take 1: While we can’t speak to how much of these announced investments will in fact materialize—or what the timetable might be—the announcements suggest tech companies recognize that access to 24/7 dispatchable power rather than temporary renewables is going to be needed if they are to be long-term competitive in AI.

Out Take 2: Who exactly are these “analysts” claiming AI will require more renewables? More to the point, why do they think a tech company would spend tens of billions on AI facilities only to turn the sites down to half or quarter capacity when the wind stops blowing or the sun sets?

Our Take 3: Seems to us these analysts the WSJ is citing might actually be renewables cheerleaders… even lobbyists. Are we wrong?

While we conduct our reviews on AI, Data centers, and their impact on the United States’ grid, this is a significant story. Yesterday, on Energy News Beat, we published: Trump to Outline AI Priorities in Speech Next Week: Implications for Energy and Grid Reliability.

This will be a significant event, and we will be closely monitoring its impact. In our day jobs of evaluating oil and gas deals, we examine where the wells are being drilled and where the demand is expected to be. Some of the key points we are tracking include changes in microgrids, grid management, and the importance of manufacturers and businesses having more control over their power sources. I love Doug’s question, “Who exactly are these ‘analysts’ claiming AI will require more renewables? More to the point, why do they think a tech company would spend tens of billions on AI facilities only to turn the sites down to half or quarter capacity when the wind stops blowing or the sun sets?”

Follow the Money – and make sure your business can stay operational when the lights go out on your competitors.