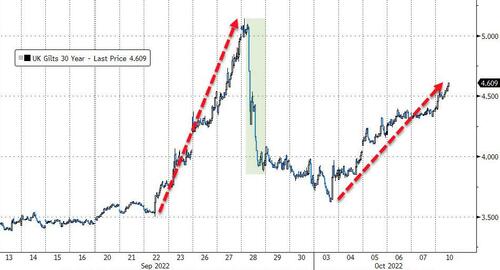

Update (1030ET): Despite The BoE promises to do almost ‘whatever it takes’, long-dated gilt prices are collapsing today. 30Y gilt yields are up a stunning 34bps now, soaring towards crisis highs…

What next for BoE?

The pain in the UK is spreading to US yields (remember US bond market holiday today but futures trading)…

10Y UST yields are implied around 6bps higher for now.

* * *

Over the weekend, Band of England (BoE) Deputy Governor Dave Ramsden indicated that the bank intends to charge forward on interest rate hikes, suggesting that this is the only way to tame the ongoing inflation crisis.

“However difficult the consequences might be for the economy, the MPC must stay the course and set monetary policy to return inflation to achieve the 2% target sustainably in the medium term, consistent with the remit given to us.”

Just two days after that statement, BoE on Monday announced further measures to ensure financial stability in the U.K., building on its intervention in the long-dated bond market.

Specifically, The BOE said it will:

Double the size of its auctions to purchase long-dated UK government bonds to ?10 billion a day until Oct. 14, when the BOE plans to close that program as previously announced

Launch a Temporary Expanded Collateral Repo Facility, or TECRF, that will run beyond the end of this week until Nov. 10. Its purpose is to enable banks to ease pressures in LDI funds through liquidity insurance operations.

Temporary expansion of collateral it accepts under its existing Sterling Monetary Framework to include corporate bonds.

Additionally, regular repo-related operations also remain available to help.

So far, investors haven’t taken up as much of the support as the BOE has offered. In the eight auctions to date, the BOE bought just ?4.6 billion of bonds, about 12% of the ?40 billion capacity of the program.

However, analysts have warned that the intervention fails to adequately address the underlying issue.

Antoine Bouvet, senior rates strategist at ING, said:

“The suspicion is that risk reduction by pension funds has been too limited so far.

“The question is do they have enough cash to meet new collateral requirements if the gilt market sells off again, as the gilt purchases by the Bank of England end this week.

“I think the fear is that the answer’s no and that it will trigger the same snowball effect that we had two weeks ago.”

Bob Parker, advisor at CBP Quilvest, told CNBC Monday that the new measures would likely assuage market concerns in the short term, but “a number of major problems” remain going into 2023, the first of which is that the Bank of England will need to raise interest rates further.

He anticipates that gilt yields will rise further, with the 10-year already up more than 100 basis points over the last month.

“The reality is we still have negative real yields in excess of 5% with inflation trending at least for the next few months around 10%, and as a result … institutional demand and retail demand for gilts, I think, is going to remain very muted,” Parker said.

RBC Capital Markets is skeptical that the announcement will meaningfully change the market dynamics.

The question is whether these new measures will really change the market function substantially.

First, the BoE did not get anywhere close to buying the maximum amounts in the previous operations anyway and thus increasing the maximum potential purchases would not necessarily change the fate of the market if actual purchases remain low.

Secondly, as regards the repo operations, the question is whether there has been a significant liquidity demand from banks in the first place and furthermore, it appears that the repos collateralized with corporate bonds appear quite expensive with rather large hair-cuts applied and thus it remains debatable whether they will be used much in the first place

The BoE has a problem however, as this desperate move has prompted more selling in the 30Y gilt (yields up 22bps today)…

…heading back towards crisis levels fast…

“It is extraordinary,” said Joshua Raymond, director at financial brokerage XTB. “Market interventions of this type by the central bank are not normal.”

Not normal indeed!