Which devalued the yen by a Third-Worldish 30% against the USD in two years as other central banks hiked in big increments and started QT.

By Wolf Richter for WOLF STREET.

Scraps NIRP. Citing “the virtuous cycle between wages and prices,” with both rising, and citing its thingy that “the price stability target of 2 percent would be achieved in a sustainable and stable manner,” the Bank of Japan today scrapped its negative interest rate policy by hiking its short-term policy rate by a whopping 10 basis points from -0.1% to a whopping 0.0%, the first rate hike, if you can even call it that, since 2007.

Kind of scuttles yield-curve control, what’s left of it, without getting rid of it completely. The BOJ said: If there is a “rapid rise in long-term interest rates,” it would make “nimble responses,” for example, by increasing the purchases of Japanese Government Bonds [JGBs]. So yield curve control isn’t quite out the window, it’s just watered down further.

Ends purchases of equity ETFs and J-REITs, though it had essentially already stopped buying them in 2023 as the Nikkei stock index was soaring toward all-time highs for the first time since 1989.

Slows purchases of corporate paper and corporate bonds and will end them altogether in about a year, it said.

Doesn’t scuttle QE. It said in its Statement that it would “continue its JGB purchases with broadly the same amount as before,” namely about ¥6 trillion per month (about $40 billion). It said it “will conduct the purchases while taking account of factors such as market developments and supply and demand conditions for JGBs.”

But the net increases of its total assets have been small, averaging only ¥1.7 trillion ($11 billion) per month over the past 12 months, after maturities, reduction in loans, and other factors.

So these are minuscule movements by a central bank that had, and still has, one of the most aggressive monetary policies that led to its holding over half of the huge pile of JGBs and becoming the largest holder of Japanese equities.

The Bank of Japan was the last central bank still clinging to a negative interest rate policy, an absurdity that was invented in Europe and by 2014 had spread across central banks in Europe. The Bank of Japan copied it in milder form in 2016, when it cut its short-term policy rate from 0% to -0.1% and kept it there until today.

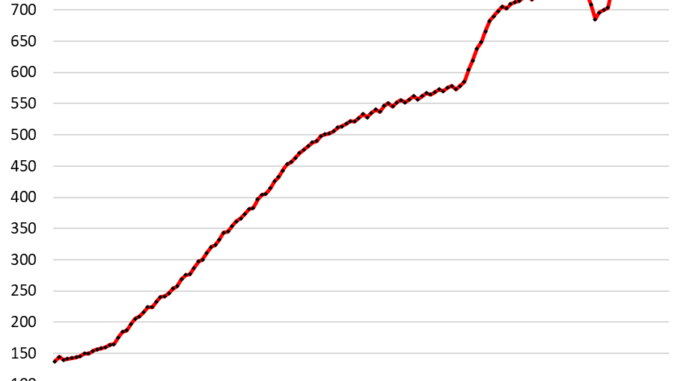

Yields have risen, but only a little. Over the years, the negative policy rate caused the 3-month government bond yield to trade in the range of -0.1% to -0.25%, and briefly in late 2016 as low as -0.4%. All yields up through the 1-year yield traded in the negative over those years.

In anticipation of the whopper of a rate hike, the three-month yield rose a hair above 0% last week and today is right at 0%. All yields above 3 months are now in the positive.

The 10-year yield dipped today to 0.73%, after trading close to 1% in late October and early November 2023.

The Japanese yield curve remains relatively steep at the long end, with the 40-year yield at 1.9%:

Back in 2016 when it joined the NIRP absurdity, the BOJ also instituted “yield curve control,” where it threatened to purchase “unlimited” amounts of government bonds to keep the 10-year yield in a tight band near 0%.

The loosening, if you can call it that, started in December 2022 – by which time other central banks had started hiking their policy rates in big increments and had turned to QT to combat surging inflation – when the BOJ “shocked” markets by lifting the yield band’s ceiling to 0.5%. In 2023, it lifted the ceiling to 1%. And in October 2023, it discarded that explicit ceiling.

You can see what’s happening here: A central bank making its loosest-ever monetary policy just slightly less loose in tiny increments at the slowest-ever snail’s pace, and that trend continued today.

Today’s micro-moves were widely telegraphed and leaked so that there would be no surprise, and there was no surprise.

And of course, the BOJ patted itself on the back, saying in its Statement that its mega-QE program, Yield Curve Control, and negative interest rate absurdity “have fulfilled their roles.”

These policies have crushed the yen, which is currently trading at ¥151 to $1, down from a range of ¥105 to ¥110 in the years through early 2021, representing a Third-Worldish 30% devaluation of the yen against the USD. Which has turned Japan into a budget-traveler’s paradise, and which has impoverished the Japanese when they go spend their crushed yen-income overseas.