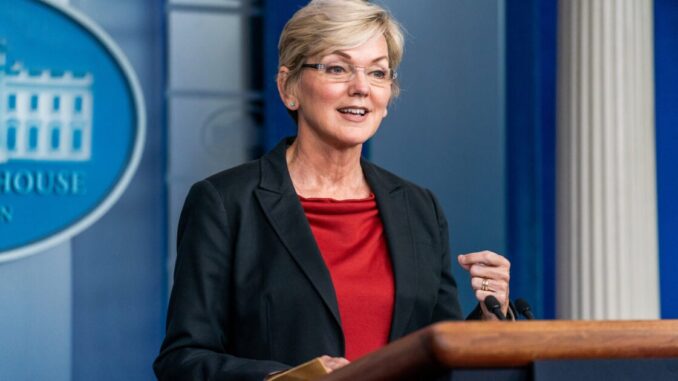

China could flood the U.S. electric-vehicle market with its offerings, Energy Secretary Jennifer Granholm warned Wednesday, weeks after President Joe Biden raised similar concerns.

“We are very concerned about China bigfooting our industry in the U.S. even as we are building up now this incredible backbone of manufacturing,” Granholm said during a discussion panel at an Axios event.

China is being perceived as a threat to the U.S. auto industry as U.S. vehicle exports decline and companies such as General Motors cut international operations.

“We saw this happen in the solar industry … there was a flooding of the market,” Granholm said.

China exported nearly 5 million vehicles in 2023, China Association of Automobile Manufacturers data showed, overtaking Japan to become the world’s No.1 country for car exports in 2023.

Chinese EV makers have also been releasing new models in record times, and the outlook for Chinese automakers remains stable despite intensifying competition, said Fitch Ratings in December.

“China is investing massive amounts for the purpose of bigfooting so we need to understand that it is important for people to buy EVs in an affordable fashion but we can do that and we can keep our country safe,” said Granholm.

The White House said last month the U.S. was probing whether Chinese vehicle imports pose national security risks, as they could collect sensitive data about U.S. citizens and infrastructure and send it to China.

“China’s policies could flood our market with its vehicles, posing risks to our national security,” U.S. President Joe Biden said in a statement. “I’m not going to let that happen on my watch.”

The U.S. is attempting to boost domestic EV supply chains through the Inflation Reduction Act, which provides tax credits for vehicles that undergo final assembly in North America, meet critical mineral and battery component requirements, among other conditions.

EVs whose battery components are built or assembled by a “foreign entity of concern” namely China, Iran, North Korea and Russia don’t qualify for the tax incentives.

“We also know if it’s built in America and with the incentives through the Inflation Reduction Act, we can get those price points down and we have seen doubling of EV uptake last year and more of that is projected,” Granholm said.

The U.S. has been ramping up pressure on Chinese companies in recent years.

In October 2022, it introduced rules aimed at restricting China’s ability to access, obtain or manufacture advanced semiconductor chips amid concerns that China could use them for military purposes.

Last year, the U.S. announced new regulations preventing U.S. chip designer Nvidia from selling advanced AI chips to China.

The U.S. Senate voted on Wednesday to approve a bill that could restrict business with Chinese biotech firms such as WuXi AppTec and BGI on national security concerns.

Source: Cnbc-com.cdn.ampproject.org